Investing in US stocks through a Tax-Free Savings Account (TFSA) can be a strategic move for Canadians looking to maximize their capital gains while enjoying tax-free growth. This article delves into the ins and outs of using a TFSA for US stock investments, providing insights and practical advice to help you make informed decisions.

Understanding TFSA Capital Gains

First, let's clarify what a TFSA is and how it can be used for capital gains. A TFSA is a registered account that allows Canadians to earn tax-free investment income. Contributions are not tax-deductible, but any investment growth, dividends, or capital gains within the account are tax-free.

When you invest in US stocks through a TFSA, you can benefit from the potential for significant capital gains without having to pay taxes on those gains. This can be particularly advantageous if you're investing in high-growth US companies that offer substantial capital appreciation over time.

Benefits of Investing in US Stocks Through a TFSA

Tax-Free Growth: The primary benefit of using a TFSA for US stock investments is the tax-free growth. This means you won't have to pay taxes on any capital gains you earn within the account, allowing your investments to grow faster.

Diversification: Investing in US stocks through a TFSA allows you to diversify your portfolio beyond Canadian stocks. This can help reduce risk and potentially increase your returns.

Access to High-Growth Companies: The US stock market is home to many high-growth companies that may not be available in Canada. By investing in these companies through a TFSA, you can take advantage of their potential for significant capital gains.

How to Invest in US Stocks Through a TFSA

Open a TFSA: If you haven't already, open a TFSA. The annual contribution limit for 2021 is $6,000, and you can carry forward any unused contribution room from previous years.

Choose a Broker: Select a brokerage firm that offers access to US stocks. Many Canadian brokers offer this service, so be sure to compare fees and features.

Research US Stocks: Conduct thorough research to identify US stocks that align with your investment goals and risk tolerance. Consider factors such as market capitalization, financial health, and growth potential.

Purchase US Stocks: Once you've identified the stocks you want to invest in, purchase them through your TFSA. Remember that any capital gains you earn will be tax-free.

Case Study: Investing in Apple Inc.

Let's consider an example of investing in Apple Inc. through a TFSA. If you invested

Conclusion

Investing in US stocks through a TFSA can be a powerful strategy for maximizing capital gains while enjoying tax-free growth. By understanding the benefits and following a well-researched approach, you can take advantage of the potential for significant returns in the US stock market.

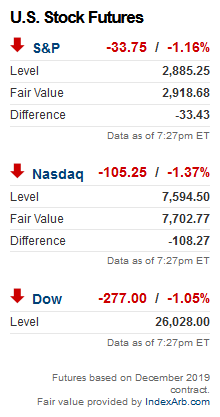

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....