Investing in US stocks can be a lucrative opportunity for nonresident aliens. With the right knowledge and guidance, these individuals can tap into the vast potential of the American stock market. This article delves into the intricacies of nonresident alien investing in US stocks, providing a comprehensive guide to navigate this exciting venture.

What is a Nonresident Alien?

A nonresident alien (NRA) is an individual who is not a U.S. citizen or a permanent resident. NRAs are subject to specific tax regulations when investing in US stocks. Understanding these regulations is crucial for a successful investment journey.

Tax Implications for NRAs

When NRAs invest in US stocks, they are required to pay taxes on their investment income. The U.S. tax system for NRAs is different from that of U.S. residents. Here are some key points to consider:

Withholding Tax: U.S. brokerage firms are required to withhold 30% of the dividends and interest paid to NRAs. This withholding tax can be reduced or eliminated if the NRA has a tax treaty with the U.S.

Capital Gains Tax: NRAs are subject to a 30% tax on capital gains realized from the sale of US stocks. However, this rate can be reduced or eliminated under certain tax treaties.

Form W-8BEN: NRAs must complete Form W-8BEN to certify their nonresident alien status and claim any applicable tax treaty benefits.

Choosing the Right Brokerage Firm

Selecting the right brokerage firm is crucial for NRAs looking to invest in US stocks. Here are some factors to consider:

Compliance with Tax Regulations: Ensure that the brokerage firm is compliant with U.S. tax regulations for NRAs.

International Trading Capabilities: Look for a brokerage firm that offers international trading capabilities and supports NRAs.

Customer Support: Choose a brokerage firm that provides excellent customer support, especially for NRAs who may have questions regarding tax compliance.

Top US Stocks for NRAs

NRAs can invest in a wide range of US stocks, including:

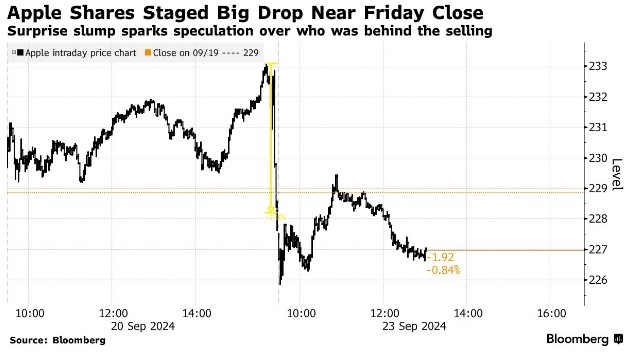

Technology Stocks: Companies like Apple, Microsoft, and Amazon offer significant growth potential.

Healthcare Stocks: The healthcare sector is expected to grow due to an aging population and advancements in medical technology.

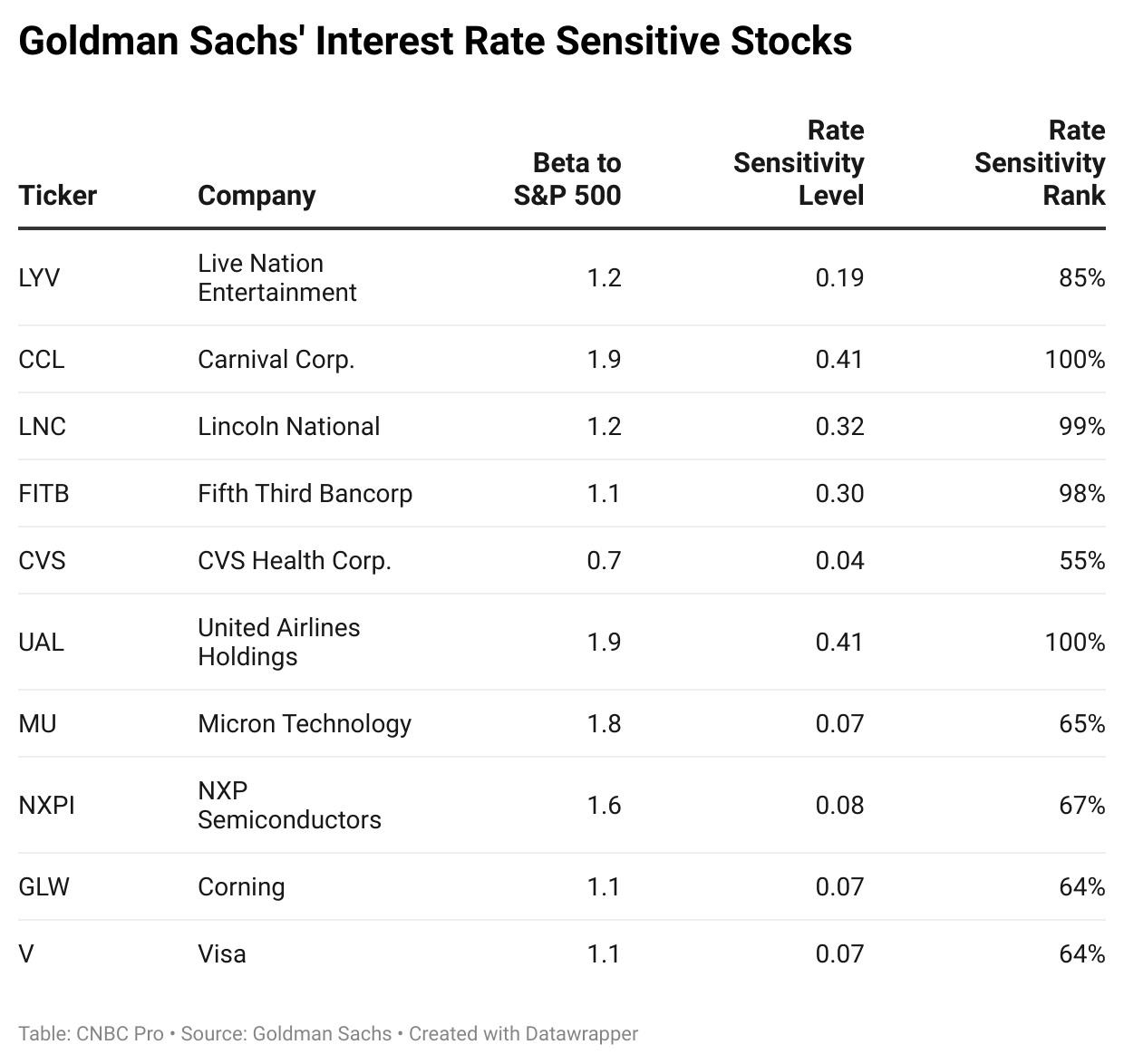

Financial Stocks: Major banks and financial institutions, such as JPMorgan Chase and Goldman Sachs, offer stability and growth potential.

Case Study: John’s Investment Journey

John, a nonresident alien from Canada, decided to invest in US stocks. After researching various brokerage firms, he chose XYZ Brokerage, a firm known for its compliance with U.S. tax regulations for NRAs. John completed Form W-8BEN and started investing in technology stocks, including Apple and Microsoft. Within a year, his investments grew significantly, and he enjoyed substantial returns.

Conclusion

Investing in US stocks can be a rewarding venture for nonresident aliens. By understanding the tax implications, choosing the right brokerage firm, and investing in the right stocks, NRAs can navigate the American stock market successfully. Remember to consult with a tax professional to ensure compliance with U.S. tax regulations.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....