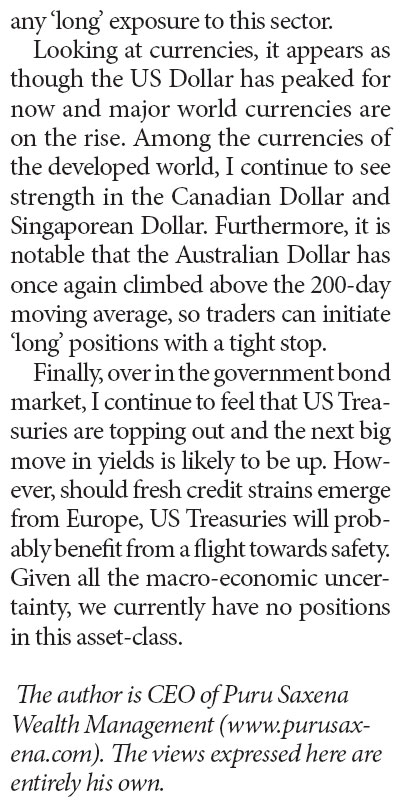

In the world of finance, index charts play a crucial role in analyzing and predicting market trends. Whether you are a seasoned investor or just starting out, understanding how to read and interpret index charts can significantly enhance your decision-making process. This article delves into the basics of index charts, their importance, and how they can be effectively utilized to gain insights into financial markets.

What Are Index Charts?

An index chart is a visual representation of the performance of a specific financial market or asset class. These charts are typically used to track the movement of a particular index, such as the S&P 500, the Dow Jones Industrial Average, or the NASDAQ Composite. By analyzing these charts, investors can gain valuable insights into market trends, identify potential opportunities, and make informed investment decisions.

Understanding the Components of an Index Chart

An index chart consists of several key components that provide essential information about market performance. These include:

Time Frame: The time frame represents the duration over which the data is displayed. Common time frames include daily, weekly, monthly, and yearly charts. The choice of time frame depends on the investor's trading strategy and investment horizon.

Price Chart: The price chart shows the historical price movements of the index. It can be displayed as a line chart, bar chart, or candlestick chart. Each type of chart has its own advantages and is suitable for different trading styles.

Volume: Volume refers to the number of shares or contracts traded during a specific period. Analyzing volume can help identify periods of high or low activity, which can be indicative of market sentiment.

Indicators and Oscillators: These are mathematical tools used to analyze market data and identify potential trading opportunities. Common indicators include moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence).

The Importance of Index Charts

Index charts are essential for several reasons:

Trend Analysis: By analyzing index charts, investors can identify the current trend of the market. This information can be used to make informed decisions about buying or selling assets.

Market Sentiment: Index charts provide insights into market sentiment. For example, a rising index chart may indicate bullish sentiment, while a falling chart may suggest bearish sentiment.

Risk Management: Index charts can help investors manage risk by identifying potential market downturns or overvaluations.

Case Study: The S&P 500 Index Chart

Let's take a look at a case study involving the S&P 500 index chart. In 2020, the S&P 500 experienced a significant downturn due to the COVID-19 pandemic. However, as the pandemic situation improved, the index began to recover. By analyzing the index chart, investors could have identified the potential for a rebound and made strategic investment decisions.

Conclusion

Index charts are a powerful tool for analyzing financial markets. By understanding the components of an index chart and how to interpret them, investors can gain valuable insights into market trends and make informed decisions. Whether you are a beginner or an experienced investor, mastering the art of reading index charts can significantly enhance your investment strategy.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....