The Dow Jones Industrial Average (DJIA), often simply referred to as the "Dow," is one of the most widely followed stock market indices in the world. It provides a snapshot of the overall performance of the stock market and is a key indicator of economic health. This article delves into the daily movements of the DJIA, exploring its significance, how it's calculated, and its impact on the global financial landscape.

Understanding the DJIA

The DJIA is a price-weighted average of 30 large, publicly-traded companies in the United States. These companies represent a diverse range of industries, including technology, finance, healthcare, and more. The index is maintained by S&P Dow Jones Indices and is designed to reflect the performance of the overall market.

How the DJIA is Calculated

The DJIA is calculated by taking the sum of the prices of the 30 stocks and dividing it by a divisor. This divisor is adjusted periodically to account for stock splits, dividends, and other corporate actions. The price-weighted nature of the index means that companies with higher stock prices have a greater impact on the overall value of the index.

Daily Movements of the DJIA

The DJIA is updated in real-time throughout the trading day, reflecting the latest market movements. This means that investors can monitor the index's performance and make informed decisions based on its daily fluctuations. Here's a breakdown of the key factors that influence the DJIA's daily movements:

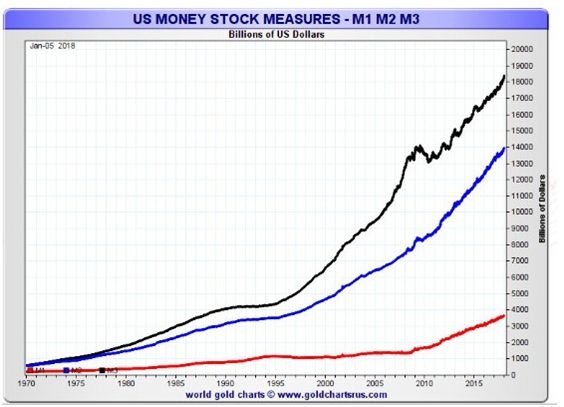

Economic Data: Economic reports, such as unemployment rates, inflation, and GDP growth, can significantly impact the DJIA. Positive economic data can boost investor confidence and drive the index higher, while negative data can lead to declines.

Corporate Earnings: The earnings reports of the companies included in the DJIA can have a substantial impact on the index. Strong earnings can lead to higher stock prices and, consequently, a higher DJIA, while weak earnings can have the opposite effect.

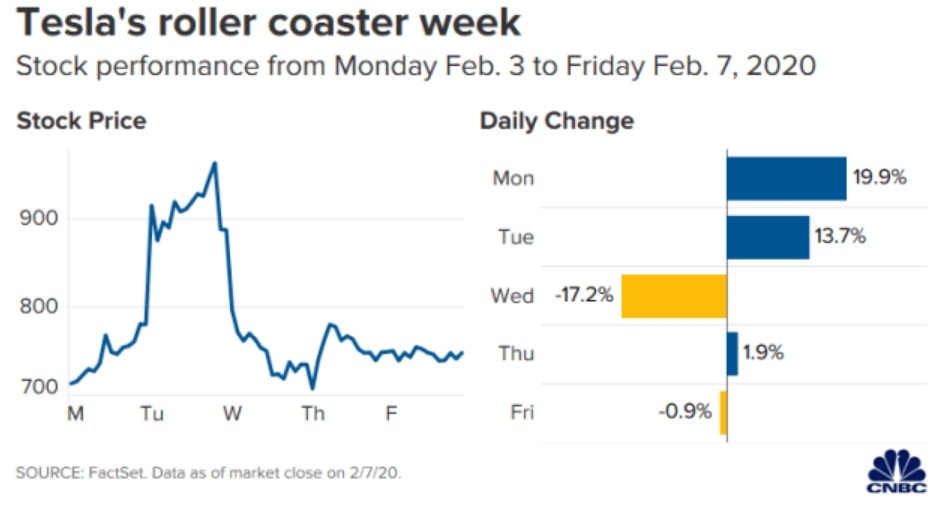

Global Events: Events such as political instability, trade disputes, and natural disasters can also influence the DJIA. These events can lead to increased volatility and cause the index to fluctuate significantly.

