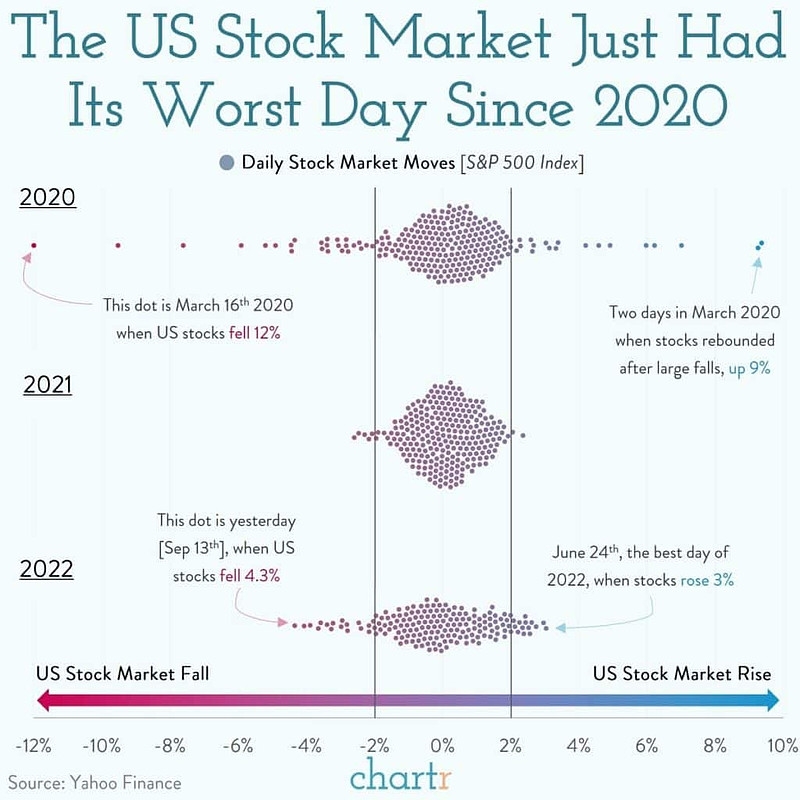

In the volatile world of stock markets, it's not uncommon to see stocks plummeting. These sudden drops can be caused by a variety of factors, from economic shifts to company-specific issues. As an investor, it's crucial to understand why stocks plummet and how to navigate these turbulent times. This article delves into the reasons behind plummeting stocks and offers strategies for managing risk.

Economic Factors: The Underlying Cause

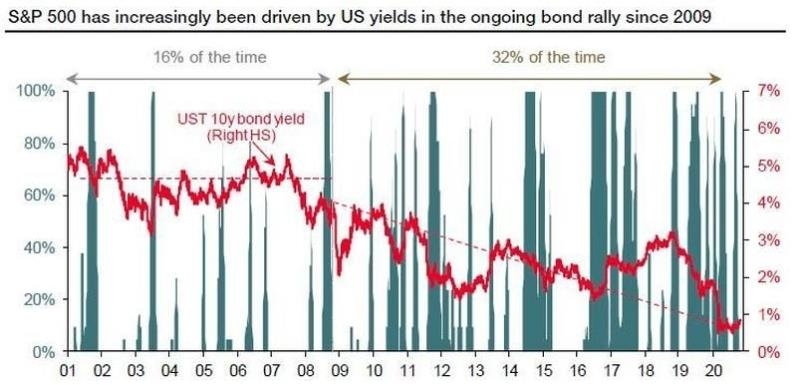

One of the primary reasons stocks plummet is due to economic factors. Economic downturns, such as recessions, can lead to a widespread decline in stock prices. When the economy is struggling, investors tend to become more risk-averse, leading to a sell-off of stocks. Additionally, changes in interest rates, inflation, and trade policies can also impact stock prices.

Company-Specific Issues: A Closer Look

Apart from economic factors, company-specific issues can also cause stocks to plummet. Here are some common reasons:

- Poor Financial Performance: If a company's earnings reports show a significant decline, investors may lose confidence and sell off their shares, causing the stock price to plummet.

- Product Failures: A new product launch that flops can be a major setback for a company, leading to a drop in stock prices.

- Legal Issues: Companies facing legal disputes or fines can see their stock prices plummet as investors worry about the potential impact on the company's financial health.

