In today's fast-paced financial world, getting stocks is more than just a financial move—it's a strategic endeavor. Whether you're a seasoned investor or a beginner looking to dip your toes into the stock market, understanding how to get stocks and where to find the best opportunities is crucial. This guide will walk you through the essentials of purchasing stocks, from the basics to advanced strategies, ensuring you make informed decisions.

Understanding Stocks

First things first, let's clarify what stocks are. A stock represents a share in the ownership of a company. When you buy stocks, you become a shareholder, entitling you to a portion of the company's profits and assets. The value of your stocks can increase or decrease based on the company's performance and market conditions.

Where to Get Stocks

The primary place to get stocks is through a brokerage account. A brokerage firm acts as an intermediary between you and the stock market, allowing you to buy and sell stocks. Here are some popular platforms to consider:

- Brokerage Websites: Websites like TD Ameritrade, E*TRADE, and Fidelity offer user-friendly platforms with a variety of tools and resources.

- Mobile Apps: Apps like Robinhood, Webull, and Acorns make it easy to buy stocks on the go, with some offering free trades.

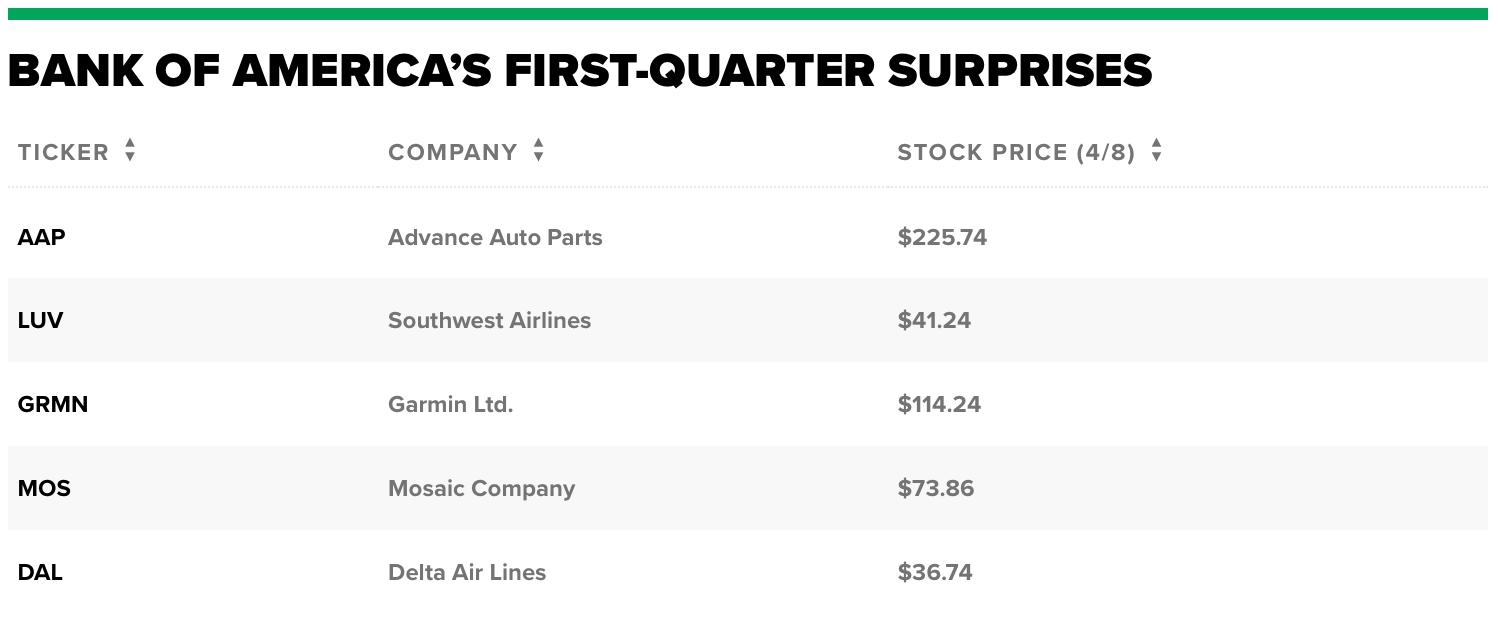

- Traditional Banks: Many banks, such as Chase and Bank of America, offer brokerage services as well.

How to Get Stocks

- Open a Brokerage Account: The first step is to open a brokerage account. This process typically involves providing personal information, choosing an account type, and funding your account.

- Research: Before buying stocks, research the companies you're interested in. Look at their financial statements, news, and industry trends.

- Choose Your Stocks: Based on your research, decide which stocks to buy. Consider your investment goals, risk tolerance, and time horizon.

- Place Your Order: Once you've chosen your stocks, place your order through your brokerage account. You can choose to buy stocks at the market price or set a limit price.

- Monitor Your Investments: After purchasing stocks, keep an eye on their performance. Stay informed about market news and the company's financials.

Advanced Strategies

For those looking to get stocks beyond the basics, here are some advanced strategies:

- Dividend Stocks: Invest in companies that pay dividends, providing you with regular income.

- Options Trading: Use options to hedge your portfolio or speculate on stock price movements.

- ETFs and Mutual Funds: Consider investing in Exchange-Traded Funds (ETFs) or mutual funds for diversification and professional management.

Case Study: Apple Inc.

Let's take a look at a real-world example. Apple Inc. (AAPL) is a prime example of a successful stock investment. Since its initial public offering (IPO) in 1980, Apple has seen its stock price skyrocket. Investors who bought Apple stocks in the early 2000s have seen their investments grow exponentially.

Conclusion

Getting stocks is a vital step in building a diversified investment portfolio. By understanding the basics, researching companies, and using advanced strategies, you can make informed decisions and potentially achieve significant returns. Whether you're a beginner or an experienced investor, the key to success lies in education, discipline, and patience.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....