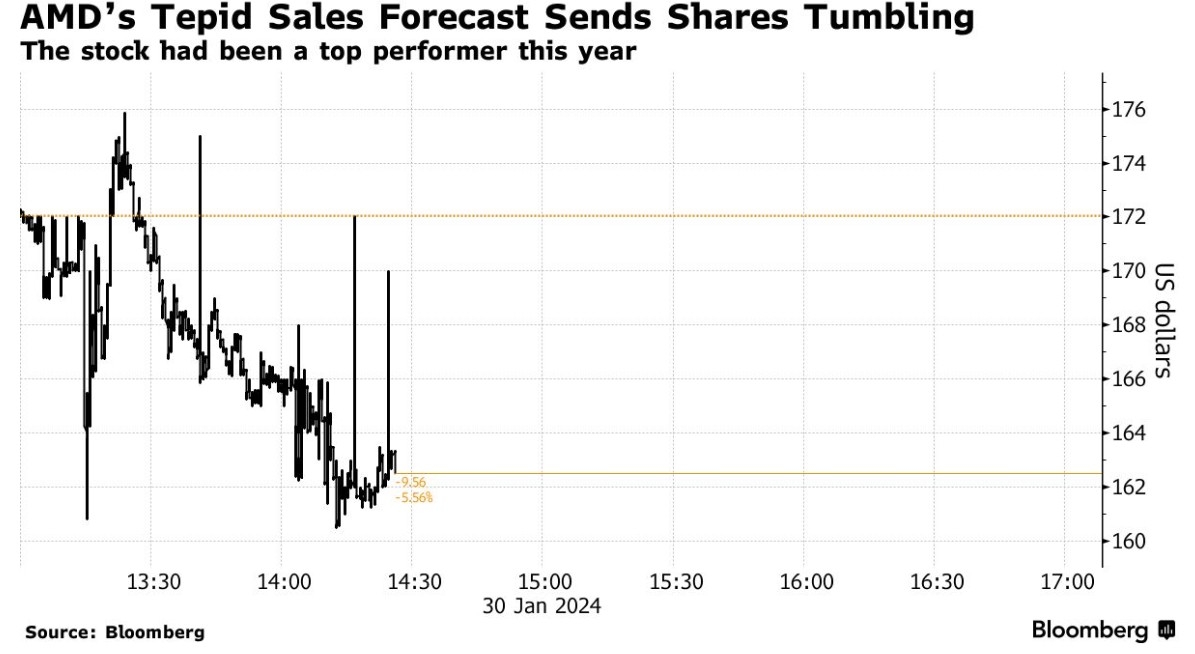

In the wake of the NASDAQ drop, investors and market analysts are grappling with the sudden downturn in the tech-heavy index. This article delves into the factors contributing to this decline, its impact on the market, and what it means for investors moving forward.

What Caused the NASDAQ Drop?

The NASDAQ drop has been attributed to several factors, including global economic uncertainties, inflation concerns, and increased interest rates. As the world grapples with the aftermath of the COVID-19 pandemic, these factors have begun to take a toll on the market.

Global Economic Uncertainties

The ongoing COVID-19 pandemic has created a global economic environment of uncertainty. As countries battle the virus, there are concerns about the pace of economic recovery. This uncertainty has led to volatility in the markets, including the NASDAQ drop.

Inflation Concerns

Another contributing factor to the NASDAQ drop is inflation concerns. As economies begin to reopen, there is a fear of price increases and inflation. This has led to a cautious approach among investors, who are concerned about the long-term implications of rising prices.

Increased Interest Rates

The Federal Reserve's recent decision to increase interest rates has also played a role in the NASDAQ drop. As rates rise, it becomes more expensive for companies to borrow money, which can impact their growth and profitability.

Impact on the Market

The NASDAQ drop has had a significant impact on the market. Tech companies, which are heavily represented in the index, have seen their shares decline. This has had a ripple effect on other sectors, leading to a broader market downturn.

What Does It Mean for Investors?

For investors, the NASDAQ drop is a reminder of the risks involved in the market. It's crucial to stay informed and to have a diversified portfolio to mitigate risks. Here are a few key takeaways:

- Stay Informed: Keep up-to-date with the latest market news and economic indicators.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification can help mitigate risks.

- Long-Term Perspective: Focus on long-term investing rather than short-term fluctuations.

Case Study: Apple

One of the biggest drops in the NASDAQ was seen in tech giant Apple. The company's stock fell by 5% in a single day, which is a significant move for a company of its size. This decline was attributed to global supply chain disruptions and consumer demand concerns.

Conclusion

The NASDAQ drop is a reminder of the volatility in the market. Understanding the factors contributing to the downturn and having a well-diversified portfolio can help investors navigate these turbulent times. As the world continues to navigate the aftermath of the COVID-19 pandemic, it's crucial to stay informed and adaptable.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....