In a world increasingly aware of the need for sustainability, green technology stocks have become a cornerstone of modern investment. The United States, as a leader in technological innovation, is home to numerous companies at the forefront of this movement. This article explores the potential of green tech stocks in the US and why they are poised to be a significant part of the future investment landscape.

Understanding Green Tech Stocks

Green technology, or "green tech," refers to the application of innovative, sustainable, and environmentally friendly solutions. These solutions are designed to reduce negative environmental impacts while creating economic and social benefits. Green tech stocks are shares in companies that are involved in developing and producing green technologies.

Why Invest in Green Tech Stocks?

There are several compelling reasons to consider investing in green tech stocks:

Growth Potential: The global green tech market is projected to grow significantly over the next decade. As awareness of climate change and environmental issues increases, the demand for sustainable solutions is expected to rise.

Regulatory Environment: Governments around the world are implementing policies and regulations to promote the adoption of green technologies. This creates a favorable environment for companies in the green tech sector.

Corporate Social Responsibility: More companies are recognizing the importance of sustainability and incorporating it into their business models. Investing in green tech stocks aligns with the values of socially conscious investors.

Emerging Green Tech Stocks in the US

Several green tech stocks in the US have emerged as leaders in their respective industries. Here are some notable examples:

Tesla (TSLA): As the world's leading electric vehicle (EV) manufacturer, Tesla is at the forefront of the green tech revolution. The company's commitment to sustainable transportation has propelled it to become a market leader.

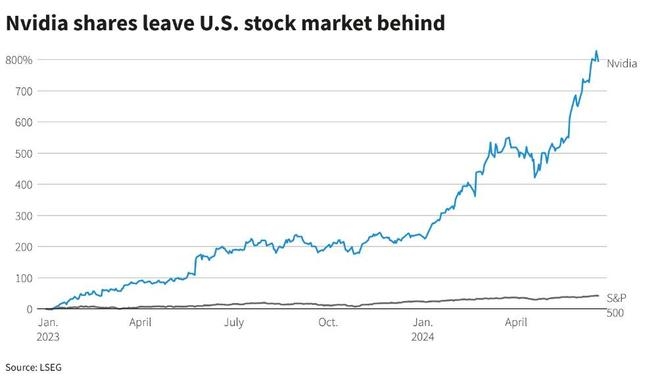

NVIDIA (NVDA): This tech giant is a key player in the development of AI and autonomous vehicles. NVIDIA's GPUs are crucial for training AI systems and driving the advancement of self-driving cars.

Enphase Energy (ENPH): Enphase Energy is a leading provider of microinverters for solar power systems. The company's innovative technology helps maximize the efficiency of solar installations.

First Solar (FSLR): First Solar is a leading manufacturer of photovoltaic (PV) solar panels. The company's thin-film technology is more efficient and cost-effective than traditional solar panels.

Case Studies

Let's take a closer look at two companies that exemplify the potential of green tech stocks:

Tesla: In 2010, Tesla's market capitalization was just over

2 billion. By 2021, it had grown to over 800 billion, making it one of the most valuable companies in the world. This incredible growth can be attributed to the company's commitment to sustainable transportation and its innovative technology.Enphase Energy: Since its inception in 2006, Enphase Energy has experienced significant growth. The company's microinverters have become a standard in the solar industry, thanks to their high efficiency and reliability.

Conclusion

Green tech stocks are a promising investment opportunity in the US. As the world becomes more environmentally conscious, the demand for sustainable solutions will continue to grow. By investing in green tech stocks, investors can align their values with the future of the planet while potentially achieving significant financial returns.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....