In the fast-paced world of finance, staying informed about stock prices is crucial for investors and traders. Bloomberg, a leading global provider of business and financial information, offers a comprehensive platform for tracking stock prices. This article delves into the intricacies of Bloomberg stock prices, exploring how they are calculated, the factors that influence them, and the tools available for analysis.

How Bloomberg Calculates Stock Prices

Bloomberg calculates stock prices in real-time, providing investors with up-to-date information. The platform aggregates data from various exchanges and financial institutions, ensuring accuracy and reliability. Here’s a brief overview of the process:

- Data Collection: Bloomberg collects data from exchanges, financial institutions, and other sources to ensure comprehensive coverage.

- Real-Time Updates: The platform continuously updates stock prices, reflecting the latest market movements.

- Data Verification: Bloomberg employs advanced algorithms to verify the accuracy of the data, minimizing errors and discrepancies.

Factors Influencing Bloomberg Stock Prices

Several factors influence Bloomberg stock prices, including:

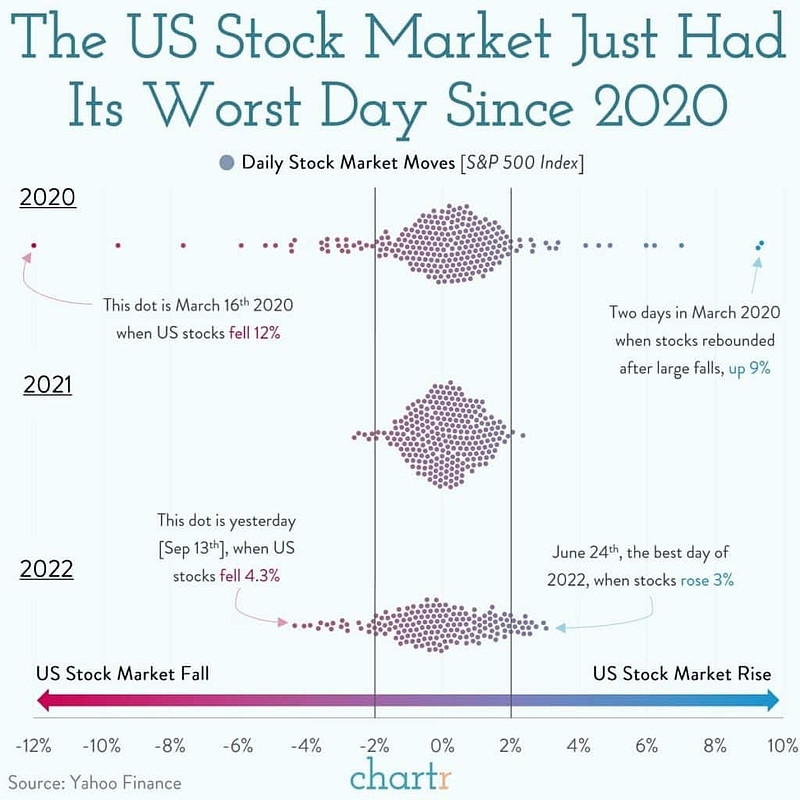

- Economic Indicators: Economic data such as GDP, unemployment rates, and inflation can significantly impact stock prices.

- Company Performance: A company’s financial performance, including revenue, earnings, and growth prospects, plays a crucial role in determining its stock price.

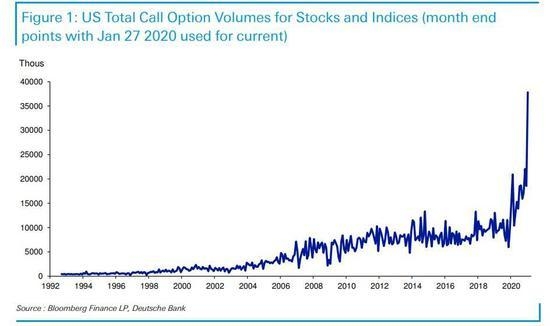

- Market Sentiment: The overall mood of the market can influence stock prices, with factors like geopolitical events, political instability, and technological advancements affecting investor sentiment.

Bloomberg Tools for Stock Price Analysis

Bloomberg offers a range of tools and resources for analyzing stock prices:

- Bloomberg Terminal: The flagship product, Bloomberg Terminal, provides access to a vast array of financial data, including real-time stock prices, news, and analytics.

- Bloomberg Professional: Designed for professional investors, Bloomberg Professional offers comprehensive stock price data, news, and research.

- Bloomberg TV: This platform provides real-time stock prices, market analysis, and interviews with industry experts.

Case Study: Apple Inc.

