In today's fast-paced world, the art of investing has become more crucial than ever. Whether you're a seasoned investor or just starting out, it's essential to have a solid understanding of the market and the strategies that can help you grow your wealth. This article aims to provide you with valuable insights and tips to help you make informed investment decisions.

Understanding the Basics of Investing

Before diving into the world of investing, it's crucial to understand the basics. Investing involves allocating money with the expectation of generating an income or profit. The primary types of investments include stocks, bonds, real estate, and mutual funds. Each type carries its own set of risks and rewards, so it's essential to research and understand them before making any decisions.

Key Strategies for Successful Investing

Diversify Your Portfolio: Diversification is a key strategy to minimize risk. By investing in a variety of assets, you can reduce the impact of any single investment's performance on your overall portfolio. This can be achieved by investing in different sectors, industries, and geographical regions.

Set Realistic Goals: Before investing, it's essential to set clear, realistic goals. Determine what you want to achieve with your investments, whether it's generating short-term income or long-term wealth. This will help you stay focused and make informed decisions.

Understand Risk Tolerance: Your risk tolerance will determine the types of investments that are suitable for you. If you're risk-averse, you may prefer low-risk investments like bonds or certificates of deposit. On the other hand, if you're comfortable with higher risk, you might consider investing in stocks or real estate.

Stay Informed: Keeping up with market trends and economic news is crucial for successful investing. This will help you make informed decisions and adjust your portfolio as needed.

Avoid Emotional Investing: Emotional decision-making can lead to poor investment choices. Stay disciplined and avoid making impulsive decisions based on fear or greed.

Case Studies: Successful Investors

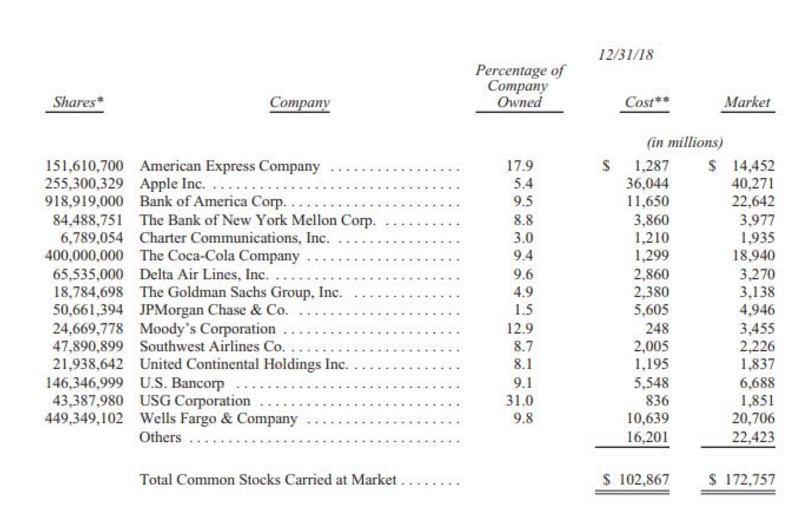

Warren Buffett: Known as the "Oracle of Omaha," Buffett is one of the most successful investors of all time. His strategy focuses on long-term investing in companies with strong fundamentals and a competitive advantage.

Peter Lynch: As the manager of the Fidelity Magellan Fund, Lynch achieved an average annual return of 29.2% from 1977 to 1990. His approach was to invest in companies he knew well and believed in, regardless of market trends.

Final Thoughts

Investing can be a complex and challenging endeavor, but with the right knowledge and strategies, you can maximize your wealth and achieve your financial goals. Remember to stay informed, diversify your portfolio, and remain disciplined in your approach. By doing so, you'll be well on your way to becoming a successful investor.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....