Understanding the U.S. Estate Tax for Nonresident Aliens

When it comes to estate planning, understanding the tax implications is crucial. For nonresident aliens who own U.S. stocks, navigating the U.S. estate tax can be particularly complex. This article delves into how nonresident aliens are taxed on U.S. stocks and provides insights into estate planning strategies.

What is the U.S. Estate Tax?

The U.S. estate tax is a tax imposed on the transfer of property at the time of death. This tax applies to both U.S. citizens and residents, as well as certain nonresident aliens who own property in the United States. The tax rate for the estate tax is progressive, meaning the rate increases as the value of the estate increases.

Nonresident Aliens and U.S. Stocks

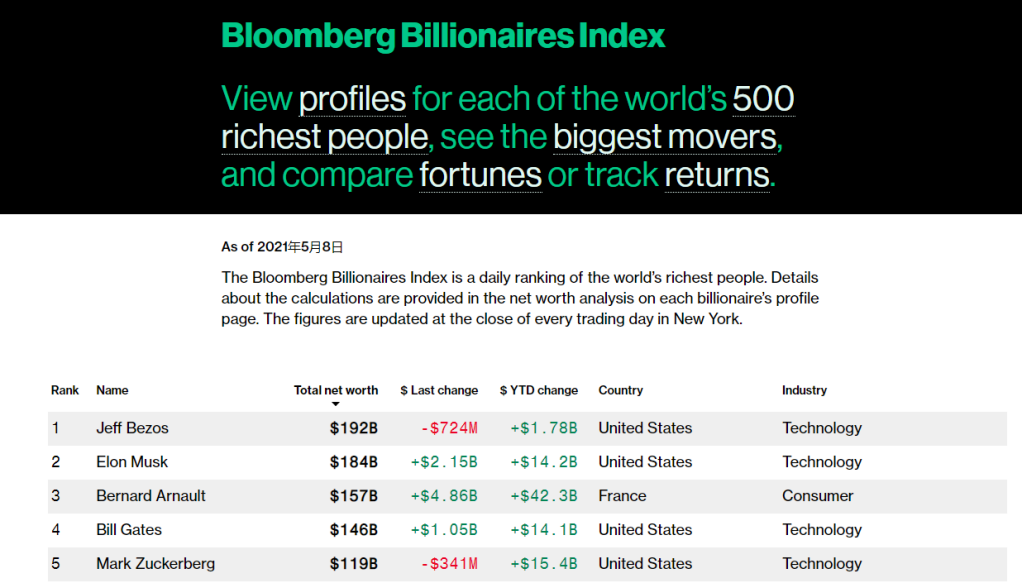

Nonresident aliens who own U.S. stocks are subject to the U.S. estate tax if the value of their U.S. stocks exceeds the applicable exemption amount. The exemption amount for nonresident aliens is significantly lower than that for U.S. citizens and residents. As of 2021, the exemption amount for nonresident aliens is $60,000.

Taxation Process

When a nonresident alien passes away, their U.S. stocks are subject to estate tax. The tax is calculated based on the fair market value of the stocks at the time of death. The executor of the estate is responsible for paying the estate tax, and the tax must be paid within nine months after the date of death.

Estate Tax Return

Nonresident aliens must file Form 706 NA, United States Estate (and Generation-Skipping Transfer) Tax Return, to report the estate tax liability. This form must be filed within nine months after the date of death. If the estate tax is not paid within this timeframe, penalties and interest may apply.

Estate Planning Strategies

To minimize the estate tax liability for nonresident aliens owning U.S. stocks, it is important to implement effective estate planning strategies. Here are some key strategies to consider:

Gift Tax Exemptions: Nonresident aliens can take advantage of the annual gift tax exclusion, which allows them to gift up to $15,000 per recipient per year without incurring gift tax.

Trusts: Establishing a trust can help protect assets from estate tax. Nonresident aliens can create a foreign trust to hold their U.S. stocks, which may offer certain tax advantages.

Life Insurance: Purchasing life insurance can provide liquidity to cover estate tax liabilities. Nonresident aliens can purchase life insurance policies on their lives to ensure that the estate tax is paid.

Case Study

Let's consider a hypothetical scenario involving a nonresident alien named John. John owns

By implementing estate planning strategies, such as establishing a foreign trust and purchasing life insurance, John's estate could potentially minimize the estate tax liability.

In conclusion, nonresident aliens who own U.S. stocks must understand the U.S. estate tax implications. By utilizing effective estate planning strategies and seeking professional advice, nonresident aliens can mitigate their estate tax liability and ensure a smooth transition of their assets.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....