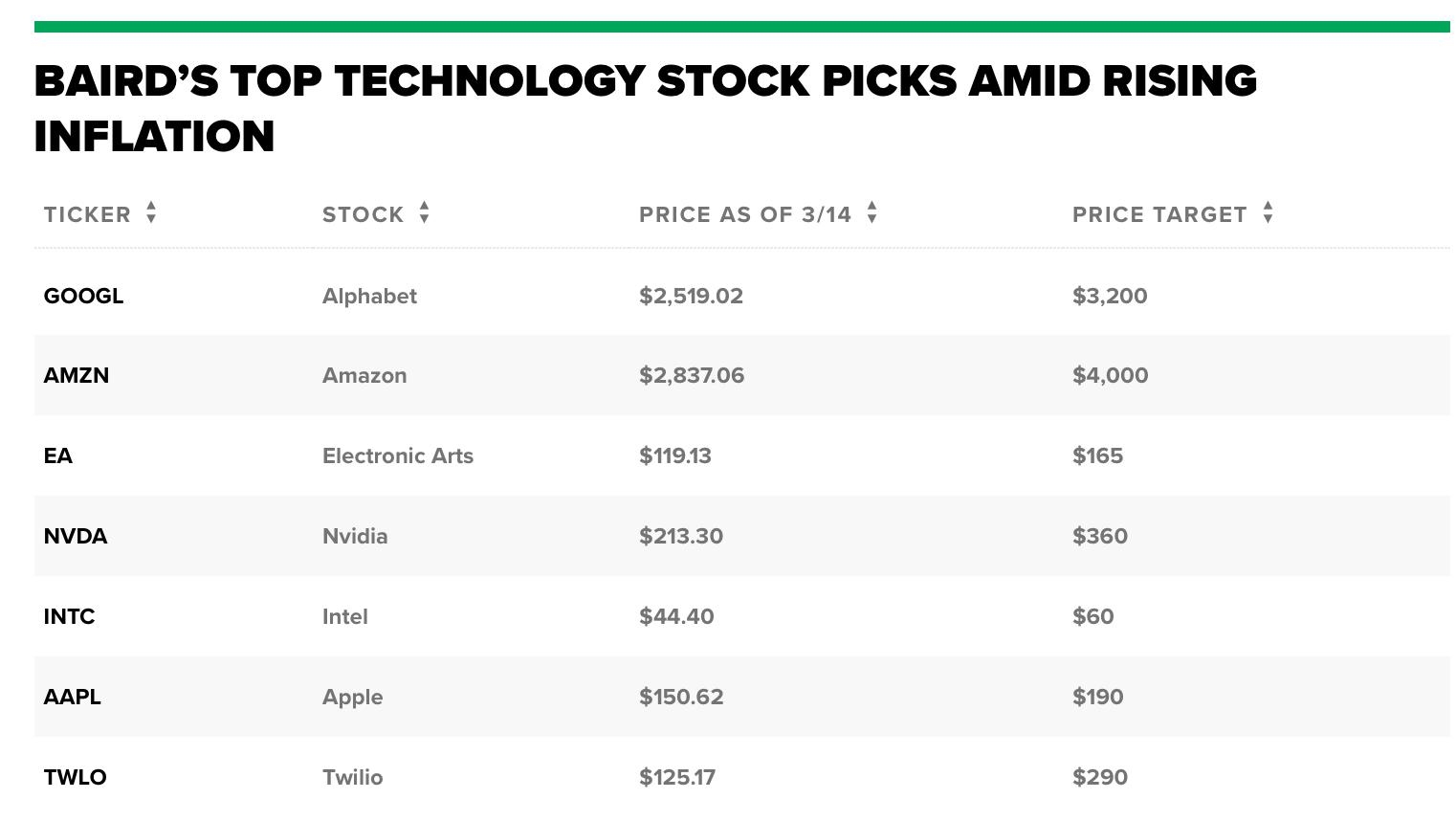

To illustrate the impact of factors on stock prices, let’s consider Apple Inc. (AAPL). In 2021, Apple’s stock price experienced significant volatility due to various factors:

- Economic Indicators: As the global economy recovered from the COVID-19 pandemic, Apple’s stock price surged due to increased demand for its products.

- Company Performance: Apple reported strong revenue and earnings growth, driven by its iPhone, iPad, and Mac sales.

- Market Sentiment: The tech sector, in general, performed well during this period, contributing to Apple’s stock price appreciation.

Conclusion

Understanding Bloomberg stock prices is essential for investors and traders seeking to make informed decisions. By analyzing the factors influencing stock prices and utilizing Bloomberg’s tools for analysis, investors can gain valuable insights into the market and make better investment choices.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....