The US stock market has long been considered a barometer of economic health and a key driver of global financial markets. As we approach 2025, the outlook for US stocks is increasingly bright, with several factors contributing to this positive sentiment. This article delves into the key drivers behind this optimistic view and highlights what investors should expect in the coming years.

1. Economic Growth and Low Interest Rates

The US economy has been on a robust growth trajectory, bolstered by strong consumer spending and business investment. The Federal Reserve has maintained low interest rates, which have helped to stimulate economic activity and keep borrowing costs low for businesses and consumers. This low-interest-rate environment has been a boon for the stock market, as it encourages investors to seek higher returns in equities rather than fixed-income investments.

2. Technological Advancements and Innovation

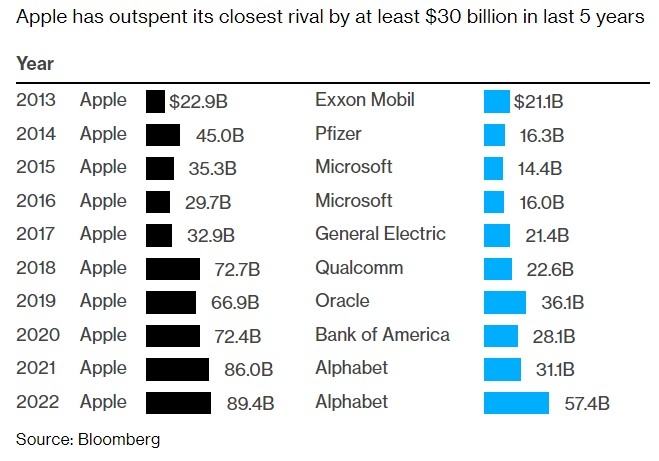

The US has been at the forefront of technological innovation, with companies like Apple, Google, and Microsoft leading the charge. These tech giants have continued to grow and expand their market presence, driving overall market performance. Additionally, emerging technologies such as artificial intelligence, blockchain, and 5G are expected to fuel further growth in the years to come, creating new opportunities for investors.

3. Strong Corporate Earnings

US companies have reported strong earnings in recent years, driven by factors such as cost-cutting measures, increased productivity, and a favorable economic environment. This trend is expected to continue in the coming years, as companies continue to innovate and adapt to changing market conditions.

4. Diversification and Global Opportunities

The US stock market has become increasingly diversified, with a growing number of international companies listed on US exchanges. This diversification has helped to mitigate the impact of global economic uncertainty and has opened up new investment opportunities for US investors. Companies like Alibaba and Tencent, for example, have expanded their presence in the US market, offering investors exposure to the rapidly growing Chinese economy.

5. Case Study: Tesla

Tesla, the electric vehicle (EV) manufacturer, is a prime example of a company that has transformed the automotive industry and generated significant wealth for its investors. Since going public in 2010, Tesla’s stock has soared, driven by strong demand for its products and a clear vision for the future of transportation. This case study highlights the potential of investing in innovative and forward-thinking companies.

6. Risk Factors to Consider

While the outlook for US stocks in 2025 is optimistic, it is essential to recognize the risks involved. Factors such as geopolitical tensions, rising inflation, and changes in monetary policy could impact market performance. Investors should stay informed and maintain a diversified portfolio to mitigate these risks.

7. Conclusion

The strong US stocks outlook for 2025 is driven by a combination of economic growth, technological advancements, and strong corporate earnings. While there are risks to consider, the overall sentiment remains positive. Investors should remain focused on innovative and forward-thinking companies, while also maintaining a diversified portfolio to maximize returns and mitigate risks.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....