In the ever-evolving world of finance, the stock market crash graph serves as a critical tool for investors and analysts alike. This article delves into the significance of stock market crash graphs, providing insights into their impact on the financial landscape. By examining historical data and real-life examples, we aim to decode the financial turmoil that these graphs represent.

Understanding the Stock Market Crash Graph

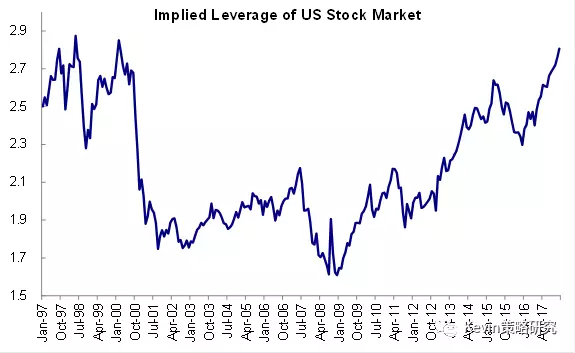

A stock market crash graph is a visual representation of the decline in stock prices over a specific period. It typically shows the movement of a stock index, such as the S&P 500, Dow Jones, or NASDAQ, during a period of significant market downturn. These graphs are essential for understanding the extent and severity of a stock market crash, as well as its potential implications for the broader economy.

Historical Stock Market Crashes

To appreciate the significance of stock market crash graphs, it's crucial to look back at some of the most notable historical crashes. One of the most infamous crashes occurred in 1929, often referred to as the "Great Depression." The stock market crash graph from that period shows a steep decline in stock prices, leading to a severe economic downturn that lasted for years.

Another significant crash took place in 2008, following the financial crisis. The stock market crash graph from that period reveals a similar pattern of rapid decline, indicating the widespread impact of the crisis on the global financial system.

Decoding the Financial Turmoil

The stock market crash graph offers valuable insights into the financial turmoil that a crash represents. By analyzing the graph, investors and analysts can identify key factors that contributed to the crash, such as:

- Economic Indicators: Changes in economic indicators, such as GDP growth, unemployment rates, and inflation, can provide clues about the health of the economy and the potential for a stock market crash.

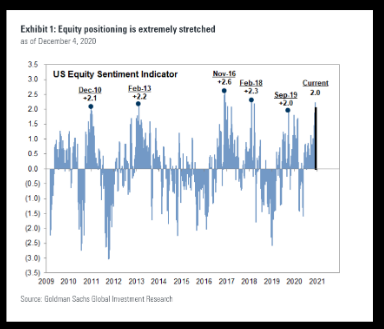

- Market Sentiment: The mood of investors can significantly influence stock prices. A stock market crash graph can help identify periods of extreme pessimism or optimism that may precede a crash.

- Policy Changes: Changes in government policies, such as interest rate adjustments or regulatory reforms, can impact the stock market and lead to a crash.

Real-Life Examples

To illustrate the importance of stock market crash graphs, let's consider a real-life example. In 2018, the stock market experienced a significant downturn, with the S&P 500 falling by nearly 20% in a matter of months. The stock market crash graph from that period shows a rapid decline in stock prices, reflecting the widespread uncertainty and fear among investors.

By analyzing the graph, it becomes clear that the crash was driven by a combination of factors, including concerns about global economic growth, trade tensions, and rising interest rates. This example demonstrates how a stock market crash graph can help investors and analysts understand the complex factors at play during a market downturn.

Conclusion

The stock market crash graph is a powerful tool for understanding the financial turmoil that a crash represents. By examining historical data and real-life examples, we can gain valuable insights into the factors that contribute to a stock market crash and its potential impact on the broader economy. As investors and analysts continue to navigate the complex world of finance, the stock market crash graph remains an essential resource for decoding the financial turmoil that lies ahead.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....