Are you looking to dive into the world of stock investing but feeling overwhelmed? Don’t worry; you’re not alone. The stock market can seem daunting, but with the right knowledge and strategy, anyone can become a successful investor. In this comprehensive guide, we’ll explore the basics of investing in stocks, provide valuable tips, and share some real-world examples to help you get started.

Understanding the Stock Market

Before you begin investing, it’s crucial to understand the stock market. Stocks represent a share of ownership in a company. When you buy a stock, you become a partial owner of that company. The stock market is where shares of companies are bought and sold, and its value fluctuates based on various factors such as supply and demand, company performance, and economic conditions.

Choosing the Right Stocks

Selecting the right stocks is a critical step in your investing journey. There are several factors to consider when choosing stocks, including:

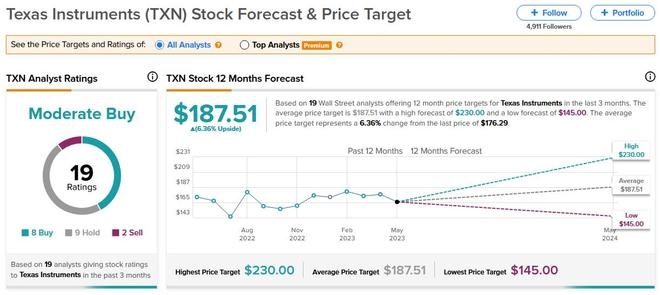

- Company Performance: Look for companies with a strong track record of profitability and revenue growth.

- Industry Trends: Research the industry in which the company operates to ensure it has a promising future.

- Financial Health: Analyze the company’s financial statements, such as its balance sheet, income statement, and cash flow statement, to gauge its financial health.

- Dividends: Consider companies that offer dividends, as these can provide a regular income stream.

Investing Strategies

There are various strategies you can employ when investing in stocks:

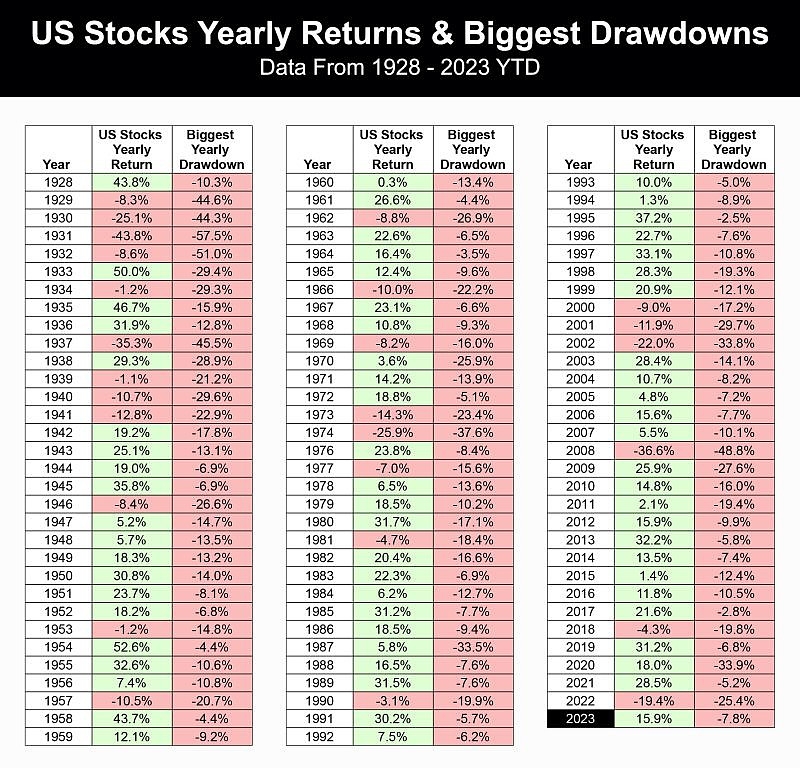

- Long-Term Investing: This approach involves holding onto stocks for an extended period, typically several years or more. Long-term investors tend to focus on companies with strong fundamentals and potential for growth.

- Short-Term Trading: Short-term trading involves buying and selling stocks within a relatively short timeframe, often days or weeks. This strategy requires more research and skill but can yield higher returns.