Navigating Plummeting Stocks: Strategies for Investors

When faced with plummeting stocks, it's important to remain calm and take a strategic approach. Here are some tips for managing risk:

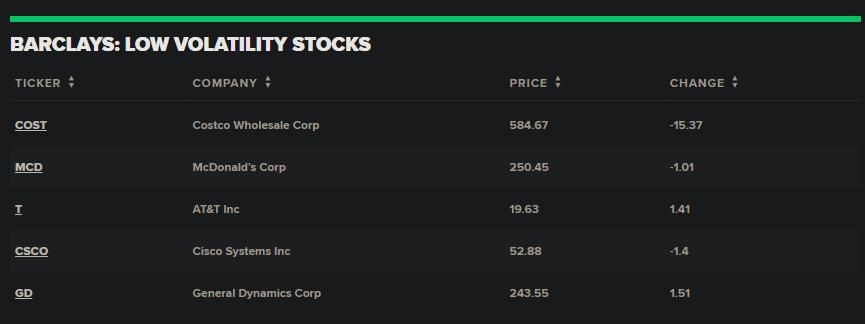

- Diversify Your Portfolio: Diversification is key to mitigating risk. By investing in a variety of stocks across different sectors and industries, you can reduce the impact of a single stock's decline.

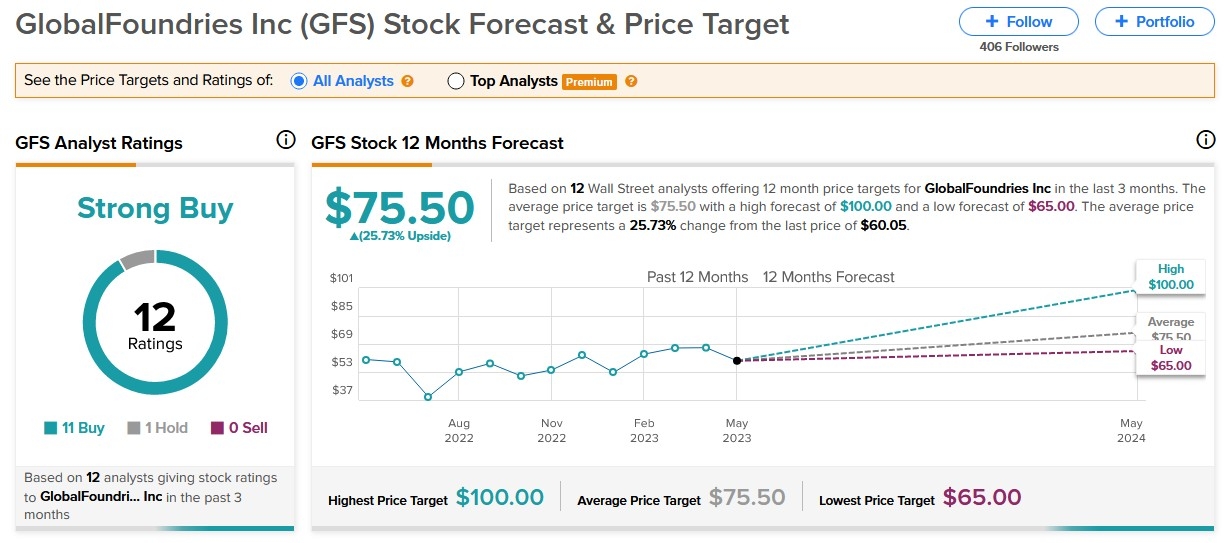

- Review Your Holdings: Take the time to review your portfolio and identify any stocks that may be overvalued or facing significant risks. Consider selling these stocks to reduce your exposure to potential losses.

- Stay Informed: Keep up-to-date with the latest news and developments in the market. This will help you make informed decisions and avoid making impulsive moves.

Case Studies: Learning from the Past

To illustrate the impact of plummeting stocks, let's look at a couple of case studies:

- Tesla: In 2020, Tesla's stock experienced a significant drop following the release of its earnings report. The company's revenue and earnings per share missed Wall Street estimates, causing investors to sell off their shares. However, the stock eventually recovered as Tesla continued to innovate and grow.

- Facebook: In 2018, Facebook's stock plummeted after the company faced scrutiny over its privacy policies and data breaches. The stock price fell by nearly 20% in a single day. However, the company has since taken steps to improve its privacy practices, and the stock has recovered somewhat.

Conclusion

Plummeting stocks can be a challenging aspect of investing, but understanding the underlying causes and adopting strategic approaches can help mitigate risk. By diversifying your portfolio, staying informed, and reviewing your holdings, you can navigate these turbulent times and make informed decisions as an investor.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....