In the world of finance, the Wall Street Journal stock price is a term that resonates with investors and traders alike. Understanding the intricacies behind this figure can provide valuable insights into the stock market's health and potential opportunities. This article delves into the various factors that influence the Wall Street Journal stock price, offering a comprehensive guide for those seeking to navigate the complexities of the financial landscape.

Understanding the Wall Street Journal Stock Price

The Wall Street Journal stock price refers to the current market value of a particular stock as reported by the Wall Street Journal. This figure is crucial for investors, as it reflects the perceived value of the stock in the market. To fully grasp the significance of the Wall Street Journal stock price, it's essential to consider several key factors:

1. Market Demand and Supply

The most fundamental factor influencing the Wall Street Journal stock price is the basic economic principle of supply and demand. When demand for a stock increases, its price tends to rise, and vice versa. This dynamic is influenced by various factors, including investor sentiment, economic indicators, and corporate news.

2. Company Performance

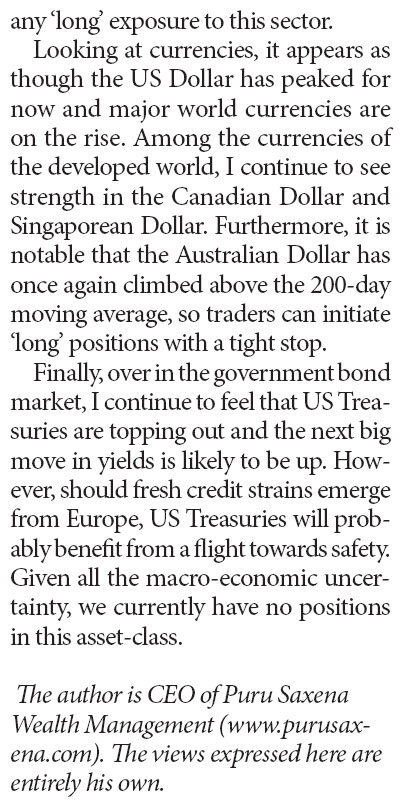

The financial performance of a company plays a pivotal role in determining its stock price. Strong earnings reports, revenue growth, and positive outlooks from management can drive up the stock price, while poor performance or negative news can have the opposite effect.

3. Economic Indicators

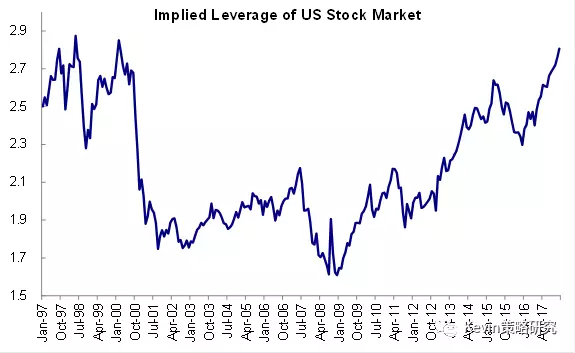

Economic indicators, such as interest rates, inflation, and GDP growth, can significantly impact the Wall Street Journal stock price. These indicators reflect the overall health of the economy and can influence investor sentiment and market trends.

4. Market Sentiment

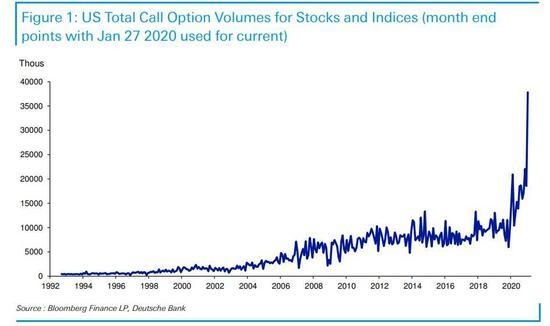

Market sentiment refers to the overall mood or attitude of investors towards the market. This sentiment can be influenced by a wide range of factors, including political events, geopolitical tensions, and natural disasters. Positive market sentiment can boost stock prices, while negative sentiment can lead to declines.

5. Dividends and Splits

Dividends and stock splits can also affect the Wall Street Journal stock price. Dividends provide investors with a portion of a company's profits, while stock splits can increase the number of shares outstanding, potentially lowering the stock price.

Case Studies: Analyzing the Wall Street Journal Stock Price

To illustrate the impact of these factors on the Wall Street Journal stock price, let's consider a few case studies:

1. Apple Inc. (AAPL)

Apple Inc. has consistently been a top performer in the tech industry, thanks to its innovative products and strong financial performance. As a result, the Wall Street Journal stock price for Apple has seen significant growth over the years, driven by factors such as high demand for its products, strong earnings reports, and a positive market sentiment.

2. Tesla Inc. (TSLA)

Tesla Inc. has been a highly volatile stock, with its Wall Street Journal stock price experiencing sharp swings due to various factors. While the company has seen impressive growth in terms of sales and market share, concerns about its profitability and competition have led to periods of volatility in its stock price.

3. Amazon.com Inc. (AMZN)

Amazon.com Inc. has been a dominant force in the e-commerce industry, with its Wall Street Journal stock price reflecting its impressive growth and market position. Factors such as strong revenue growth, expansion into new markets, and a positive market sentiment have contributed to the stock's upward trajectory.

Conclusion

Understanding the Wall Street Journal stock price requires a comprehensive analysis of various factors, including market demand and supply, company performance, economic indicators, market sentiment, and dividends and splits. By considering these factors, investors can gain valuable insights into the stock market and make informed decisions.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....