In today's fast-paced financial world, staying updated on the stock market is crucial for investors. DJT, which stands for the Dow Jones Transportation Average, is one of the key indices that investors watch closely. This article aims to provide a comprehensive overview of DJT's US stock price, its significance, and what it means for investors.

Understanding DJT

The Dow Jones Transportation Average (DJT) is a price-weighted average of 20 transportation companies listed on the New York Stock Exchange and the NASDAQ. This index is widely considered as a bellwether for the transportation sector and is part of the broader Dow Jones Industrial Average (DJIA).

Significance of DJT's Stock Price

The DJT's stock price holds immense significance for several reasons:

Indication of Sector Health: As mentioned earlier, DJT represents the transportation sector. A rising DJT indicates a healthy transportation industry, while a falling DJT suggests potential issues in the sector.

Market Trends: The DJT's stock price can provide insights into the overall market trends. Since DJT is a component of the DJIA, its movements often correlate with the broader market.

Investment Opportunities: Investors can use the DJT's stock price to identify potential investment opportunities within the transportation sector.

Factors Affecting DJT's Stock Price

Several factors can influence the DJT's stock price:

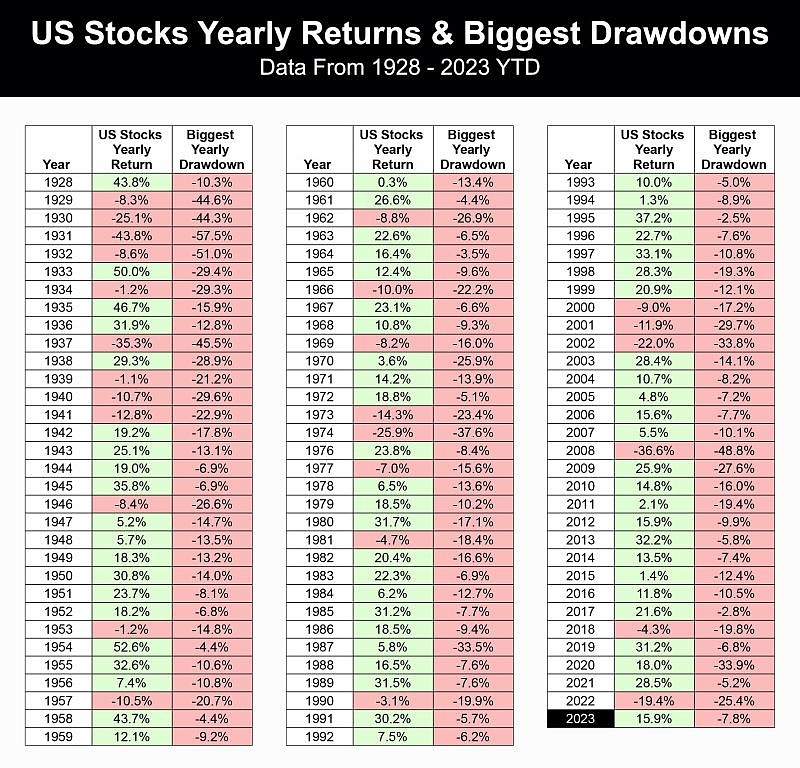

Economic Indicators: Economic indicators such as GDP growth, inflation, and unemployment rates can impact the DJT's stock price. A strong economy usually translates to higher stock prices.

Industry-Specific News: News and developments related to the transportation sector, such as new regulations, mergers, and acquisitions, can significantly affect the DJT's stock price.

Commodity Prices: The price of commodities like oil and coal, which are essential for transportation, can also influence the DJT's stock price.

Case Study: UPS

Let's take a look at a case study to understand the impact of DJT's stock price on a specific company. United Parcel Service (UPS) is one of the companies included in the DJT index.

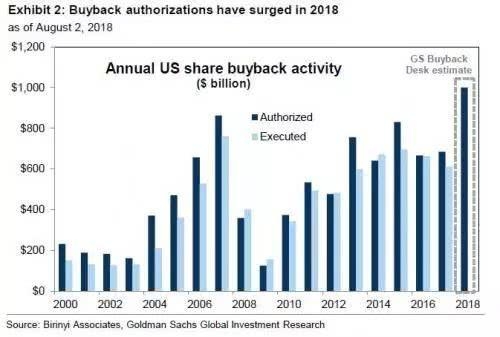

In 2018, the DJT's stock price experienced a significant rise. This was primarily due to strong economic growth and increased consumer spending. As a result, UPS, being a key player in the transportation sector, saw its stock price rise as well. Conversely, during the COVID-19 pandemic, the DJT's stock price and UPS's stock price declined due to reduced economic activity and lockdowns.

Conclusion

In conclusion, understanding the DJT's stock price is essential for investors looking to invest in the transportation sector or stay updated on market trends. By considering factors such as economic indicators, industry-specific news, and commodity prices, investors can make informed decisions based on the DJT's stock price.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....