In the ever-changing world of finance, staying updated with the latest market trends is crucial. The Dow futures, a significant indicator of the stock market's direction, are a vital component for investors to understand. This article provides an in-depth look at the Dow futures right now, including key insights, market trends, and relevant case studies.

Understanding the Dow Futures

The Dow Jones Industrial Average (DJIA), often simply referred to as "the Dow," is a stock market index that tracks the stock performance of 30 large companies listed on the New York Stock Exchange (NYSE) and the NASDAQ. The Dow futures are financial contracts that represent the future price of the DJIA index. These futures allow investors to speculate on the direction of the stock market and to hedge against potential losses.

Key Insights into the Dow Futures Right Now

- Current Value: As of [insert current date], the Dow futures are trading at [insert current value]. This reflects the collective sentiment of investors regarding the overall market's direction.

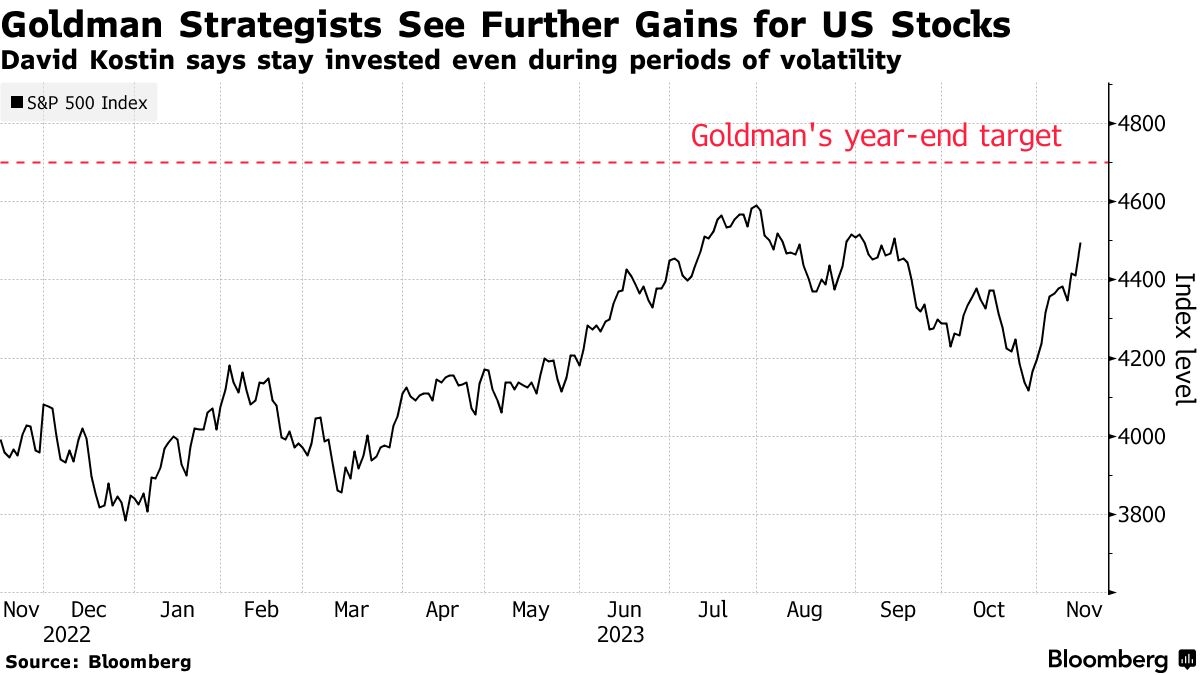

- Market Trends: The Dow futures have been experiencing [insert recent trend, such as a rise or fall]. This trend is primarily driven by [insert relevant factors, such as economic indicators, political events, or corporate earnings reports].

- Economic Factors: Factors such as interest rates, inflation, and unemployment have a significant impact on the Dow futures. Understanding these factors can help investors make informed decisions.

Market Trends Affecting the Dow Futures

- Economic Growth: Strong economic growth can lead to increased corporate earnings and a rise in the stock market. Conversely, weak economic growth can result in falling stock prices.

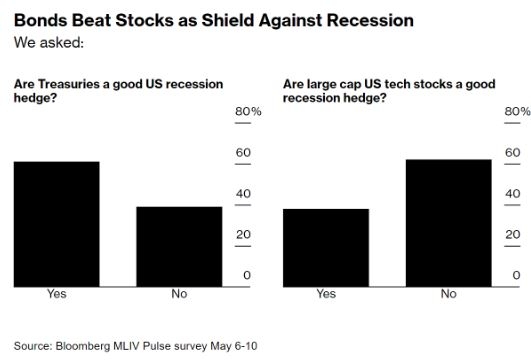

- Inflation: High inflation can erode purchasing power and lead to lower stock prices. Conversely, low inflation can support higher stock prices.

