In the ever-evolving world of finance, the number of stocks traded in the United States per year has been a key indicator of market activity and investor confidence. This article delves into the trends, factors influencing these numbers, and the impact on the broader financial landscape.

Understanding Stock Trading Volumes in the US

What Does "Number of Stocks Traded" Mean? The term "number of stocks traded" refers to the total count of shares being bought and sold on US stock exchanges within a given year. This metric is a critical gauge of investor activity and market sentiment.

Historical Trends

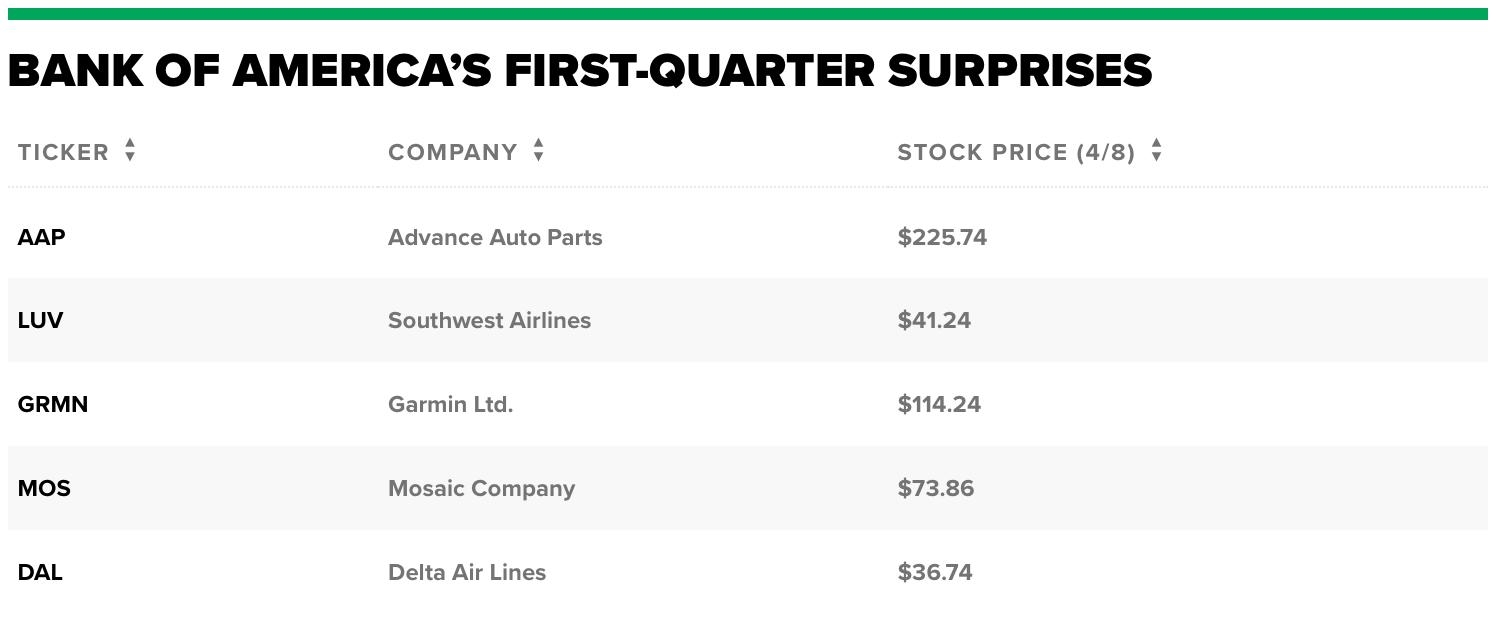

Over the past decade, the number of stocks traded in the US has seen a significant surge. From 2010 to 2020, the average number of stocks traded per year increased by 25%, according to data from the Securities and Exchange Commission (SEC).

Factors Influencing Stock Trading Volumes

- Economic Growth: A robust economy often translates to higher stock trading volumes as investors feel more confident about investing in the market.

- Technological Advancements: The rise of online trading platforms has made it easier and more accessible for individuals to buy and sell stocks, contributing to higher trading volumes.

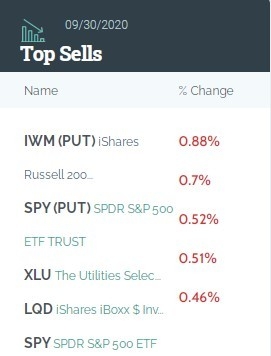

- Market Sentiment: Investor sentiment can significantly impact trading volumes. For instance, during the COVID-19 pandemic, there was a surge in trading volumes as investors reacted to market volatility.

Impact on the Financial Landscape

The increasing number of stocks traded has several implications for the financial landscape:

- Higher Liquidity: Higher trading volumes lead to increased liquidity in the market, making it easier for investors to buy and sell stocks without significantly impacting the price.

- Market Efficiency: Increased trading volumes can enhance market efficiency, as more information is available to investors and prices adjust more quickly to new information.

- Opportunities for Brokers and Exchanges: Higher trading volumes mean more revenue for brokers and exchanges, as they earn fees from every trade.

Case Study: The 2020 Stock Market Crash

One of the most significant events that impacted stock trading volumes in the US was the 2020 stock market crash. In the first two months of the year, trading volumes were already up by 20% compared to the same period in 2019. However, the pandemic caused a sharp decline in trading volumes as investors sold off stocks in response to market uncertainty.

Conclusion

The number of stocks traded in the US per year is a crucial indicator of market activity and investor confidence. Understanding these trends and the factors influencing them can provide valuable insights into the broader financial landscape. As the market continues to evolve, it will be interesting to see how trading volumes change and what impact they have on the financial world.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....