Are you a Chinese investor contemplating the possibility of purchasing US stocks? If so, you've come to the right place. The United States stock market is one of the largest and most diverse in the world, offering numerous opportunities for investment. In this article, we'll explore the ins and outs of buying US stocks as a Chinese investor.

Understanding the Process

The process of buying US stocks for Chinese investors is relatively straightforward, although there are a few key considerations to keep in mind. Here's a step-by-step guide:

Open a Brokerage Account: The first step is to open a brokerage account with a reputable brokerage firm. Many online brokers offer accounts that cater specifically to international investors, including Chinese investors. Some popular options include TD Ameritrade, E*TRADE, and Charles Schwab.

Choose a Brokerage Account Type: There are several types of brokerage accounts to choose from, including cash accounts, margin accounts, and IRA accounts. Each has its own set of rules and benefits, so it's important to choose the one that best suits your investment goals and risk tolerance.

Fund Your Account: Once your brokerage account is set up, you'll need to fund it with US dollars. You can do this by transferring funds from your Chinese bank account or by using a wire transfer.

Research and Analyze Stocks: Before purchasing any stocks, it's important to do thorough research and analysis. This includes understanding the company's financials, market trends, and industry outlook. There are numerous resources available to help you with this, including financial news websites, stock market analysis tools, and investment forums.

Place Your Order: Once you've identified a stock you're interested in, you can place an order through your brokerage account. You can choose to buy shares at the current market price or set a limit order to purchase shares at a specific price.

Key Considerations for Chinese Investors

While buying US stocks can be a rewarding investment opportunity, there are several key considerations for Chinese investors to keep in mind:

Currency Conversion: As a Chinese investor, you'll need to convert your renminbi into US dollars to purchase stocks. Be aware of the exchange rate and any associated fees or taxes.

Tax Implications: It's important to understand the tax implications of investing in US stocks. While US companies are subject to US tax laws, you may also be subject to Chinese tax laws on your investment gains.

Regulatory Compliance: Make sure you understand the regulatory requirements for investing in US stocks as an international investor. This includes any reporting or compliance requirements.

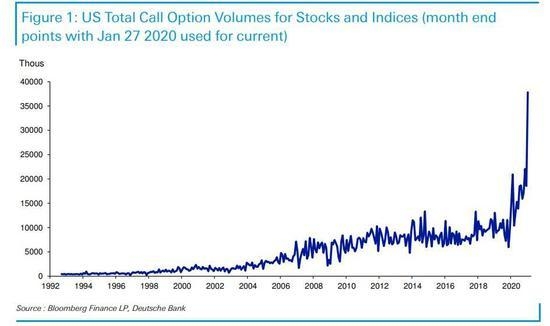

Market Volatility: The US stock market can be volatile, so it's important to be prepared for potential ups and downs in your investment portfolio.

Case Study: Alibaba's IPO

A notable example of a Chinese company that has successfully listed on the US stock market is Alibaba Group Holding Limited. In September 2014, Alibaba went public on the New York Stock Exchange (NYSE) under the ticker symbol BABA. The IPO was one of the largest in history, raising over $21 billion.

Chinese investors were able to participate in this opportunity by purchasing shares through their brokerage accounts. However, it's important to note that Alibaba's stock price has experienced significant volatility since its IPO, highlighting the importance of thorough research and analysis before investing.

Conclusion

Buying US stocks as a Chinese investor can be a lucrative investment opportunity, but it's important to approach it with careful planning and research. By following the steps outlined in this article and understanding the key considerations, you can navigate the process with confidence and potentially benefit from the diverse opportunities offered by the US stock market.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....