The stock market's performance is a key indicator of the overall economic health of a country. Today, many investors are curious about the current state of the market and how low it has gone. In this article, we will delve into the factors contributing to the stock market's decline and provide a comprehensive analysis of its current status.

Market Trends and Factors Influencing Stock Prices

The stock market's value is influenced by various factors, including economic indicators, corporate earnings, and geopolitical events. In recent months, several factors have contributed to the downward trend in the stock market.

Economic Indicators: The Federal Reserve's decision to raise interest rates has had a significant impact on the stock market. Higher interest rates can lead to increased borrowing costs for companies, which can negatively affect their profitability.

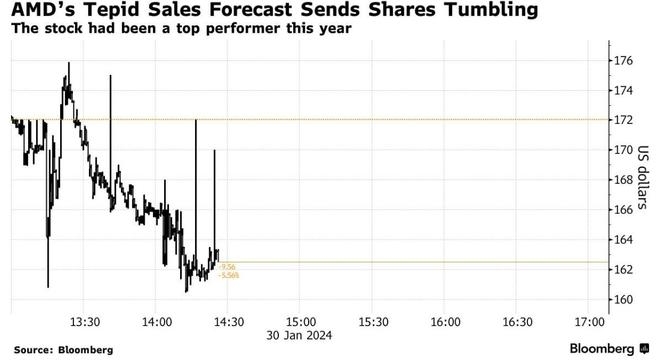

Corporate Earnings: Many companies have reported lower-than-expected earnings, which has caused investors to lose confidence in the market.

Geopolitical Events: Tensions between major economies, such as the United States and China, have also contributed to the market's decline. These tensions have raised concerns about global trade and economic growth.

Current Stock Market Levels

As of today, the stock market has experienced a significant decline. The following are some key indices and their current levels:

Dow Jones Industrial Average: The Dow Jones has fallen by over 10% from its recent peak, reaching a level of around 26,000 points.

S&P 500: The S&P 500 has also seen a substantial decline, with a current level of approximately 2,800 points.

NASDAQ Composite: The NASDAQ has been hit the hardest, with a decline of over 15% from its recent peak, currently trading at around 8,000 points.

Impact on Investors

The decline in the stock market has had a significant impact on investors. Many have seen their portfolios shrink, leading to increased anxiety and uncertainty. However, it is important to remember that market fluctuations are a normal part of investing.

Case Studies

To illustrate the impact of the stock market's decline, let's consider two case studies:

Company A: This company, which had a market capitalization of

10 billion, saw its value drop to 8 billion following the market's decline. This resulted in a loss of $2 billion in shareholder value.Investor B: This investor, who had a portfolio valued at

1 million, saw its value drop to 900,000 following the market's decline. This resulted in a loss of $100,000 in investment value.

Conclusion

In conclusion, the stock market has experienced a significant decline in recent months, driven by factors such as economic indicators, corporate earnings, and geopolitical events. While this has caused concern among investors, it is important to remember that market fluctuations are a normal part of investing. By staying informed and maintaining a long-term perspective, investors can navigate these challenging times and potentially benefit from future market recoveries.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....