In October 2025, the US stock market continues to evolve, with investors closely monitoring various valuation metrics to gauge market health and potential future trends. This article delves into the key metrics that are currently shaping the US stock market landscape, providing valuable insights for investors and traders.

Market Capitalization

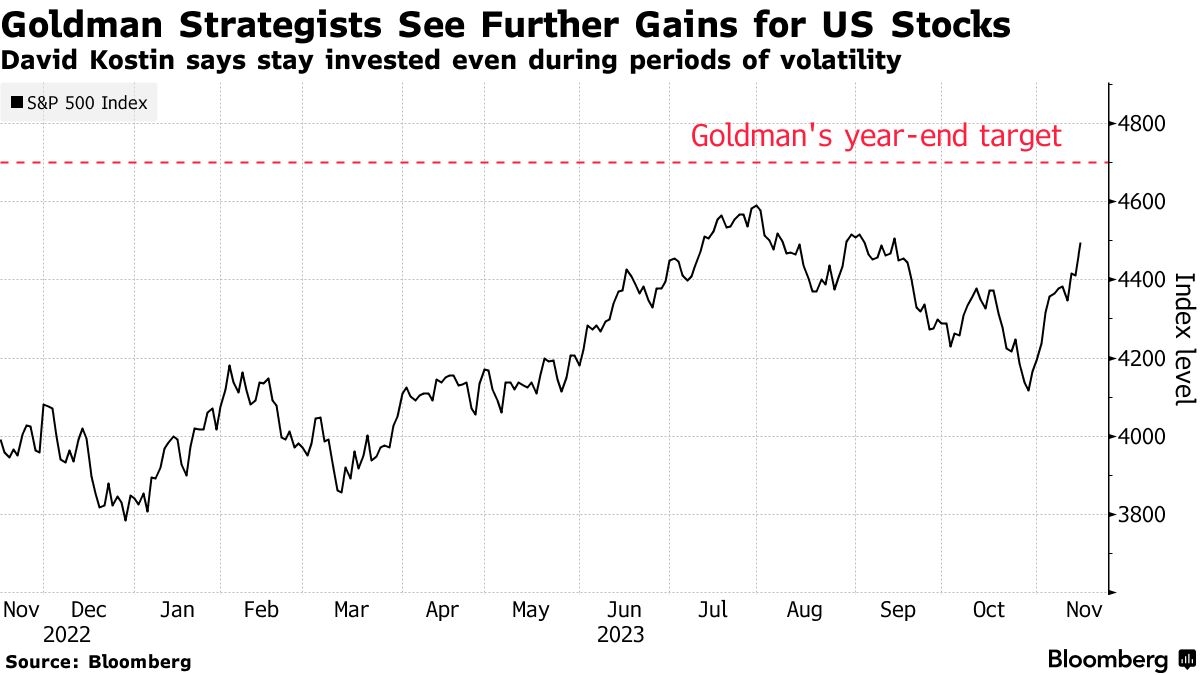

One of the most fundamental valuation metrics is market capitalization, which represents the total value of all shares of a company. As of October 2025, the US stock market has seen significant growth in market capitalization, driven by the strong performance of tech giants like Apple, Microsoft, and Amazon. The S&P 500, a widely followed index, has reached an all-time high, reflecting the overall strength of the US stock market.

Price-to-Earnings (P/E) Ratio

The price-to-earnings (P/E) ratio is another critical metric that measures the relationship between a company's stock price and its earnings per share (EPS). As of October 2025, the P/E ratio for the S&P 500 stands at around 25, which is slightly above its historical average. This indicates that the market is slightly overvalued, but not excessively so. Investors should closely monitor this ratio for signs of potential overheating or undervaluation.

Dividend Yield

The dividend yield is the percentage return on an investment based on the dividend payment. In October 2025, the dividend yield for the S&P 500 is around 2.5%, which is slightly lower than the long-term average. This suggests that investors are placing more emphasis on capital gains rather than dividends, reflecting the strong market momentum.

Earnings Growth

Earnings growth is a key indicator of a company's financial health and potential future performance. As of October 2025, the S&P 500 companies are expected to report solid earnings growth, driven by factors such as strong economic growth, low unemployment, and favorable tax policies. This positive outlook is contributing to the overall strength of the stock market.

Valuation Metrics: A Case Study

To illustrate the importance of valuation metrics, let's consider a hypothetical scenario. Company A, a tech giant, has seen its stock price soar in the past year. However, upon closer examination, we find that its P/E ratio is significantly higher than its competitors and its earnings growth is slowing. This indicates that the stock may be overvalued, and investors should exercise caution.

Conclusion

In October 2025, the US stock market continues to exhibit strong performance, driven by factors such as market capitalization, P/E ratio, dividend yield, and earnings growth. However, investors should remain vigilant and closely monitor these valuation metrics to ensure they are making informed investment decisions.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....