Are you considering investing in Schp stock or US Treasury securities? Understanding the differences between these two investment options is crucial for making an informed decision. In this article, we'll delve into the key aspects of Schp stock and US Treasury, comparing their risk, return, and other important factors.

What is Schp Stock?

Schp stock refers to shares of stock in Scholastic Corporation, an educational publisher and supplier of children's books and educational materials. Scholastic is a well-known name in the education industry, and its stock is listed on the New York Stock Exchange under the ticker symbol SCHL.

Understanding US Treasury Securities

US Treasury securities are debt instruments issued by the United States government to finance its spending. These securities include Treasury bills, notes, and bonds, and are considered among the safest investments available due to the backing of the U.S. government.

Risk and Return: Schp Stock vs. US Treasury

When comparing Schp stock and US Treasury securities, it's essential to consider risk and return.

Risk:

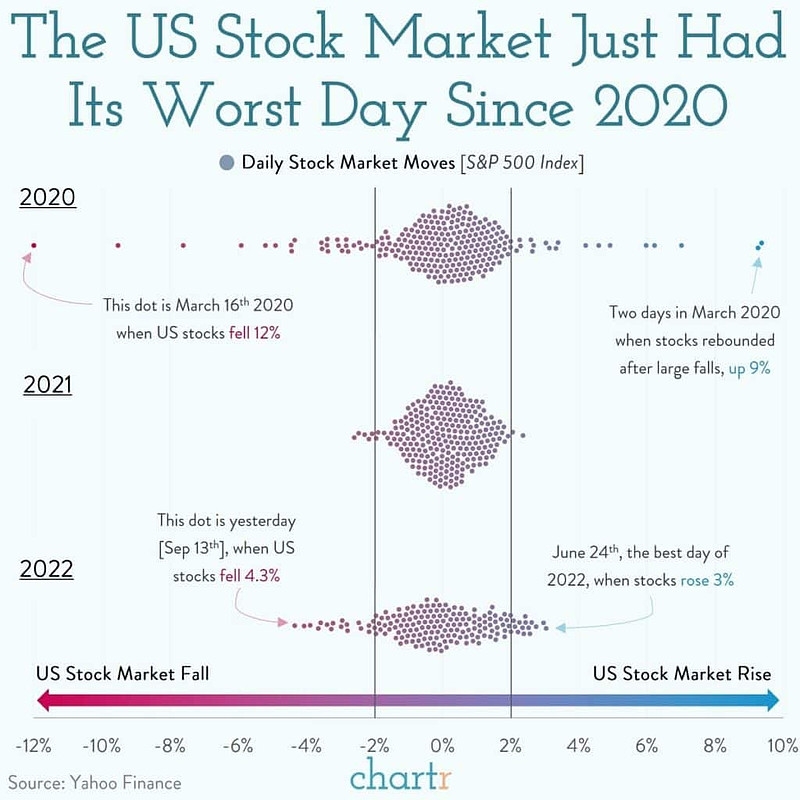

- Schp Stock: As a stock, Schp carries inherent risk due to market volatility and the company's performance. Factors such as changes in the education industry, competition, and economic conditions can impact the stock's price.

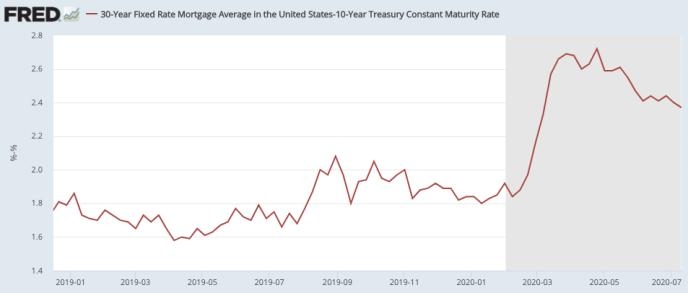

- US Treasury: US Treasury securities are considered low-risk investments. They are backed by the full faith and credit of the U.S. government, making them one of the safest investments available.

Return:

- Schp Stock: The return on Schp stock can be higher than that of US Treasury securities, but it comes with increased risk. Stock prices can fluctuate significantly, and investors may experience losses.

- US Treasury: US Treasury securities offer a lower return compared to stocks but provide a stable and predictable income stream. They are suitable for investors seeking capital preservation and income.

Dividends:

- Schp Stock: Scholastic Corporation may pay dividends to its shareholders, which can provide an additional source of income.

- US Treasury: US Treasury securities do not pay dividends. Instead, they generate income through interest payments.

Liquidity:

- Schp Stock: Schp stock is highly liquid, meaning it can be bought and sold quickly without significantly impacting the price.

- US Treasury: US Treasury securities are also highly liquid, making them easy to buy and sell.

Case Study:

Let's consider a hypothetical scenario to illustrate the differences between Schp stock and US Treasury securities.

Imagine an investor with a moderate risk tolerance who is considering investing $10,000. They have two options:

- Invest in Schp stock: The investor may expect a return of 10% on their investment, but there is a risk of losing some or all of their capital.

- Invest in US Treasury securities: The investor may expect a return of 2% on their investment, but the risk of losing capital is minimal.

In this scenario, the investor prioritizes capital preservation and a stable income stream, making US Treasury securities the more suitable option.

Conclusion

When deciding between Schp stock and US Treasury securities, it's crucial to consider your risk tolerance, investment goals, and time horizon. While Schp stock offers the potential for higher returns, it comes with increased risk. US Treasury securities, on the other hand, provide a lower return but are considered safer and more stable investments.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....