- Dividend Investing: Dividend investors seek companies that regularly pay dividends, as these provide a steady income stream.

Real-World Examples

Let’s look at a couple of real-world examples to illustrate the different investing strategies:

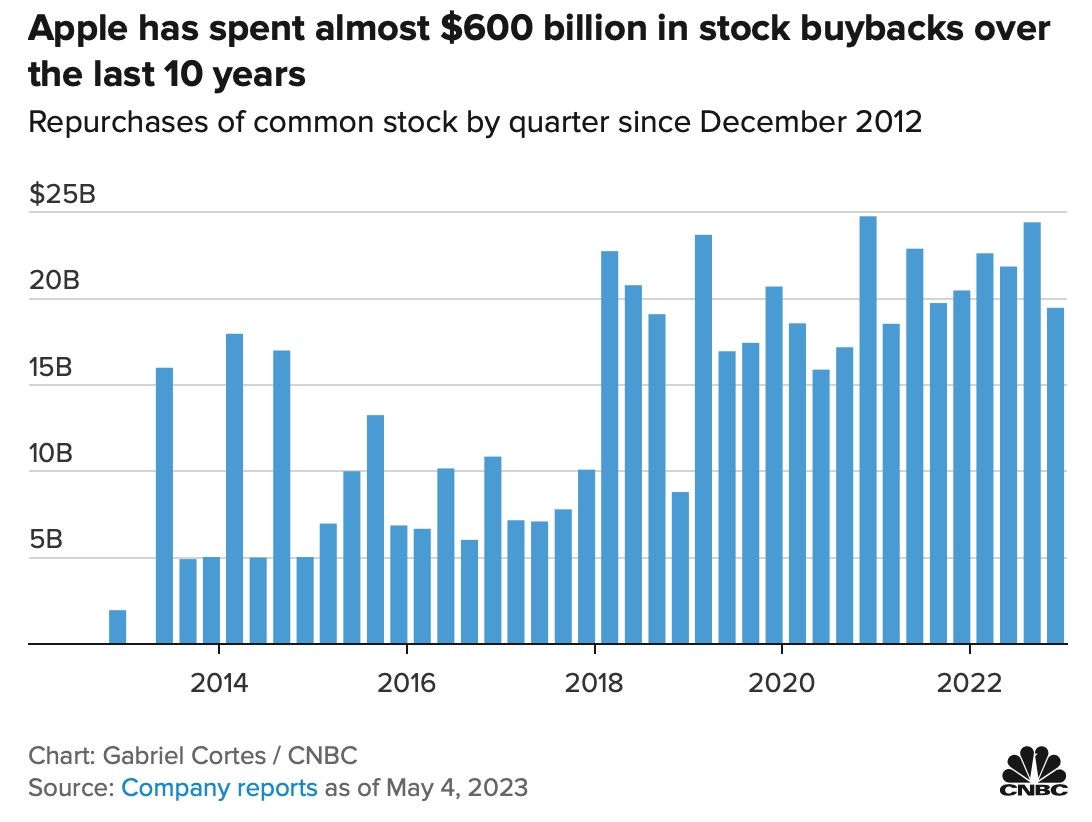

- Long-Term Investing: Apple Inc. (AAPL) has been a strong performer over the years, and investors who bought shares in 2010 and held onto them have seen significant gains.

- Short-Term Trading: Tesla Inc. (TSLA) is an excellent example of a company that has seen rapid price movements, making it a popular choice for short-term traders.

Tips for Success

To help you succeed in stock investing, here are some valuable tips:

- Do Your Research: Before investing, thoroughly research the company, industry, and market conditions.

- Diversify Your Portfolio: Diversifying your portfolio can help mitigate risk by investing in a variety of stocks across different sectors and industries.

- Stay Informed: Keep up-to-date with market news and company updates to make informed decisions.

- Be Patient: Investing is a long-term endeavor, and patience is key to achieving your goals.

In conclusion, investing in stocks can be a rewarding experience, but it requires knowledge, discipline, and patience. By understanding the stock market, choosing the right stocks, employing effective investing strategies, and following our tips for success, you can increase your chances of becoming a successful investor. Start your journey today and watch your investments grow!

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....