In the vast world of finance, the all share market index serves as a crucial indicator of the overall health and performance of a stock market. It encompasses the entire spectrum of publicly traded companies, providing investors with a snapshot of market trends and economic conditions. This article delves into the intricacies of the all share market index, exploring its significance, components, and impact on investors.

What is the All Share Market Index?

The all share market index is a composite measure that reflects the performance of all publicly traded companies within a particular stock market. Unlike other indices that may focus on specific sectors or market capitalizations, the all share index captures the entire market landscape. It provides a holistic view of market dynamics, making it an invaluable tool for investors and analysts alike.

Components of the All Share Market Index

The composition of the all share market index varies depending on the stock market in question. However, most indices typically include the following components:

- Market Capitalization: This refers to the total value of all the shares of a company. It is calculated by multiplying the number of outstanding shares by the current market price.

- Number of Companies: The index includes all publicly traded companies within the specified market.

- Sector Representation: The index reflects the various sectors within the market, ensuring a balanced representation of different industries.

- Geographical Coverage: The index encompasses companies from different geographical regions, providing a comprehensive view of the market.

Significance of the All Share Market Index

The all share market index holds immense significance for several reasons:

- Market Performance Indicator: It serves as a reliable gauge of the overall performance of the stock market. A rising index indicates a healthy market, while a falling index suggests potential challenges.

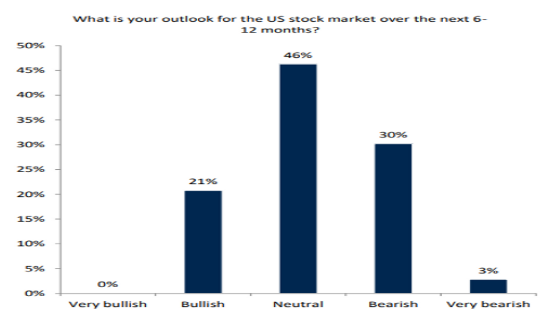

- Investment Decision Making: Investors rely on the all share index to make informed investment decisions. By analyzing the index, they can gain insights into market trends and economic conditions.

- Benchmarking: The index serves as a benchmark for comparing the performance of individual companies against the broader market.

Impact of the All Share Market Index on Investors

The all share market index has a profound impact on investors in several ways:

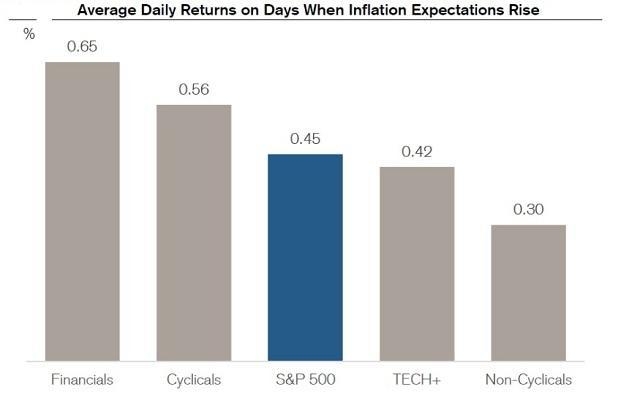

- Risk Assessment: A rising index indicates a favorable market environment, making it an attractive time for investors to take on higher-risk investments.

- Diversification: The index provides a diverse range of investment opportunities, allowing investors to diversify their portfolios and mitigate risks.

- Market Sentiment: The index reflects the overall sentiment of investors, providing valuable insights into market psychology.

Case Studies: The All Share Market Index in Action

To illustrate the impact of the all share market index, let's consider two case studies:

- Rising Index: In 2020, the S&P 500 index experienced a significant rise, reflecting the strong performance of the stock market during the COVID-19 pandemic. This rise encouraged investors to take on higher-risk investments, leading to increased market activity.

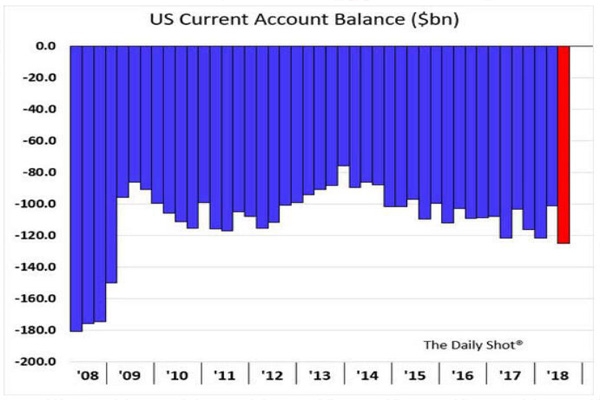

- Falling Index: In 2008, the Dow Jones Industrial Average experienced a sharp decline, reflecting the global financial crisis. This decline led to widespread panic and a shift towards safer investment options.

Conclusion

The all share market index is a vital tool for understanding the overall performance and dynamics of a stock market. By analyzing its components and impact, investors can make informed decisions and navigate the complex world of finance with confidence.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....