In recent weeks, the stock market has been a hot topic of discussion among investors and financial experts alike. The question on everyone's mind is, "Are stocks down?" This article delves into the current market trends, analyzes the factors contributing to the downward trend, and provides insights into what this means for investors.

Market Trends

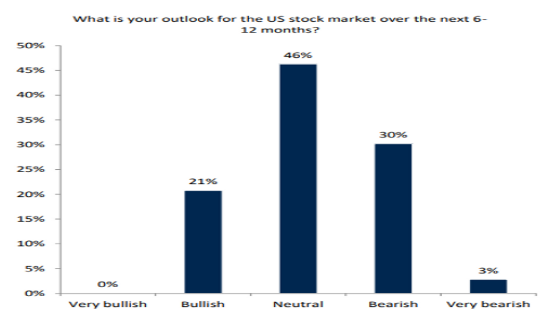

The stock market has experienced a downward trend in recent months, with many investors questioning the reasons behind this shift. According to financial experts, several factors have contributed to the current market situation.

Economic Factors

One of the primary reasons for the downward trend in stocks is the economic uncertainty caused by the COVID-19 pandemic. As the global economy struggles to recover, companies are facing challenges such as reduced consumer spending, supply chain disruptions, and increased costs. These economic factors have led to a decrease in corporate earnings, which in turn has impacted stock prices.

Inflation Concerns

Another significant factor contributing to the downward trend is inflation. As the cost of goods and services rises, companies are facing increased expenses, which can lead to lower profits. Additionally, the Federal Reserve's decision to raise interest rates has further added to the economic uncertainty, causing investors to become cautious.

Geopolitical Tensions

Geopolitical tensions have also played a role in the downward trend of stocks. Issues such as trade disputes, political instability, and conflicts can create uncertainty in the market, leading to a decrease in investor confidence.

Sector Analysis

The downward trend in stocks has impacted various sectors differently. For instance, technology stocks have been particularly hard hit, with many investors concerned about the potential for increased competition and regulatory scrutiny. On the other hand, sectors such as healthcare and consumer staples have remained relatively stable, as they are considered to be more resilient in times of economic uncertainty.

Case Studies

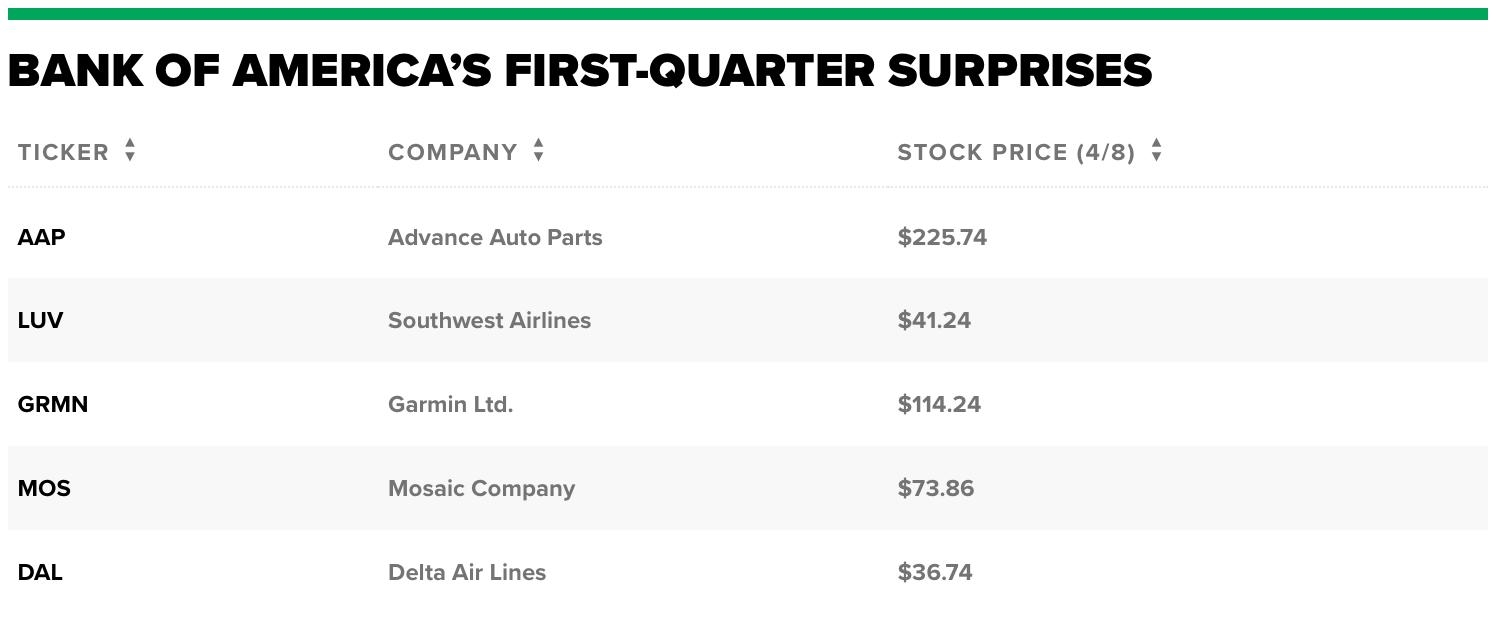

To illustrate the impact of the current market trends, let's consider a few case studies:

Apple Inc.: As one of the largest technology companies in the world, Apple has experienced a significant drop in its stock price. This decline can be attributed to a combination of economic uncertainty and increased competition in the smartphone market.

Tesla Inc.: Another prominent technology company, Tesla, has also faced challenges. The company's stock has been impacted by supply chain disruptions and concerns about its ability to meet increasing demand.

Johnson & Johnson: In contrast, healthcare companies such as Johnson & Johnson have remained relatively stable. This can be attributed to the demand for healthcare products and services, which is not as affected by economic uncertainty.

Investor Strategies

Given the current market trends, investors need to adopt a cautious approach. Here are a few strategies to consider:

Diversification: Diversifying your portfolio can help mitigate the risk of losses in any one sector or stock.

Long-term Perspective: Focus on long-term investments rather than short-term gains.

Stay Informed: Keep up with the latest market trends and economic news to make informed decisions.

In conclusion, the question "Are stocks down?" is a valid concern for many investors. The current market trends are influenced by a combination of economic, inflation, and geopolitical factors. While the downward trend has impacted various sectors differently, investors need to adopt a cautious approach and stay informed to navigate these challenging times.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....