The stock market has been a cornerstone of financial growth and investment opportunities for decades. Understanding how much the stock market grows each year can provide valuable insights into the overall health of the economy and investment trends. In this article, we'll delve into the average annual growth rate of the stock market and explore the factors that influence this growth.

Understanding Stock Market Growth

Stock market growth is typically measured by the increase in the value of stocks over a specific period. This growth can be influenced by various factors, including economic conditions, corporate earnings, and investor sentiment. To get a clear picture of the stock market's growth, we'll look at historical data and recent trends.

Historical Growth Rates

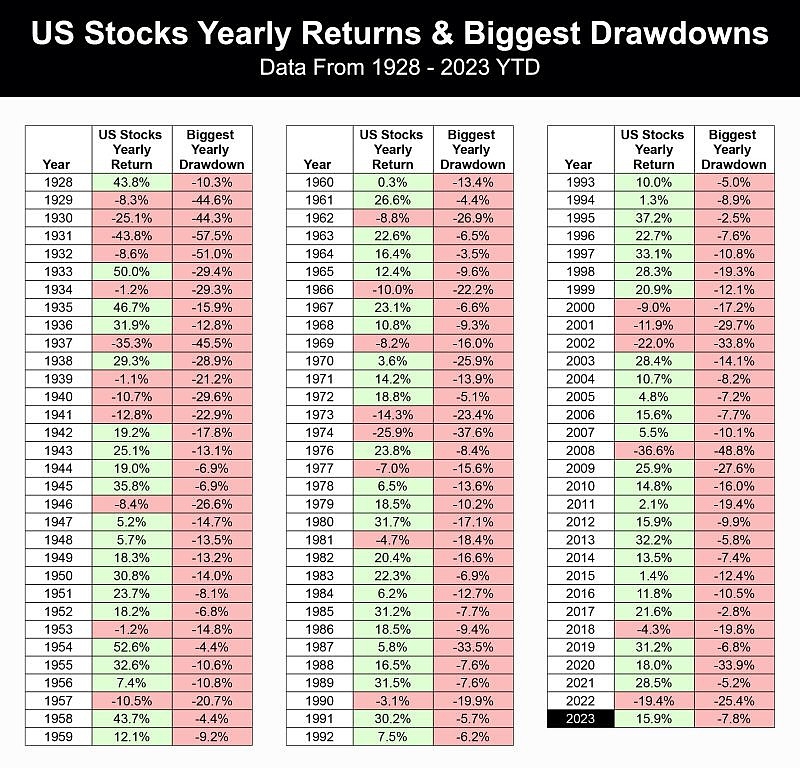

Over the past century, the stock market has experienced varying growth rates. During the early 20th century, the market saw modest growth, with the average annual return hovering around 5-7%. However, in the latter half of the 20th century, the stock market experienced significant growth, with the average annual return rising to around 10-12%.

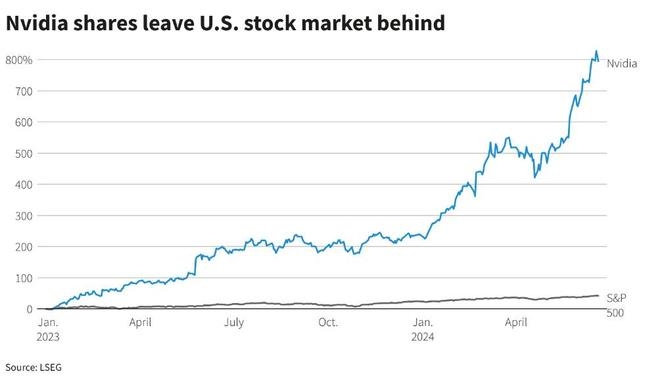

In the 1990s, the stock market experienced a period of remarkable growth, often referred to as the "Dot-com bubble." During this time, the market saw annual returns of up to 20-30%. However, this period was followed by a significant downturn in 2000-2002.

Since then, the stock market has continued to grow, albeit at a slower pace. The average annual return has hovered around 7-10% over the past two decades, with some fluctuations due to economic cycles and market volatility.

Factors Influencing Stock Market Growth

Several factors contribute to the growth of the stock market each year. Here are some of the key factors:

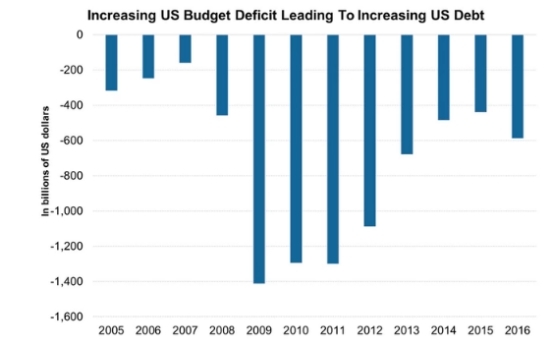

- Economic Growth: A strong economy with low unemployment and rising wages tends to drive stock market growth. When companies earn higher profits, their stock prices often increase.

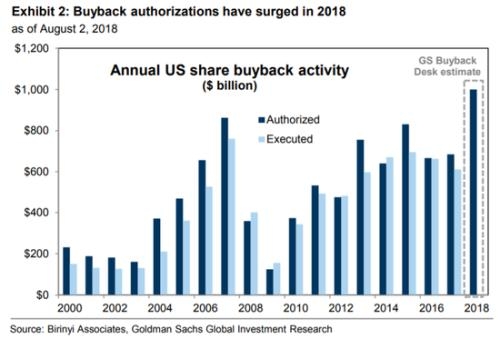

- Corporate Earnings: The earnings of publicly traded companies play a crucial role in stock market growth. Companies with strong financial performance tend to see their stock prices rise.

- Interest Rates: Interest rates can have a significant impact on the stock market. Lower interest rates can encourage investors to seek higher returns in the stock market, leading to increased demand for stocks.

- Investor Sentiment: The mood of investors can influence stock market growth. Optimistic sentiment can drive stock prices higher, while pessimism can lead to sell-offs and lower prices.

- Market Volatility: Volatility in the stock market can impact growth. While some volatility is normal, extreme volatility can lead to significant fluctuations in stock prices.

Recent Trends

In recent years, the stock market has experienced a period of steady growth, with the S&P 500 index reaching new highs. This growth can be attributed to several factors, including:

- Low Interest Rates: The Federal Reserve has kept interest rates low, making borrowing cheaper for businesses and consumers.

- Corporate Earnings: Many companies have reported strong earnings, with some sectors, such as technology and healthcare, leading the way.

- Global Economic Growth: The global economy has been growing, with emerging markets playing a significant role in this growth.

Conclusion

The stock market has experienced varying growth rates over the years, with the average annual return hovering around 7-10% in recent decades. Understanding the factors that influence stock market growth can help investors make informed decisions and navigate the market's ups and downs. As the economy continues to evolve, it's essential to stay informed about the stock market's growth and the factors that drive it.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....