In the ever-evolving landscape of the financial market, the question of whether to buy US stocks now is a common concern among investors. With numerous factors at play, including economic indicators, market trends, and individual financial goals, it's crucial to have a well-rounded understanding before making a decision. In this comprehensive guide, we'll explore the key aspects you need to consider to determine if now is the right time to invest in US stocks.

Understanding the Current Market Landscape

1. Economic Indicators

Before diving into the specifics of US stocks, it's essential to assess the current economic conditions. Key indicators include unemployment rates, inflation, and GDP growth. As of early 2023, the US economy is experiencing steady growth with a low unemployment rate and controlled inflation. However, it's crucial to monitor these indicators closely as they can significantly impact stock market performance.

2. Market Trends

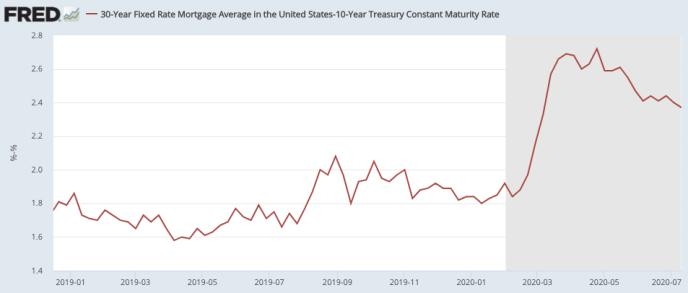

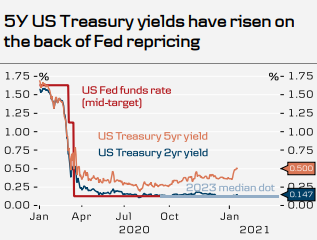

Understanding the broader market trends is equally important. Over the past few years, the US stock market has shown remarkable resilience, with the S&P 500 reaching new all-time highs. However, it's essential to analyze short-term trends as well. Factors such as geopolitical events, interest rate changes, and corporate earnings reports can influence market movements.

3. Sector Performance

Different sectors within the US stock market tend to perform differently based on various factors such as economic cycles and technological advancements. It's crucial to research individual sectors and identify those with strong potential for growth. For example, sectors like technology, healthcare, and consumer discretionary have shown promising performance in recent years.

Assessing Your Financial Goals and Risk Tolerance

1. Financial Goals

Before investing in US stocks, it's essential to clarify your financial goals. Are you seeking long-term growth, income generation, or a combination of both? Your goals will influence the types of stocks you should consider and the level of risk you're willing to take.

2. Risk Tolerance

Investing in stocks always involves some level of risk. It's crucial to assess your risk tolerance and ensure it aligns with your investment strategy. Generally, stocks with higher potential for growth also come with higher risk. Understanding your risk tolerance will help you make informed decisions.

Key Considerations for Investing in US Stocks

1. Diversification

Diversifying your portfolio is crucial to mitigate risk. Consider investing in a mix of stocks across different sectors, industries, and geographical regions. This approach can help you capitalize on various market conditions and reduce the impact of any single stock's performance.

2. Research and Due Diligence

Thorough research and due diligence are essential when selecting stocks. Analyze financial statements, assess management quality, and evaluate the company's competitive position in its industry. Additionally, consider seeking professional advice to gain a deeper understanding of the market.

3. Timing

While it's impossible to predict market movements with certainty, timing your investments can play a significant role in your overall returns. Historically, investing in stocks during periods of low volatility and market correction can offer attractive entry points.

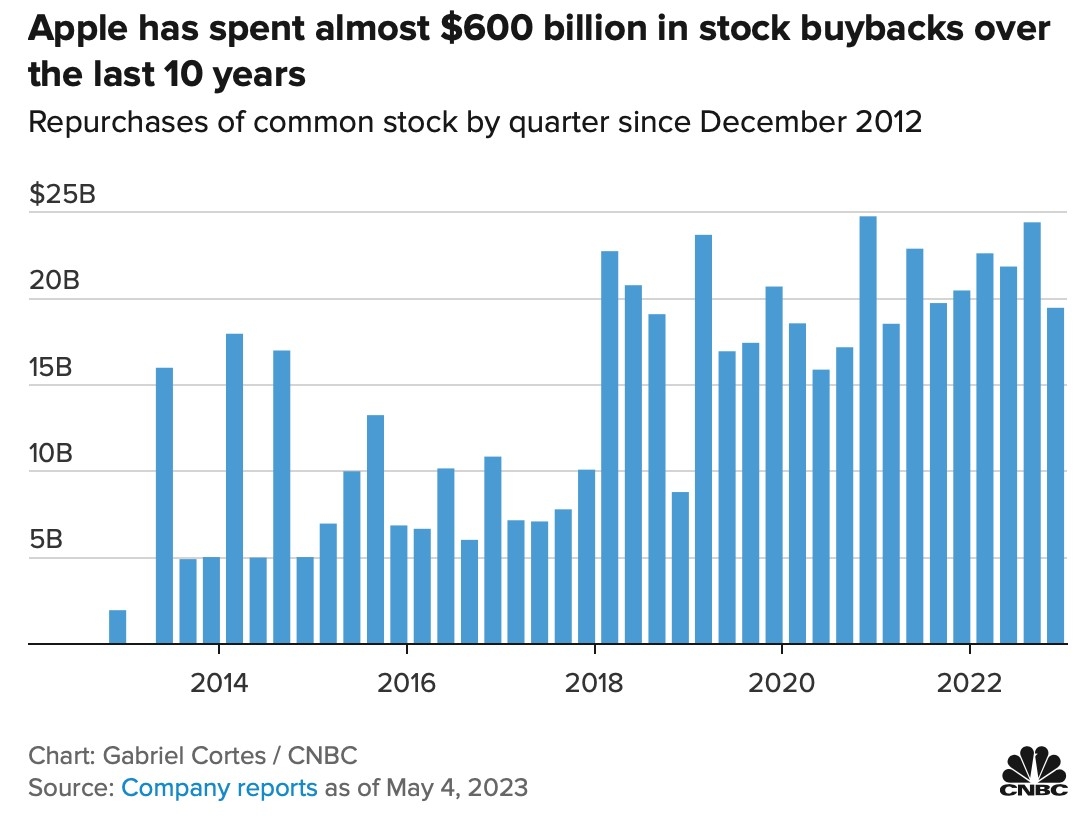

Case Study: Apple Inc. (AAPL)

To illustrate the potential of investing in US stocks, let's consider the case of Apple Inc. (AAPL). Over the past decade, Apple has consistently delivered strong financial performance, driven by its innovative products and loyal customer base. As a result, the stock has experienced significant growth, making it a compelling investment for long-term investors.

Conclusion

Determining whether to buy US stocks now requires a thorough analysis of various factors, including economic indicators, market trends, and individual financial goals. By understanding the current market landscape, assessing your risk tolerance, and conducting thorough research, you can make informed decisions that align with your investment objectives. Remember, investing in stocks always involves risk, so it's crucial to stay informed and stay disciplined in your approach.

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....