The Dow Jones Industrial Average (DJIA) has long been a barometer of the American economy and the global financial markets. As we approach 2025, investors are keen to understand what the future holds for the DJIA and how they can prepare for potential changes. In this article, we'll explore the factors that could influence the Dow Jones performance in 2025 and provide insights on how investors can position themselves for success.

Economic Trends and Factors Affecting Dow Jones Performance

One of the key factors that could impact the Dow Jones performance in 2025 is the global economic landscape. The United States and other major economies are expected to experience a mix of growth and challenges in the coming years. Factors such as inflation, interest rates, and trade policies will play a significant role in shaping the economic environment.

Inflation remains a major concern for investors. The Federal Reserve has been actively working to control inflation, and any significant changes in the inflation rate could have a significant impact on the Dow Jones. For example, if inflation remains high, the Federal Reserve may be forced to raise interest rates, which could lead to higher borrowing costs and a slowdown in economic growth.

Interest Rates are another critical factor. The Federal Reserve's monetary policy decisions can have a profound effect on the stock market. Historically, higher interest rates have been associated with lower stock prices, as borrowing costs increase and the cost of capital for companies rises. However, the relationship between interest rates and the stock market is complex, and other factors, such as economic growth and corporate earnings, also play a significant role.

Trade Policies are also a key consideration. The United States has been involved in a number of trade disputes with major trading partners, and any resolution or escalation of these disputes could have a significant impact on the global economy and the Dow Jones.

Technological Advancements and Their Impact on the Dow Jones

Technological advancements are expected to continue to drive economic growth and innovation in the coming years. Companies that are leading the way in technological innovation are likely to see significant growth, which could positively impact the Dow Jones.

Artificial Intelligence (AI) and Machine Learning are expected to have a profound impact on various industries, including healthcare, finance, and manufacturing. Companies that invest in these technologies and leverage them to improve their operations and create new products and services are likely to see strong growth.

Blockchain and Cryptocurrency are also emerging as significant technologies that could impact the financial industry and the Dow Jones. As these technologies continue to evolve, companies that are able to harness their potential could see significant growth.

Case Studies: Companies Leading the Way

To illustrate the potential impact of these factors on the Dow Jones, let's consider a few case studies of companies that are leading the way in their respective industries.

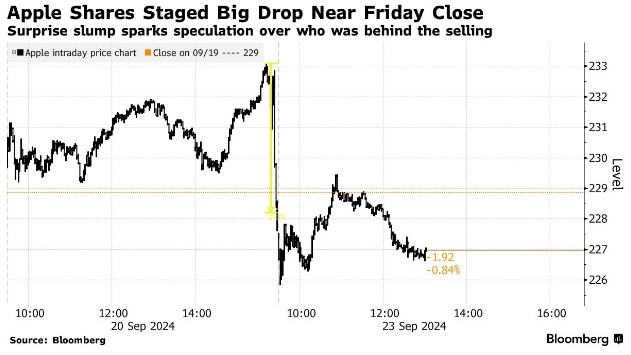

Apple is a prime example of a company that has been able to leverage technological innovation to drive growth. The company's focus on consumer electronics, software, and services has allowed it to maintain a strong position in the market, and its stock has seen significant growth over the years.

Tesla is another company that has been able to leverage technological innovation to create a new market. The company's focus on electric vehicles and sustainable energy solutions has made it a leader in the automotive industry, and its stock has seen substantial growth as a result.

Conclusion

As we look ahead to 2025, the Dow Jones Industrial Average is expected to be influenced by a variety of economic, technological, and policy factors. Investors who understand these factors and are able to position themselves accordingly are likely to be well-prepared for the challenges and opportunities that lie ahead. By focusing on companies that are leading the way in innovation and by staying informed about the economic landscape, investors can increase their chances of success in the coming years.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....