- Interest Rates: The Federal Reserve's policies on interest rates play a crucial role in the stock market. Lower interest rates can stimulate economic growth and boost stock prices, while higher interest rates can have the opposite effect.

Case Studies

- 2020 Stock Market Crash: In February 2020, the Dow futures experienced a significant drop, driven by concerns over the COVID-19 pandemic. This crash highlighted the importance of understanding market trends and economic factors.

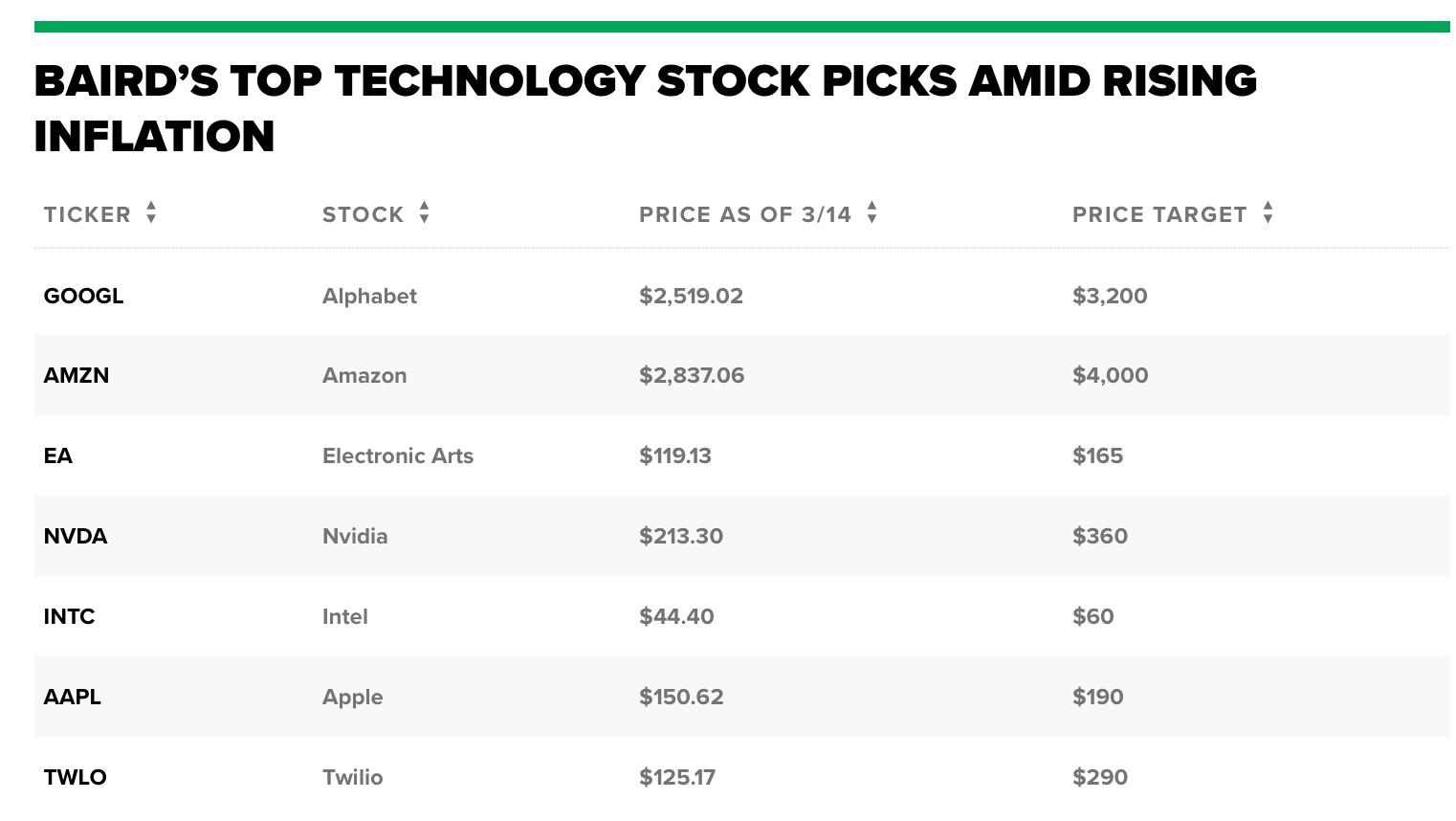

- 2021 Tech Stock Boom: In 2021, tech stocks saw significant growth, driven by increased demand for digital services and advancements in technology. This trend positively impacted the Dow futures.

Conclusion

Staying informed about the Dow futures right now is essential for investors looking to make informed decisions. By understanding market trends, economic factors, and historical case studies, investors can navigate the complexities of the stock market and make more informed decisions.

In summary, the Dow futures are a valuable tool for investors seeking to understand the current state of the market. By monitoring the Dow futures, investors can gain insights into market trends, economic factors, and historical precedents. Remember to stay updated with the latest information to make informed decisions and maximize your investment potential.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....