Impact of the DJIA

The DJIA is a key indicator of the overall health of the stock market and the economy. Its movements can have a significant impact on investors, businesses, and policymakers. Here are some of the key impacts of the DJIA:

Investor Sentiment: The DJIA can provide valuable insights into investor sentiment. A rising DJIA can indicate optimism and confidence in the market, while a falling DJIA can signal concerns and uncertainty.

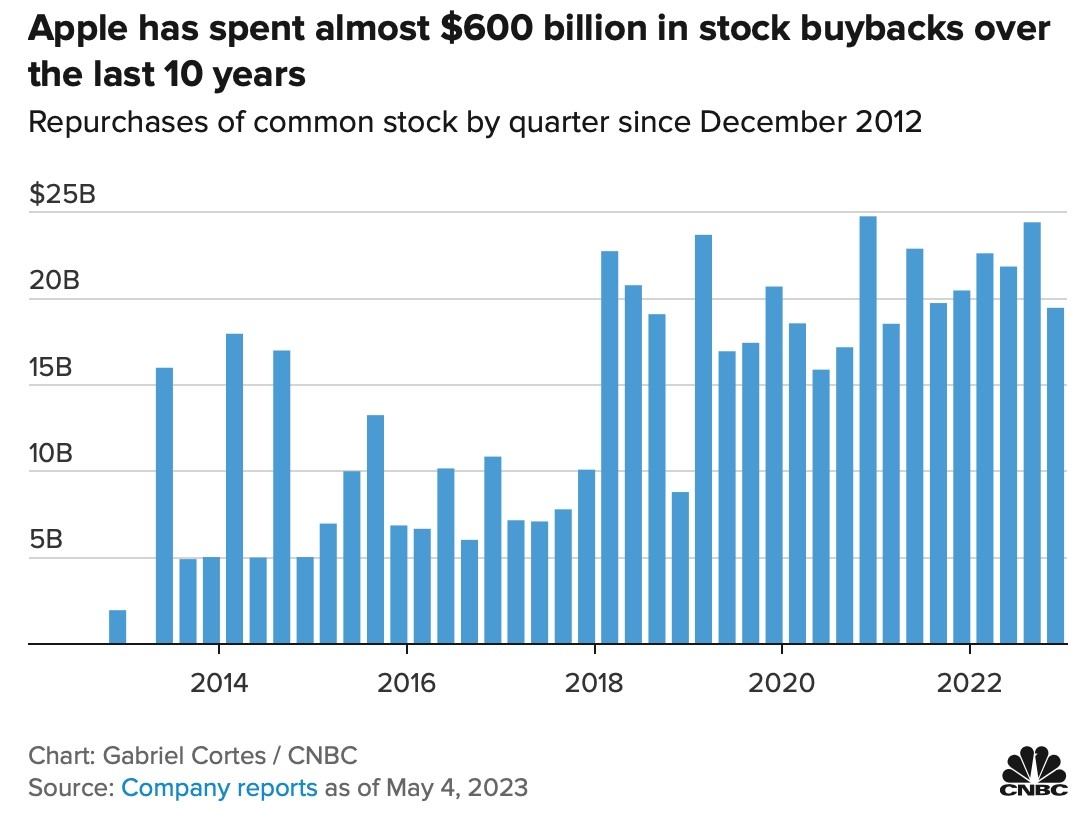

Corporate Strategy: The DJIA can influence corporate strategy, as companies may adjust their business plans based on the index's performance. For example, a rising DJIA may encourage companies to increase investment and hiring.

Policymaker Decisions: Policymakers often monitor the DJIA to gauge the overall health of the economy. This can influence decisions regarding interest rates, fiscal policy, and other economic measures.

Case Studies

To illustrate the impact of the DJIA, let's consider a few case studies:

2008 Financial Crisis: The DJIA experienced a significant decline during the 2008 financial crisis, falling from over 14,000 points to around 6,500 points. This decline reflected the widespread panic and uncertainty in the market.

2020 COVID-19 Pandemic: The DJIA also fell sharply in early 2020 due to the COVID-19 pandemic. However, it quickly recovered and reached new record highs later in the year, reflecting the resilience of the market.

In conclusion, the daily Dow Jones Industrial Average is a vital indicator of the stock market and the economy. By understanding its movements and the factors that influence them, investors and policymakers can gain valuable insights into the market's performance and make informed decisions.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....