In the fast-paced world of stock trading, the regular trading hours can sometimes feel like a sprint. However, for those who are looking to gain an edge, the Nasdaq after hours session can be a game-changer. This extended trading period offers investors a unique opportunity to trade stocks outside of the traditional market hours, potentially leading to significant gains. In this article, we will delve into the intricacies of the Nasdaq after hours session, its benefits, and how you can leverage it to your advantage.

Understanding the Nasdaq After Hours Session

The Nasdaq after hours session typically begins shortly after the regular trading day ends at 4:00 PM Eastern Time. It continues until 8:00 PM Eastern Time, giving investors an additional four hours to trade. During this period, most of the major exchanges, including the Nasdaq, allow for the trading of stocks, options, and other financial instruments.

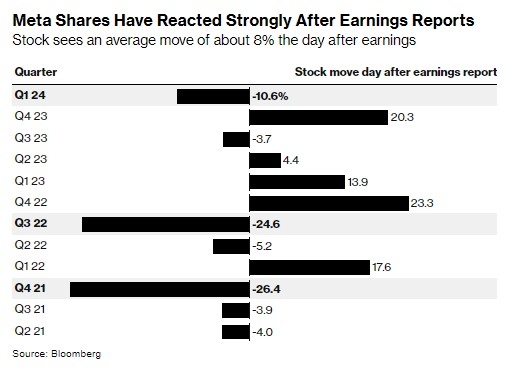

One of the key advantages of the Nasdaq after hours session is the ability to react to news and market developments that occur after the regular trading day. This can be particularly beneficial for investors who are looking to capitalize on significant news events, such as earnings reports, mergers, or regulatory announcements.

Benefits of Trading During the Nasdaq After Hours

React to Late News: The ability to trade after the regular market hours allows investors to react to news that may have been released after the market closed. This can be a significant advantage, as the stock market can react rapidly to new information.

Potential for Higher Volume: The Nasdaq after hours session often sees higher trading volumes compared to other extended trading sessions, such as the pre-market. This can lead to better liquidity and potentially more favorable trading conditions.

Leverage Technical Analysis: For those who rely on technical analysis, the Nasdaq after hours session can provide additional data points to analyze. This can help in making more informed trading decisions.

Potential for Higher Returns: While there are risks involved, the Nasdaq after hours session can offer opportunities for higher returns, especially if you are able to identify and capitalize on market-moving events.

Case Study: Trading During the Nasdaq After Hours

Let's consider a hypothetical scenario. Imagine a company releases its earnings report after the regular trading day ends. The report shows strong earnings and revenue growth, which is a positive surprise for investors. If you are able to trade during the Nasdaq after hours session, you can buy the stock immediately after the report is released, potentially benefiting from the initial price surge.

How to Trade During the Nasdaq After Hours

To trade during the Nasdaq after hours, you will need to have a brokerage account that supports extended trading hours. Most major online brokers offer this service, allowing you to trade stocks, options, and other financial instruments during the Nasdaq after hours session.

It is important to note that while the Nasdaq after hours session offers unique opportunities, it also comes with its own set of risks. The market can be more volatile during this period, and prices may not always reflect the underlying fundamentals of a company.

In conclusion, the Nasdaq after hours session can be a valuable tool for investors looking to gain an edge in the stock market. By understanding the benefits and risks, and by using the right strategies, you can potentially capitalize on the opportunities that this extended trading period offers.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....