Are you a non-US resident looking to invest in the US stock market? With the right approach and knowledge, you can take advantage of some of the world’s most dynamic and lucrative stock exchanges. This article provides a comprehensive guide on how to invest in stocks as a non-US resident, ensuring you navigate the process smoothly.

Understanding the Basics

1. Opening a Brokerage Account

The first step is to open a brokerage account. Many reputable brokers offer services tailored to non-US residents, including Fidelity, Charles Schwab, and TD Ameritrade. When choosing a broker, consider factors like fees, available investment options, and customer service.

2. Navigating Tax Implications

As a non-US resident, you must be aware of the tax implications of investing in US stocks. Generally, non-US residents are subject to a 30% withholding tax on dividends and capital gains. However, there are ways to reduce or eliminate this tax, such as applying for a tax treaty benefit or utilizing a qualified brokerage.

3. Understanding the US Stock Market

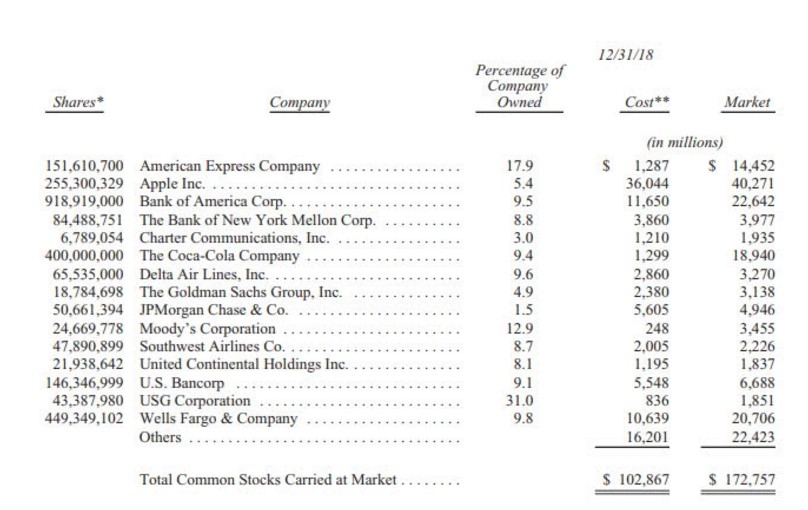

The US stock market is one of the most advanced and liquid in the world. It is home to some of the largest and most influential companies, such as Apple, Amazon, and Microsoft. Understanding the different stock exchanges, such as the New York Stock Exchange (NYSE) and NASDAQ, is crucial in making informed investment decisions.

Strategies for Successful Investing

1. Diversification

Diversifying your portfolio is key to managing risk and maximizing returns. Consider investing in a mix of stocks across various industries and geographical locations. This approach can help mitigate the impact of market volatility on your investments.

2. Research and Due Diligence

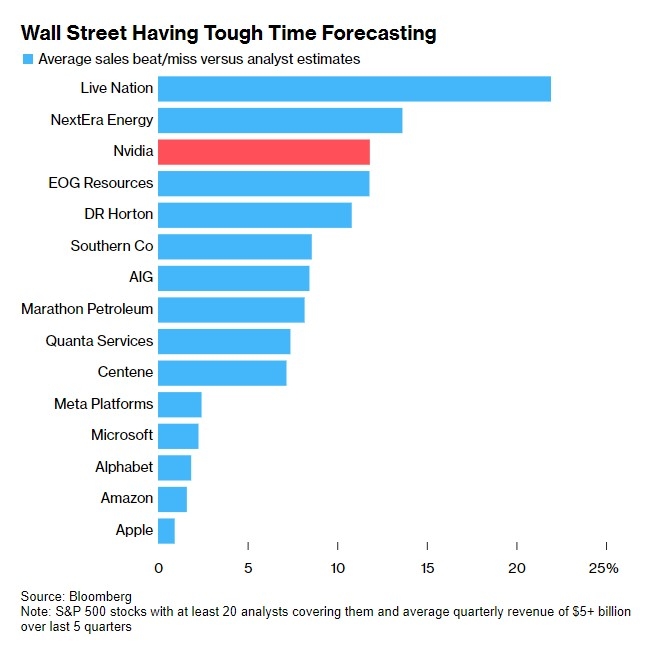

Before investing in any stock, conduct thorough research and due diligence. Analyze financial statements, assess the company’s management, and stay updated with industry trends. Utilize tools like fundamental analysis and technical analysis to make informed investment decisions.

3. Setting Realistic Goals

Set realistic investment goals based on your risk tolerance and time horizon. Whether you aim for long-term growth or short-term gains, having clear objectives will help you stay focused and disciplined in your investment strategy.

Case Studies: Successful Non-US Investors

Several non-US residents have successfully invested in the US stock market. One such example is Michele Smith, a Canadian investor who began investing in US stocks over a decade ago. By diversifying her portfolio and staying informed about market trends, Michele has achieved substantial returns on her investments.

Another example is Sara Kim, a South Korean investor who started with a small amount of capital and gradually increased her investment over time. By following a disciplined investment strategy and regularly reviewing her portfolio, Sara has built a significant nest egg.

Conclusion

Investing in stocks as a non-US resident is a viable and exciting opportunity. By understanding the basics, adopting sound investment strategies, and staying informed about market trends, you can maximize your returns while minimizing risk. Remember, successful investing requires patience, discipline, and continuous learning.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....