The US stock market has been a cornerstone of global financial activity, and as we delve into May 2025, it's crucial to analyze the current trends and projections. This article will provide a comprehensive look at the US stock market, highlighting key sectors, performance indicators, and potential future directions.

Market Performance

In May 2025, the US stock market has shown remarkable resilience. The S&P 500, a widely followed benchmark index, has experienced steady growth, driven by strong corporate earnings and favorable economic indicators. The NASDAQ, which is heavily weighted towards technology stocks, has also seen significant gains, reflecting the ongoing digital transformation across various industries.

Sector Analysis

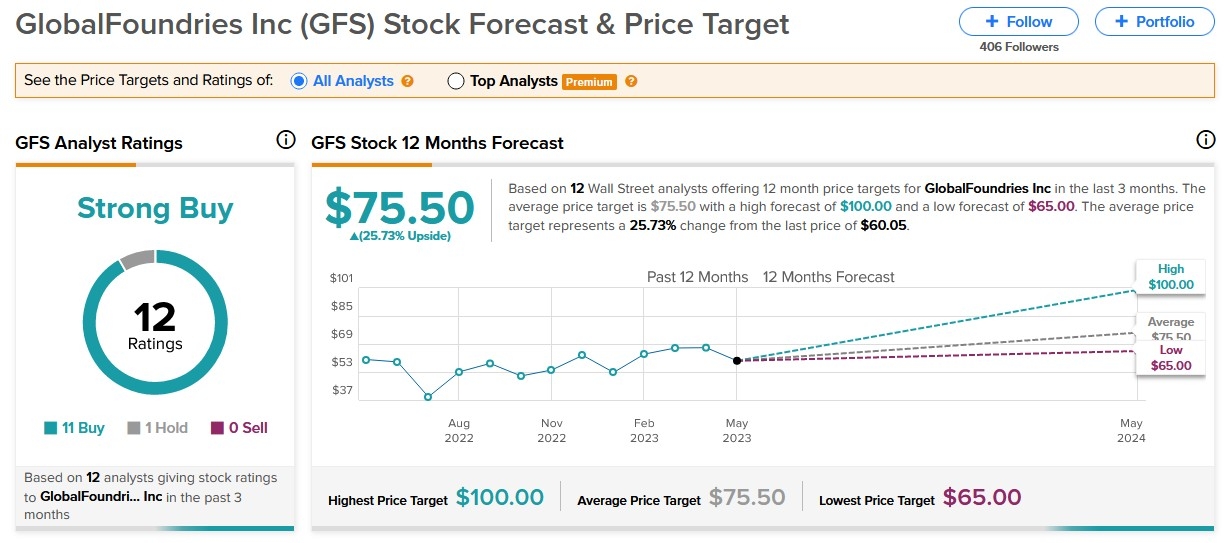

Technology: The technology sector remains a major driver of market growth. Companies like Apple, Microsoft, and Amazon have continued to post impressive earnings, contributing to the overall market performance. Additionally, the rise of artificial intelligence and machine learning has opened up new opportunities for innovation and investment.

Healthcare: The healthcare sector has also performed well, driven by advancements in medical technology and increased demand for pharmaceuticals and biotechnology products. Companies like Johnson & Johnson and Pfizer have seen substantial growth, reflecting the industry's overall strength.

Energy: The energy sector has experienced a notable turnaround, thanks to the increased demand for oil and natural gas. Companies involved in renewable energy have also gained traction, as the world continues to shift towards cleaner energy sources.

Performance Indicators

Earnings Reports: Corporate earnings have been a key factor in the market's growth. Many companies have exceeded earnings expectations, leading to increased investor confidence and stock prices.

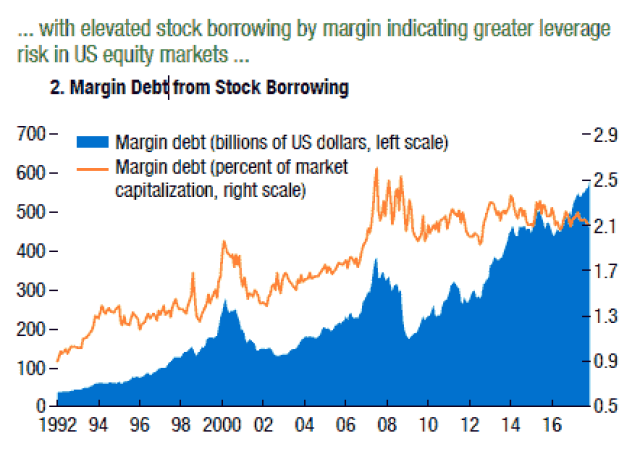

Interest Rates: The Federal Reserve's decision on interest rates has had a significant impact on the market. With rates remaining relatively low, investors have been more inclined to take on risk, driving stock prices higher.

Inflation: Despite concerns about inflation, the market has shown resilience. The Consumer Price Index (CPI) has remained within acceptable limits, allowing the Federal Reserve to maintain a cautious approach to rate hikes.

Potential Future Directions

Economic Growth: The US economy has shown signs of continued growth, supported by low unemployment rates and increasing consumer spending. This positive economic outlook is expected to drive market growth in the coming months.

Technological Innovation: The rapid pace of technological innovation is expected to continue, creating new opportunities for investment and market growth.

Global Economic Factors: Global economic factors, such as trade tensions and geopolitical events, will continue to influence the US stock market. Investors will need to stay informed and adaptable to navigate these challenges.

Case Studies

Apple Inc.: Apple has been a standout performer in the technology sector. The company's strong earnings and product launches, such as the iPhone 17 and Apple Watch 7, have driven significant growth in stock prices.

Tesla Inc.: Tesla has continued to gain momentum, with its innovative electric vehicles and energy storage solutions. The company's recent acquisition of SolarCity has further expanded its market reach.

In conclusion, the US stock market has shown remarkable resilience and growth in May 2025. As we move forward, investors should focus on key sectors, performance indicators, and potential future directions to make informed decisions.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....