In today's fast-paced financial world, having access to live NYSE data is crucial for investors looking to make informed decisions. The New York Stock Exchange (NYSE) is one of the most influential stock exchanges in the world, and its real-time data can provide invaluable insights into market trends and individual stock performance. This article delves into the importance of live NYSE data and how it can benefit investors.

Understanding Live NYSE Data

Live NYSE data refers to the real-time information provided by the NYSE regarding stock prices, trading volumes, and other relevant market data. This data is updated continuously, allowing investors to stay ahead of the curve and make timely decisions. By analyzing this data, investors can gain a deeper understanding of market dynamics and identify potential investment opportunities.

Benefits of Live NYSE Data

Real-Time Market Trends: One of the primary benefits of live NYSE data is the ability to track market trends in real time. This information can help investors stay informed about market movements and adjust their strategies accordingly.

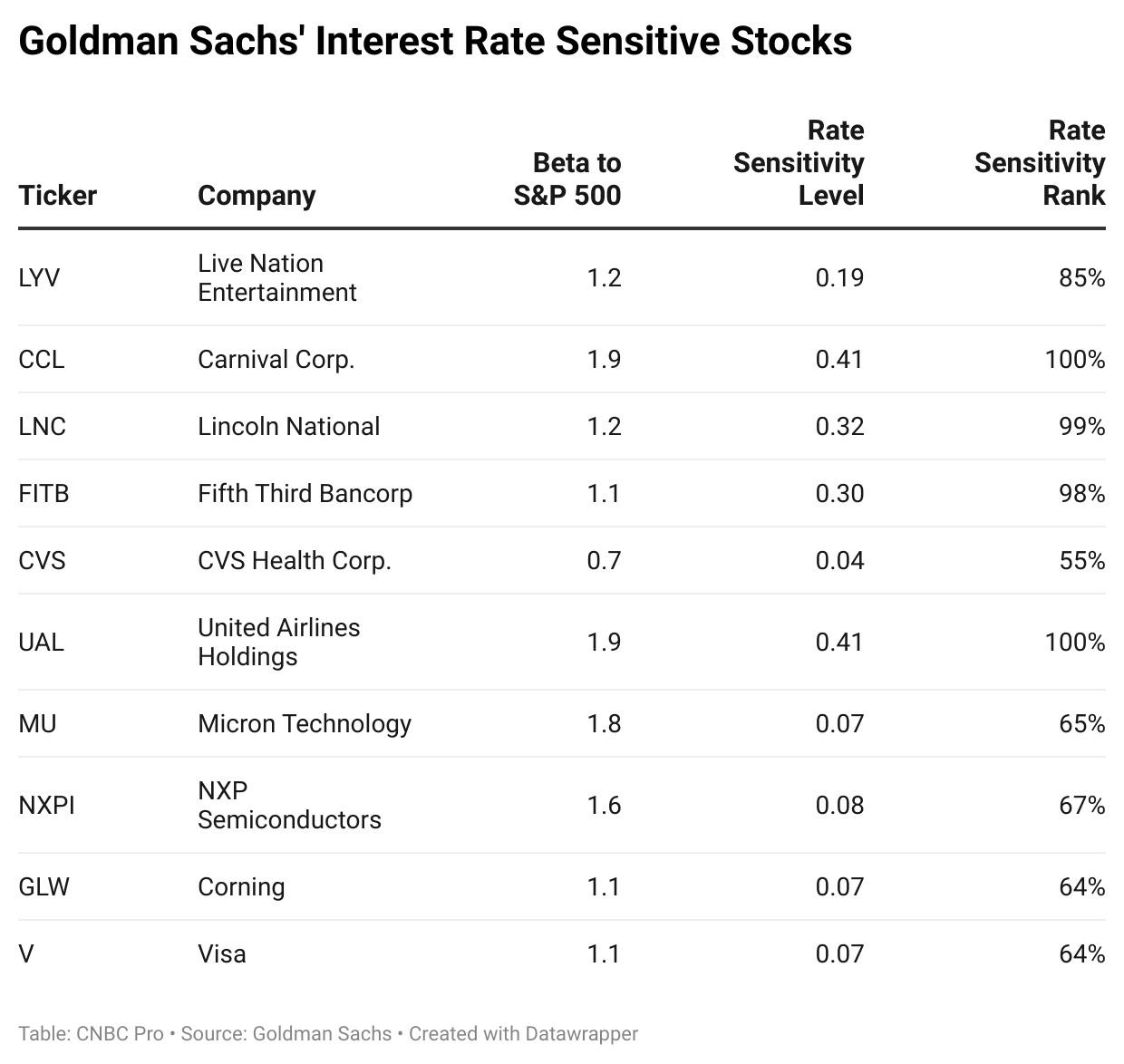

Stock Performance Analysis: Live NYSE data allows investors to monitor the performance of individual stocks in real time. By analyzing this data, investors can identify stocks that are outperforming or underperforming and make informed decisions about their investments.

Risk Management: Live NYSE data can help investors manage their risk by providing up-to-date information on market conditions and stock volatility. This can help investors avoid making impulsive decisions during times of market stress.

Informed Decision-Making: Access to live NYSE data enables investors to make more informed decisions. By having access to the latest market information, investors can better understand the potential risks and rewards associated with their investments.

Case Study: Utilizing Live NYSE Data for Profitable Investing

Consider an investor who wants to invest in a technology stock. By using live NYSE data, the investor can track the stock's performance, trading volume, and market trends. If the stock is consistently rising and has a high trading volume, the investor may decide to purchase shares. Conversely, if the stock is declining or has low trading volume, the investor may choose to avoid it.

By utilizing live NYSE data, this investor can make a more informed decision and potentially increase their chances of success.

How to Access Live NYSE Data

Investors can access live NYSE data through various platforms, including financial news websites, stock market apps, and brokerage platforms. Many of these platforms offer free access to live data, while others may require a subscription.

Conclusion

In conclusion, live NYSE data is a valuable tool for investors looking to stay informed and make informed decisions. By utilizing this data, investors can track market trends, analyze stock performance, and manage their risk effectively. Whether you are a seasoned investor or just starting out, access to live NYSE data can provide you with the insights you need to succeed in the financial markets.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....