In the world of finance, the SP Dow Jones index holds significant importance. This article delves into what the SP Dow Jones index is, its history, and its impact on the stock market. By the end of this article, you'll have a clearer understanding of this influential financial indicator.

What is the SP Dow Jones Index?

The SP Dow Jones index, also known as the S&P Dow Jones Indices, is a group of indices that tracks the performance of a wide range of companies across various sectors. These indices are created and maintained by S&P Global, a leading provider of financial information and analytics.

One of the most well-known indices in the SP Dow Jones family is the Dow Jones Industrial Average (DJIA). The DJIA tracks the performance of 30 large, publicly-traded companies in the United States and is often considered a bellwether for the broader stock market.

The History of the SP Dow Jones Indices

The SP Dow Jones Indices have a rich history that dates back to 1884. The first index, the Dow Jones Transportation Average, was introduced to track the performance of the transportation sector. Over the years, the SP Dow Jones Indices expanded to include other sectors such as utilities, financials, and consumer goods.

In 1923, the DJIA was introduced, and it quickly became a widely followed indicator of the stock market's performance. Today, the SP Dow Jones Indices include over 50 indices, each serving as a valuable tool for investors and analysts.

The Impact of the SP Dow Jones Indices

The SP Dow Jones Indices have a significant impact on the stock market and the broader economy. Here are a few key points to consider:

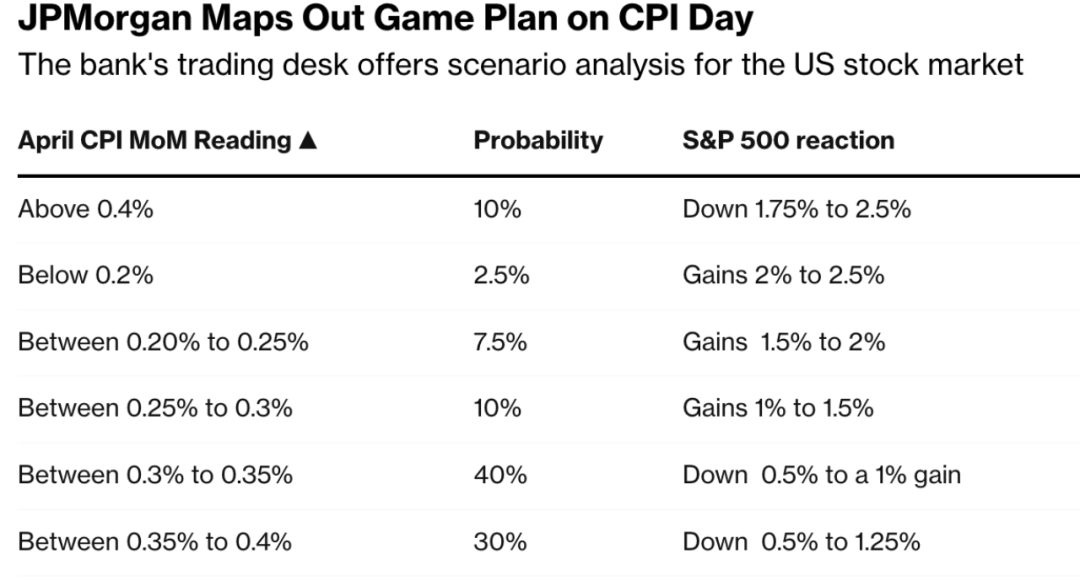

Investor Sentiment: The performance of the SP Dow Jones Indices can influence investor sentiment. For example, if the DJIA is on the rise, it may indicate that investors are optimistic about the economy and the stock market.

Economic Indicators: The SP Dow Jones Indices can serve as a barometer for the economy. For instance, a rising DJIA may suggest a strong economy, while a falling DJIA may indicate economic concerns.

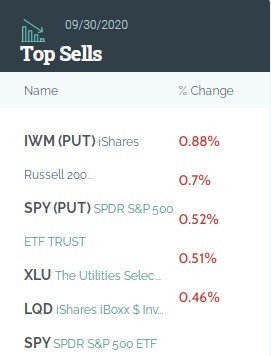

Market Trends: The SP Dow Jones Indices provide valuable insights into market trends. By analyzing the performance of different sectors within these indices, investors can identify emerging trends and make informed investment decisions.

Case Studies

To illustrate the impact of the SP Dow Jones Indices, let's consider a few case studies:

2008 Financial Crisis: During the 2008 financial crisis, the DJIA experienced a significant decline. This decline was a reflection of the broader economic turmoil at the time, as many companies faced financial difficulties.

2020 Pandemic: In 2020, the global pandemic caused another sharp decline in the DJIA. However, the index quickly recovered as the economy began to reopen, demonstrating the resilience of the stock market.

Conclusion

The SP Dow Jones Indices are essential tools for investors and analysts looking to understand the performance of the stock market and the broader economy. By tracking the performance of companies across various sectors, these indices provide valuable insights into market trends and economic conditions. Whether you're an experienced investor or just starting out, understanding the SP Dow Jones Indices can help you make informed investment decisions.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....