In the dynamic world of stock trading, the term "in-stock trade" refers to the practice of buying and selling stocks that are readily available in the market. This approach offers traders a unique way to capitalize on market fluctuations and generate substantial profits. In this article, we will delve into the intricacies of in-stock trading, explore its benefits, and provide practical strategies to help you maximize your returns.

Understanding In-Stock Trade

Before we dive into the strategies, let's clarify what in-stock trading entails. In-stock trading involves buying and selling stocks that are currently available in the market. Unlike day trading, where traders often rely on leverage, in-stock trading emphasizes a more conservative approach, focusing on long-term gains.

The Benefits of In-Stock Trading

In-stock trading offers several advantages over other trading methods:

- Lower Risk: By focusing on stocks that are readily available, traders can minimize the risk of losing capital due to liquidity issues.

- Access to a Wide Range of Stocks: In-stock trading allows traders to invest in a diverse range of stocks, giving them the flexibility to tailor their portfolios to their investment goals.

- Long-Term Gains: In-stock trading is often associated with long-term gains, making it an ideal choice for investors looking to build wealth over time.

Strategies for Successful In-Stock Trading

To succeed in in-stock trading, it's crucial to adopt effective strategies. Here are some key approaches:

Research and Analysis: Before making any investment decisions, thoroughly research the stocks you're interested in. Analyze their financial statements, industry trends, and historical performance. This will help you identify potential opportunities and avoid risky investments.

Diversify Your Portfolio: Diversification is a fundamental principle of investing. By spreading your investments across various stocks and sectors, you can reduce your risk and increase your chances of generating consistent returns.

Set Realistic Goals: Establish clear investment goals and stick to them. Whether you're looking for short-term gains or long-term wealth accumulation, having a well-defined plan will help you stay focused and disciplined.

Monitor Your Investments: Regularly review your portfolio to ensure it aligns with your investment goals. Adjust your holdings as needed to maintain a balanced and diversified portfolio.

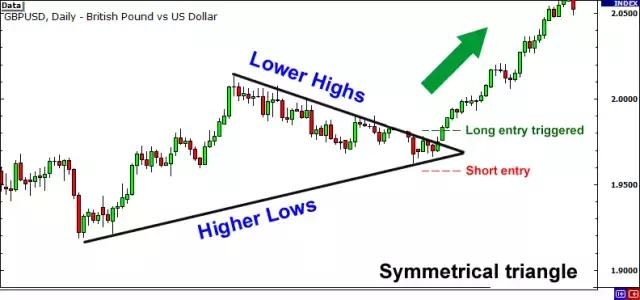

Leverage Technical Analysis: Technical analysis involves studying historical price and volume data to identify patterns and trends. By incorporating technical analysis into your trading strategy, you can make more informed investment decisions.

Case Study: In-Stock Trading Success Story

Consider the case of John, a seasoned investor who adopted an in-stock trading strategy. By focusing on well-researched stocks and diversifying his portfolio, John was able to generate a consistent annual return of 15%. His disciplined approach and commitment to continuous learning allowed him to navigate market volatility and achieve long-term success.

Conclusion

In-stock trading is a powerful tool for investors looking to generate substantial returns over time. By understanding the principles of in-stock trading and implementing effective strategies, you can increase your chances of success. Remember to conduct thorough research, diversify your portfolio, and stay disciplined to maximize your profits.

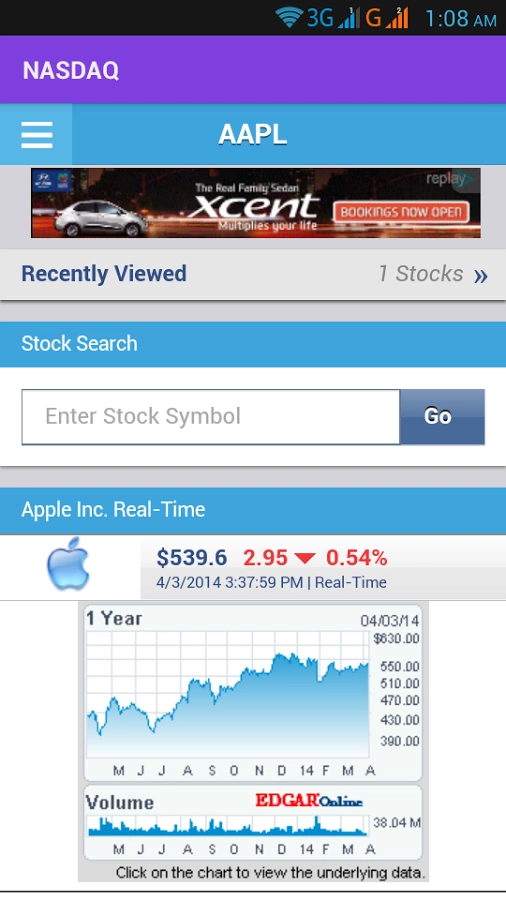

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....