In the world of finance, the Dow Jones stock market charts have long been a beacon for investors and traders. These charts offer a visual representation of the stock market's performance, providing valuable insights into market trends and potential investment opportunities. This comprehensive guide will delve into the intricacies of Dow Jones stock market charts, offering a clear understanding of their significance and how to interpret them effectively.

Understanding Dow Jones Stock Market Charts

The Dow Jones stock market charts are created using various types of graphs, including line charts, bar charts, and candlestick charts. Each chart type offers unique information that can help investors make informed decisions.

Line charts are the most common type of chart used in the Dow Jones stock market. They display the price of a stock over a specific period of time, typically in a continuous line. This allows investors to see the overall trend of the stock and identify any significant price movements.

Bar charts provide a more detailed view of the stock's price movements. They show the opening and closing prices, as well as the highest and lowest prices during a specific period. This information is crucial for understanding the volatility of a stock and identifying potential entry and exit points.

Candlestick charts are another popular type of chart used in the Dow Jones stock market. They provide a visual representation of the opening, closing, highest, and lowest prices of a stock, using a combination of bars and lines. This chart type is particularly useful for identifying patterns and trends in the stock's price movements.

Interpreting Dow Jones Stock Market Charts

Interpreting Dow Jones stock market charts requires a keen eye and a solid understanding of market dynamics. Here are some key points to consider:

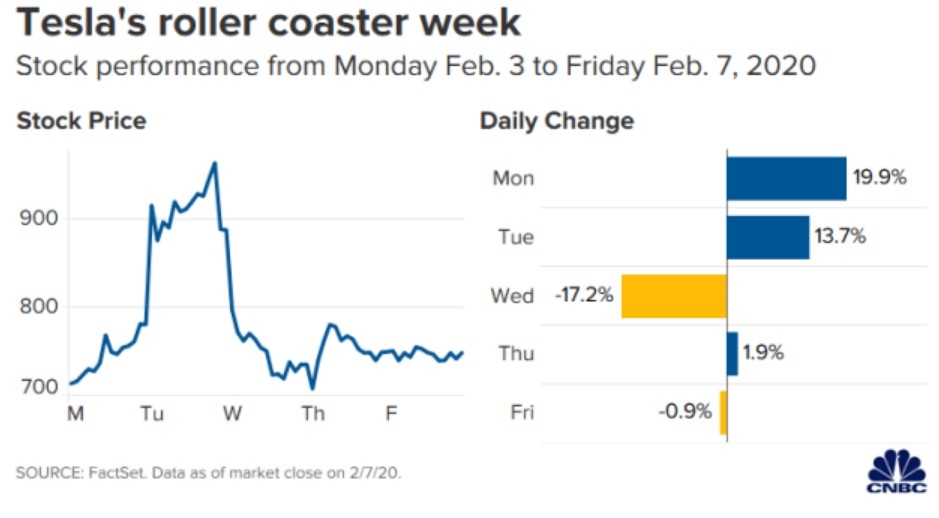

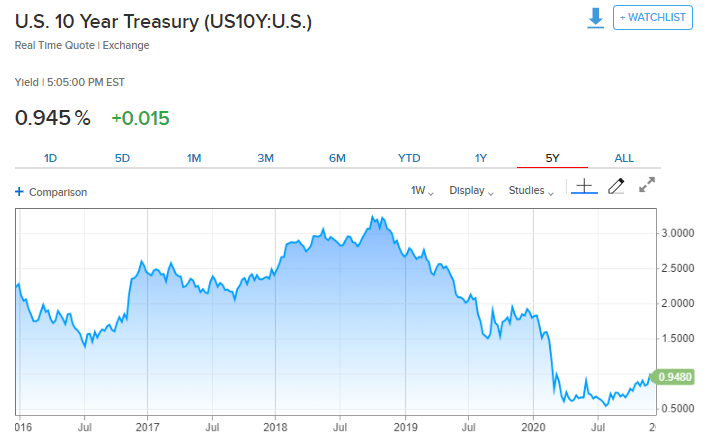

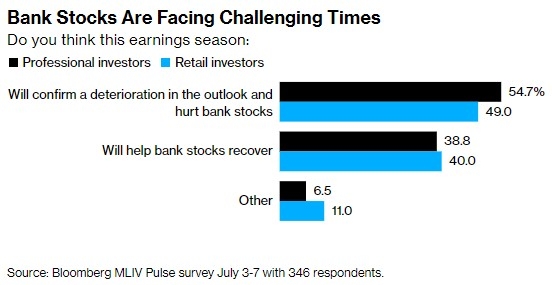

*Trends: Look for upward or downward trends in the stock's price. An upward trend indicates that the stock is gaining value, while a downward trend suggests that it is losing value.

*Support and Resistance Levels: Identify the levels at which the stock has repeatedly struggled to move above or below. These levels can provide valuable insights into potential buying and selling opportunities.

*Volume: Pay attention to the volume of trading activity. High volume often indicates strong support or resistance levels, while low volume can suggest a lack of interest in the stock.

*Patterns: Look for patterns such as head and shoulders, triangles, and flags. These patterns can provide valuable insights into potential future price movements.

Case Studies

Let's consider a hypothetical case involving a particular stock in the Dow Jones index. Over the past few months, the stock has been displaying a consistent upward trend. By analyzing the Dow Jones stock market charts, we notice that the stock has faced resistance at

If the stock reaches the resistance level of

Conclusion

Dow Jones stock market charts are a powerful tool for investors and traders. By understanding how to interpret these charts, investors can gain valuable insights into market trends and potential investment opportunities. Whether you're a seasoned investor or just starting out, mastering the art of reading Dow Jones stock market charts can help you make more informed decisions and achieve greater success in the stock market.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....