The financial crisis of 2008 was a pivotal moment in the history of the global economy, and its repercussions were felt across all markets, including the US stock market. This article delves into the impact of the financial crisis on US stocks, analyzing the key factors that contributed to the downturn and the long-term effects on the market.

The Roots of the Financial Crisis

The financial crisis originated in the US housing market, where a speculative bubble had formed. Lenders had been providing mortgages to borrowers with poor credit histories, and these mortgages were then bundled into securities and sold to investors. When the bubble burst, the value of these securities plummeted, leading to widespread losses and a credit crunch.

The Impact on US Stocks

The financial crisis had a profound impact on the US stock market. Here are some of the key effects:

- Stock Market Decline: The S&P 500, a widely followed index of large US companies, plummeted by nearly 50% from its peak in October 2007 to its trough in March 2009. This represented one of the worst bear markets in history.

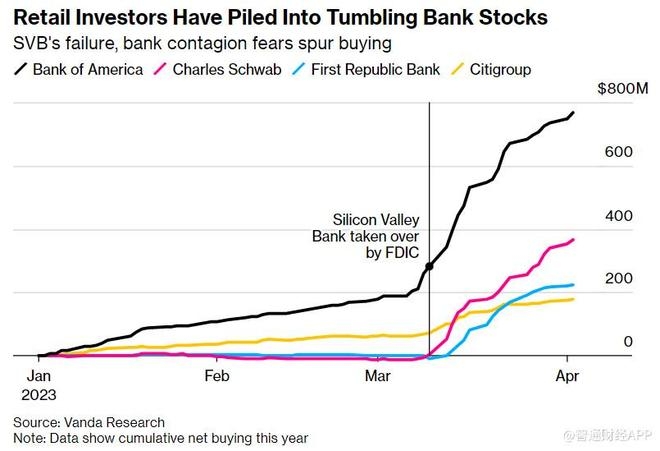

- Bank Stock Collapse: Many banks and financial institutions were hit hard by the crisis, with some, such as Lehman Brothers, collapsing altogether. This led to a massive sell-off in bank stocks, with shares of major banks like Citigroup and Bank of America falling sharply.

- Sector-Specific Impacts: Certain sectors were hit harder than others. For example, financial stocks saw the most significant declines, while consumer discretionary stocks also suffered due to falling consumer confidence.

- Volatility: The financial crisis brought about increased volatility in the stock market, with wild swings in prices as investors reacted to the evolving situation.

Long-Term Effects

The financial crisis had lasting effects on the US stock market and the broader economy:

- Regulatory Changes: In response to the crisis, regulators implemented new rules and regulations to prevent a similar situation from occurring in the future. This included the Dodd-Frank Wall Street Reform and Consumer Protection Act, which aimed to increase transparency and accountability in the financial system.

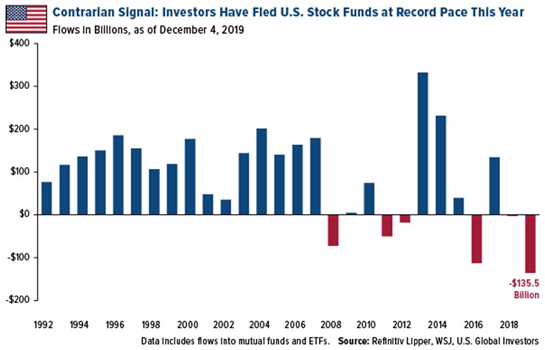

- Market Structure: The crisis led to changes in the market structure, with some investors shifting away from traditional equity investments and towards alternative assets like bonds and real estate.

- Economic Recovery: The US economy took several years to recover from the financial crisis, with unemployment reaching record highs. However, the stock market recovered more quickly, with the S&P 500 regaining its pre-crisis levels by the end of 2013.

Case Study: General Electric

One notable example of the impact of the financial crisis on a single company is General Electric (GE). As a diversified industrial conglomerate, GE was heavily exposed to the financial sector through its finance arm, GE Capital. During the crisis, GE Capital faced significant liquidity problems, and the company's stock price plummeted. However, GE managed to navigate the crisis and has since recovered, although it has not returned to its pre-crisis levels.

In conclusion, the financial crisis of 2008 had a profound impact on the US stock market, leading to significant declines and long-term changes in the market structure and investor behavior. While the crisis caused widespread pain, it also prompted regulatory changes and a renewed focus on risk management, which may help prevent future crises.

us stock market today

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....