In the ever-evolving landscape of finance, understanding the stock market is crucial for anyone looking to grow their wealth. Whether you're a seasoned investor or just starting out, this guide will provide you with the essential knowledge to navigate the stock market effectively.

Understanding the Basics

The stock market is a marketplace where shares of publicly-traded companies are bought and sold. When you purchase shares of a company, you become a partial owner, known as a shareholder. The value of these shares can fluctuate based on various factors, such as the company's performance, economic conditions, and market sentiment.

Key Terms to Know

To make informed decisions, it's important to familiarize yourself with key terms such as:

- Stock: A share of ownership in a company.

- Market Capitalization: The total value of a company's shares.

- Dividend: A portion of a company's earnings distributed to shareholders.

- Earnings Per Share (EPS): A measure of a company's profitability.

- P/E Ratio: The price-to-earnings ratio, which compares a company's stock price to its EPS.

Types of Stocks

There are several types of stocks to consider:

- Common Stocks: Provide voting rights and the potential for dividends.

- Preferred Stocks: Pay fixed dividends and have a higher claim on assets than common stocks.

- Blue-Chip Stocks: Shares of well-established, financially stable companies.

- Growth Stocks: Companies with high growth potential, often reinvesting earnings into the business.

Investment Strategies

When investing in the stock market, there are various strategies to consider:

- Long-Term Investing: Holding stocks for an extended period, often years or decades.

- Short-Term Trading: Buying and selling stocks within a short timeframe.

- Dividend Investing: Focusing on companies that consistently pay dividends.

Risk Management

It's crucial to understand the risks involved in stock market investing:

- Market Risk: The potential for losses due to market fluctuations.

- Credit Risk: The risk of a company defaulting on its financial obligations.

- Liquidity Risk: The risk of not being able to sell an investment at a desired price.

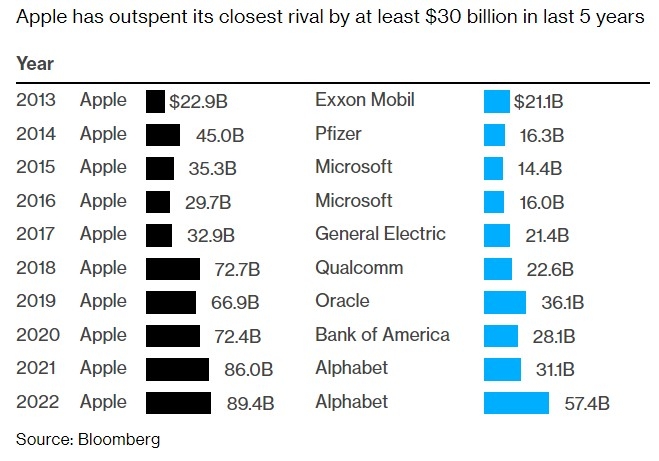

Case Study: Apple Inc.

A prime example of a successful stock market investment is Apple Inc. Since its initial public offering (IPO) in 1980, Apple's stock has seen significant growth. Over the years, the company has consistently delivered strong financial results, leading to a rise in its stock price. Investors who bought Apple's stock during its early years have seen substantial gains.

Conclusion

Navigating the stock market can be complex, but with a solid understanding of the basics, you can make informed decisions and potentially grow your wealth. Remember to diversify your investments, stay informed about market trends, and consult with a financial advisor if needed. With patience and discipline, investing in the stock market can be a rewarding endeavor.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....