In recent years, Brazilian companies have made a significant impact on the US stock exchange, drawing the attention of investors and market enthusiasts alike. This article delves into the world of Brazilian firms listed on American stock markets, highlighting their performance, sectors they operate in, and what makes them stand out.

Understanding the Market Presence of Brazilian Companies

The US stock exchange, particularly the New York Stock Exchange (NYSE) and the Nasdaq, has become a popular destination for Brazilian companies looking to expand their global reach and access capital from international investors. Several factors contribute to this trend, including:

- Access to Larger Markets: The US is the world’s largest economy, providing a vast market for Brazilian companies to tap into.

- Attractive Valuations: Many Brazilian companies offer attractive valuations, making them an attractive investment for foreign investors.

- Strategic Partnerships: US companies often look to collaborate with Brazilian firms, further enhancing their presence in the global market.

Key Brazilian Companies on the US Stock Exchange

Several Brazilian companies have made their mark on the US stock exchange, including:

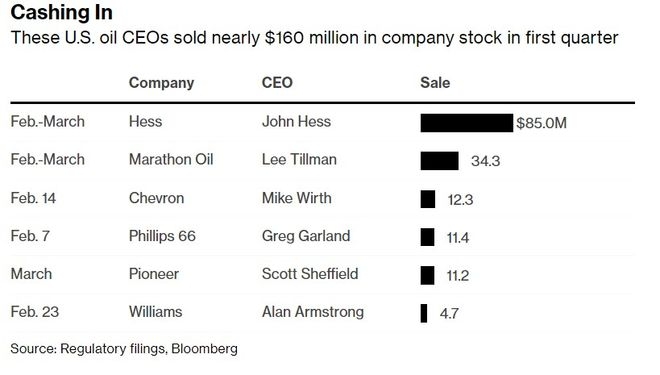

- Petrobras (PETR4.SA): As the largest oil company in Brazil, Petrobras has a significant presence on the NYSE. The company engages in the exploration, production, refining, and transportation of oil and natural gas.

- Itau Unibanco Holding (ITUB3.SA): Brazil’s largest private bank, Itau Unibanco has been listed on the NYSE since 2017. The bank offers a range of financial services, including retail banking, corporate banking, and wealth management.

- Vale (VALE3.SA): A global mining company, Vale is among the largest iron ore producers in the world. The company operates in various sectors, including mining, steelmaking, and logistics.

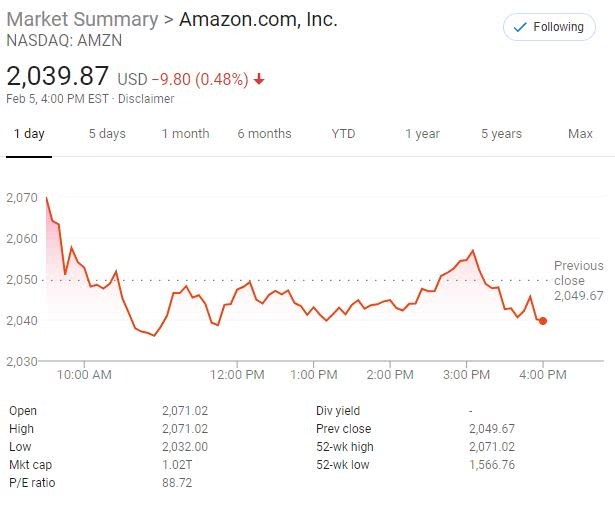

Performance of Brazilian Companies on the US Stock Exchange

The performance of Brazilian companies on the US stock exchange has been mixed. While some have delivered impressive returns, others have faced challenges. Factors contributing to their performance include:

- Economic Conditions: The performance of Brazilian companies is often tied to the country’s economic conditions, which can be volatile.

- Exchange Rate Fluctuations: The Brazilian Real’s exchange rate plays a crucial role in the performance of these companies on the US stock exchange.

- Market Sentiment: Global market sentiment can significantly impact the performance of Brazilian companies listed in the US.

Case Studies: Success Stories

Several Brazilian companies have achieved remarkable success on the US stock exchange. One such example is Natura (NATU3.SA), a global beauty and personal care company. Natura went public on the NYSE in 2016 and has since experienced significant growth. The company’s success can be attributed to its innovative approach to beauty products and strong focus on sustainability.

Another case study is Gol Linhas Aéreas Inteligentes (GOL4.SA), Brazil’s largest low-cost airline. The company went public on the NYSE in 2016 and has since become a major player in the global aviation industry. Gol’s success can be attributed to its focus on cost efficiency and customer satisfaction.

Conclusion

The presence of Brazilian companies on the US stock exchange is a testament to the country’s growing economic power and potential. As the relationship between Brazil and the US continues to strengthen, investors should keep a close eye on these companies, as they could offer significant opportunities for growth.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....