Are you looking to dive into the dynamic world of the US stock market? Whether you're a seasoned investor or just starting out, understanding the key trends, insights, and opportunities is crucial. In this article, we'll explore the US stock market, its history, and the latest trends that could impact your investment decisions.

Understanding the US Stock Market

The US stock market is the largest and most influential in the world. It's home to some of the most successful and well-known companies, including Apple, Google, and Microsoft. The market is divided into two main exchanges: the New York Stock Exchange (NYSE) and the NASDAQ.

The NYSE is the oldest and most iconic stock exchange in the United States, established in 1792. It's known for its traditional trading floor, where brokers and traders gather to buy and sell stocks. The NASDAQ, on the other hand, is known for its technology focus and is home to many tech giants.

Historical Context

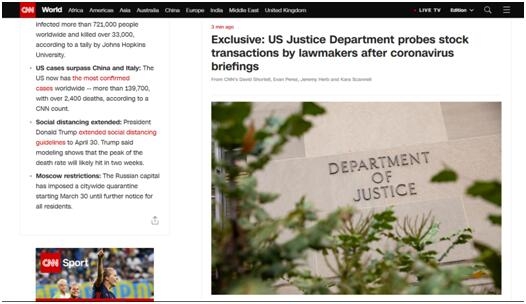

The US stock market has seen many ups and downs over the years. The Great Depression of the 1930s, the dot-com bubble of the 1990s, and the 2008 financial crisis are just a few examples of the market's volatility.

Despite these challenges, the US stock market has always managed to recover and grow stronger. In fact, the S&P 500, a widely followed index of 500 large companies, has returned an average annual return of around 10% since its inception in 1957.

Latest Trends

As of 2021, the US stock market is experiencing several key trends:

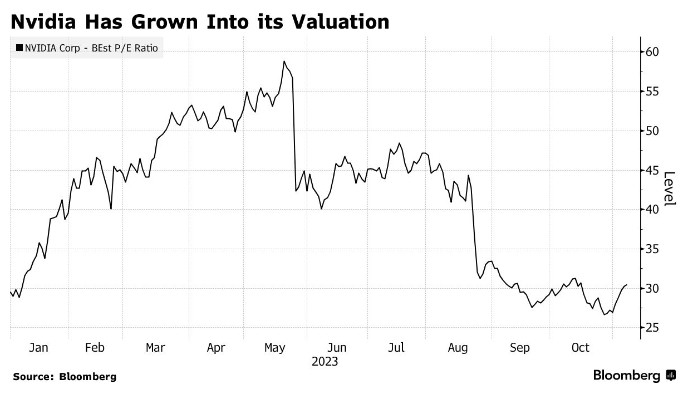

- Technology Stocks Leading the Charge: The tech sector has been a major driver of the market's growth. Companies like Apple, Amazon, and Facebook (now Meta) have seen their stock prices soar in recent years.

- Increased Focus on ESG Investing: Environmental, social, and governance (ESG) investing has gained significant traction in recent years. Investors are increasingly looking for companies that prioritize sustainability and social responsibility.

- Mergers and Acquisitions (M&A) Activity: The M&A market has been active, with companies looking to expand their reach and market share.

Opportunities in the US Stock Market

Despite the market's volatility, there are still plenty of opportunities for investors. Here are a few to consider:

- Dividend Stocks: Dividend stocks offer investors regular income and can provide a buffer against market volatility.

- Small-Cap Stocks: Small-cap stocks often offer higher growth potential than large-cap stocks, but they also come with higher risk.

- Emerging Markets: Investing in emerging markets can offer high returns, but it's important to do thorough research and consider the risks involved.

Case Study: Tesla

A great example of a company that has seen significant growth in the US stock market is Tesla. Founded in 2003, Tesla has become a leader in the electric vehicle (EV) industry. Its stock has soared since its initial public offering (IPO) in 2010, making it one of the most valuable companies in the world.

Tesla's success can be attributed to several factors, including its innovative products, strong brand, and commitment to sustainability. However, it's important to note that Tesla's stock is also highly volatile, and investors should be prepared for potential ups and downs.

Conclusion

The US stock market is a complex and dynamic environment, with opportunities and risks for investors at all levels. By understanding the key trends, insights, and opportunities, you can make more informed investment decisions and potentially achieve your financial goals.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....