In today's fast-paced financial world, market futures have emerged as a powerful tool for investors seeking to capitalize on market trends and predict future price movements. This article delves into the essence of market futures, exploring their significance, key characteristics, and strategies for successful trading.

Understanding Market Futures

Market futures are contracts that obligate the buyer to purchase, and the seller to sell, an asset at a predetermined price on a specified future date. These assets can range from commodities like oil and gold to financial instruments such as currencies and interest rates. The primary purpose of market futures is to provide a standardized and regulated platform for trading, which minimizes risk and facilitates liquidity.

Key Characteristics of Market Futures

Standardization: Market futures are standardized contracts, which means they have predefined terms and conditions. This standardization ensures that all parties involved understand their rights and obligations.

Leverage: Market futures allow investors to control a larger position with a smaller amount of capital. This leverage can amplify returns but also magnify losses, so it's crucial to manage risk effectively.

Hedging: One of the primary uses of market futures is to hedge against potential losses in the underlying asset. By taking an opposite position in the futures market, investors can offset potential price changes in the cash market.

Speculation: Another key aspect of market futures is speculation. Investors can profit from price movements in the futures market without owning the underlying asset.

Strategies for Trading Market Futures

Technical Analysis: This involves analyzing past price movements and market trends to predict future price movements. Charts, indicators, and patterns are commonly used in technical analysis.

Fundamental Analysis: This approach involves analyzing economic, social, and political factors that can influence the price of an asset. For example, geopolitical events or changes in supply and demand can impact commodity prices.

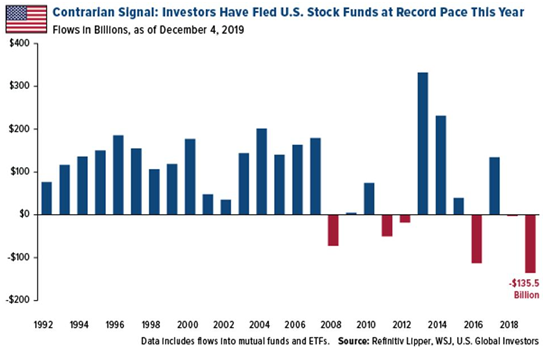

Diversification: Spreading investments across various markets and assets can reduce risk. Diversification is a crucial strategy in the market futures trading.

Risk Management: Implementing risk management techniques, such as setting stop-loss orders and position sizing, is essential to protect against significant losses.

Case Study: Oil Market Futures

One of the most popular market futures is oil. In 2020, the oil market experienced a dramatic downturn due to the COVID-19 pandemic, leading to a decrease in demand and a subsequent drop in oil prices. Investors who correctly predicted the downward trend and took appropriate positions in the oil futures market were able to capitalize on this opportunity.

Conclusion

Market futures offer a unique opportunity for investors to profit from market trends and predict future price movements. By understanding the key characteristics of market futures and employing effective strategies, investors can navigate this dynamic and potentially lucrative market. Whether you're a seasoned trader or just starting out, market futures can be a valuable addition to your investment portfolio.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....