In the world of finance, the Dow Jones Industrial Average (DJIA) stands as a benchmark for the stock market's performance. This iconic index tracks the stock prices of 30 large, publicly-owned companies in the United States and is a vital tool for investors and analysts alike. Understanding the Dow Jones and its significance can provide valuable insights into the health of the U.S. economy and the stock market.

What is the Dow Jones?

The Dow Jones was created by Charles Dow and Edward Jones in 1896. It is one of the oldest and most widely followed stock market indices. The index is calculated by adding up the stock prices of the 30 companies and dividing the sum by a divisor. The divisor is adjusted over time to account for stock splits, dividends, and other corporate actions.

Key Components of the Dow Jones

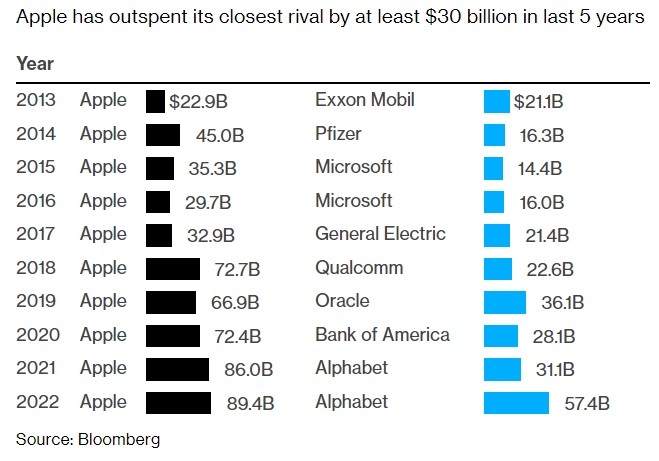

The companies included in the Dow Jones are selected based on various criteria, such as market capitalization, industry representation, and financial stability. The index is divided into three sectors: industrials, technology, and financials. Some of the most well-known companies in the Dow Jones include Apple, Microsoft, Visa, and Goldman Sachs.

Why is the Dow Jones Important?

The Dow Jones serves as a vital indicator of the overall performance of the stock market. It provides investors with a quick snapshot of the market's health and can help them make informed investment decisions. Here are some key reasons why the Dow Jones is important:

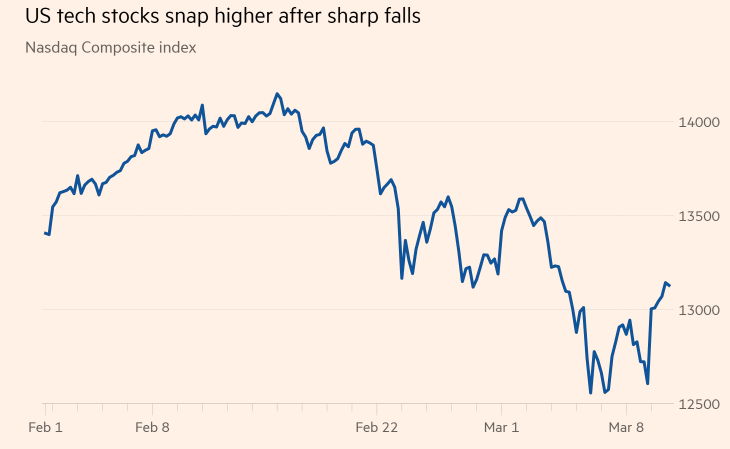

- Market Performance: The Dow Jones reflects the performance of the largest and most influential companies in the United States. A rising Dow Jones suggests that the stock market is performing well, while a falling Dow Jones indicates a bearish market.

- Economic Indicators: The Dow Jones can be used as an economic indicator. A strong Dow Jones often correlates with a healthy economy, while a weak Dow Jones can signal economic trouble.

- Investment Strategy: The Dow Jones can help investors identify trends and opportunities in the stock market. By tracking the performance of the Dow Jones, investors can adjust their investment strategies accordingly.

Case Studies

One notable example of the Dow Jones' impact on the stock market is the financial crisis of 2008. In the months leading up to the crisis, the Dow Jones experienced significant volatility, dropping by nearly 40% from its peak in October 2007 to its trough in March 2009. This decline was a precursor to the broader financial crisis that followed, highlighting the importance of the Dow Jones as a market indicator.

Another example is the tech boom of the late 1990s. During this period, technology stocks accounted for a significant portion of the Dow Jones, driving its overall performance. The dot-com bubble burst in 2000, leading to a sharp decline in the Dow Jones and the broader stock market.

Conclusion

The Dow Jones Industrial Average is a critical benchmark for the stock market and the U.S. economy. Its performance can provide valuable insights into market trends and economic conditions. By understanding the Dow Jones and its components, investors can make more informed decisions and better navigate the complexities of the financial markets.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....