The market capitalization (market cap) of US stocks is a critical indicator of the overall health and size of the US stock market. It represents the total value of all publicly traded companies in the United States. In this article, we delve into the factors influencing the market cap of US stocks, its significance, and the recent trends.

Understanding Market Cap

Market cap is calculated by multiplying the current share price of a company by the total number of its outstanding shares. It provides a snapshot of the company's size and market value. The market cap of US stocks is a reflection of the economic strength and growth potential of the country.

Factors Influencing Market Cap

Several factors influence the market cap of US stocks:

- Economic Growth: A robust economy often leads to higher corporate earnings, which in turn boost the market cap.

- Corporate Profits: Companies with strong profitability tend to have higher market caps.

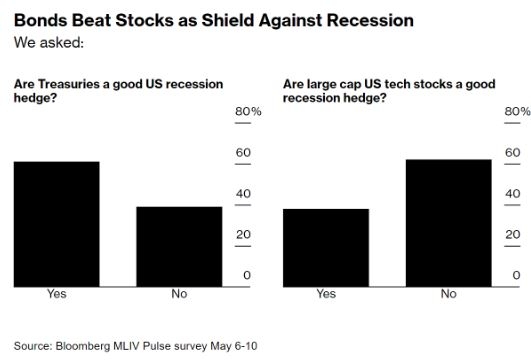

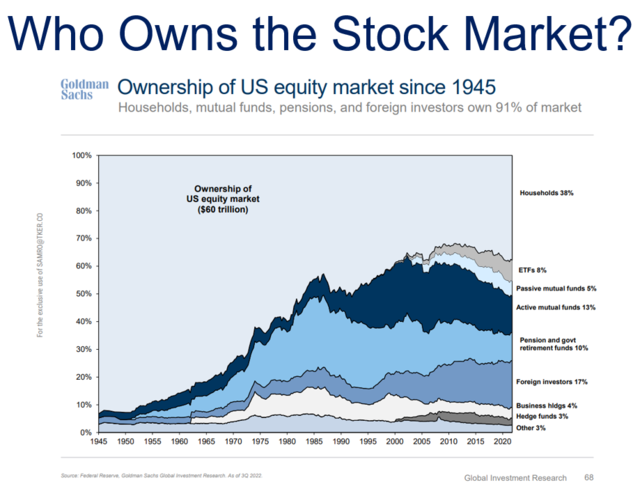

- Stock Market Sentiment: Investor confidence plays a crucial role in determining market cap. Positive sentiment can lead to higher stock prices and, consequently, higher market caps.

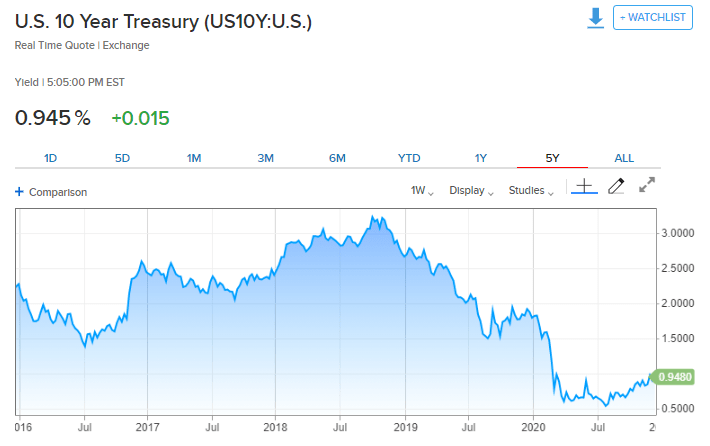

- Interest Rates: Lower interest rates can make stocks more attractive, leading to higher market caps.

- Technological Advancements: Companies in the tech sector often have high market caps due to their rapid growth and innovation.

Significance of Market Cap

The market cap of US stocks is significant for several reasons:

- Economic Indicator: It serves as a barometer of the overall economic health of the United States.

- Investment Opportunities: It helps investors identify the largest and most influential companies in the market.

- Market Size: The market cap of US stocks is one of the largest in the world, making it a crucial component of global financial markets.

Recent Trends

In recent years, the market cap of US stocks has seen significant growth. This can be attributed to several factors:

- Tech Sector: The tech sector has been a major driver of this growth, with companies like Apple, Microsoft, and Amazon having massive market caps.

- Corporate Profits: The overall profitability of US companies has been strong, leading to higher market caps.

- Low Interest Rates: The low-interest-rate environment has made stocks more attractive to investors.

Case Study: Apple Inc.

Apple Inc. is a prime example of a company with a significant market cap. As of early 2023, Apple's market cap exceeded $2 trillion. This impressive figure can be attributed to its strong financial performance, innovative products, and loyal customer base.

In conclusion, the market cap of US stocks is a crucial indicator of the overall health and size of the US stock market. Understanding its factors, significance, and recent trends can help investors make informed decisions.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....