In today's fast-paced business environment, understanding the market index is crucial for both investors and businesses. A market index is a statistical measure of the value of a selection of securities, typically a basket of stocks, and is used to track market trends and performance. This article delves into the significance of market indices, strategies for utilizing them, and real-world examples of their impact.

Understanding Market Indices

A market index is a representation of a specific market or sector. It provides a snapshot of the overall performance of the market or sector by tracking the performance of a group of stocks. The most well-known market index is the S&P 500, which tracks the performance of 500 large companies listed on the stock exchanges in the United States.

Strategies for Investors

For investors, understanding market indices can help them make informed decisions. Here are some strategies to consider:

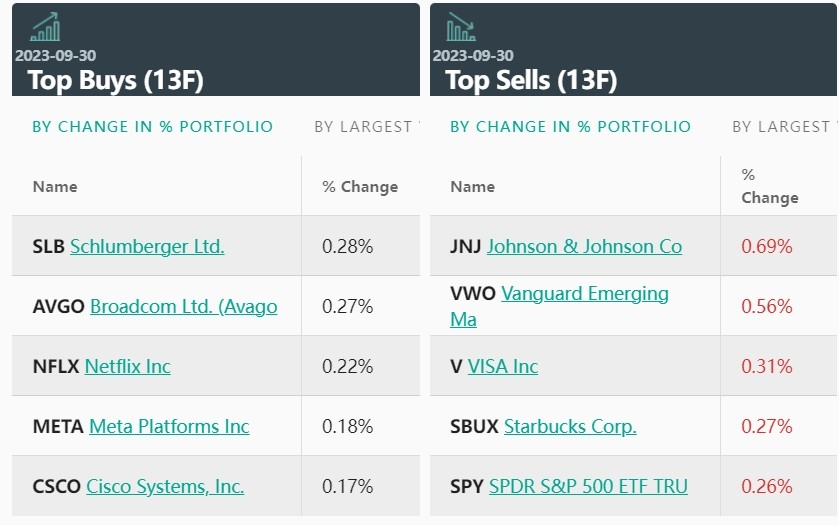

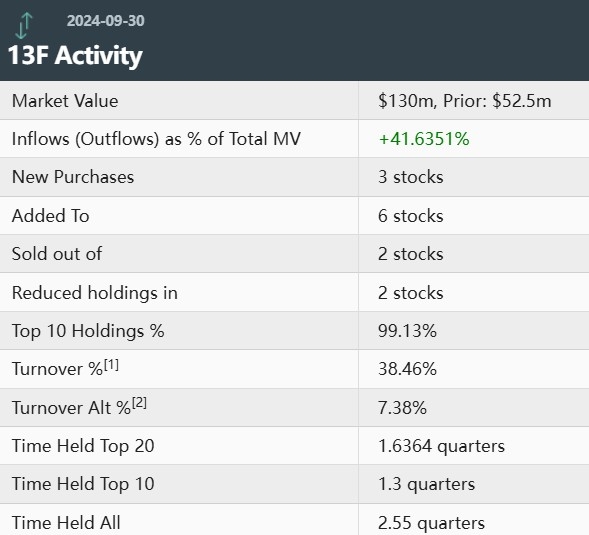

- Diversification: Investing in a variety of stocks across different market indices can help reduce risk.

- Long-term Investing: Market indices tend to show long-term growth, making them a good choice for long-term investors.

- Market Timing: Some investors use market indices to time their investments, buying when the index is low and selling when it's high.

Strategies for Businesses

Businesses can also benefit from understanding market indices. Here's how:

- Market Trends: Tracking market indices can help businesses stay aware of market trends and adjust their strategies accordingly.

- Investment Opportunities: Businesses can use market indices to identify potential investment opportunities.

- Performance Comparison: Comparing a company's performance to market indices can help identify areas for improvement.

Real-World Examples

One real-world example of the impact of market indices is the tech sector's rise in the past decade. The NASDAQ Composite, which tracks the performance of technology stocks, has seen significant growth, making it a popular investment choice for many.

Another example is the S&P 500's recovery following the 2008 financial crisis. The index's rebound provided hope for investors and businesses alike, signaling a potential turnaround in the economy.

Conclusion

In conclusion, understanding market indices is essential for both investors and businesses. By utilizing these indices, investors can make informed decisions and businesses can stay ahead of market trends. Whether you're an investor or a business owner, paying attention to market indices can provide valuable insights and opportunities for growth.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....