In the ever-evolving world of financial markets, staying ahead of the curve is crucial for investors. One of the most trusted sources for market insights is Dow Jones, a leading provider of news and financial information. In this article, we delve into the predictions made by Dow Jones experts, offering a glimpse into the future of financial markets.

Understanding Dow Jones Predictions

Dow Jones predictions are based on a comprehensive analysis of global economic trends, corporate earnings, and geopolitical events. The team of experts at Dow Jones uses advanced analytical tools and historical data to forecast market movements and identify potential investment opportunities.

Key Predictions for 2023

Global Economic Growth: Dow Jones forecasts a moderate global economic growth in 2023, driven by recovering consumer spending and increased business investment. However, the recovery is expected to be uneven, with some regions facing challenges due to geopolitical tensions and supply chain disruptions.

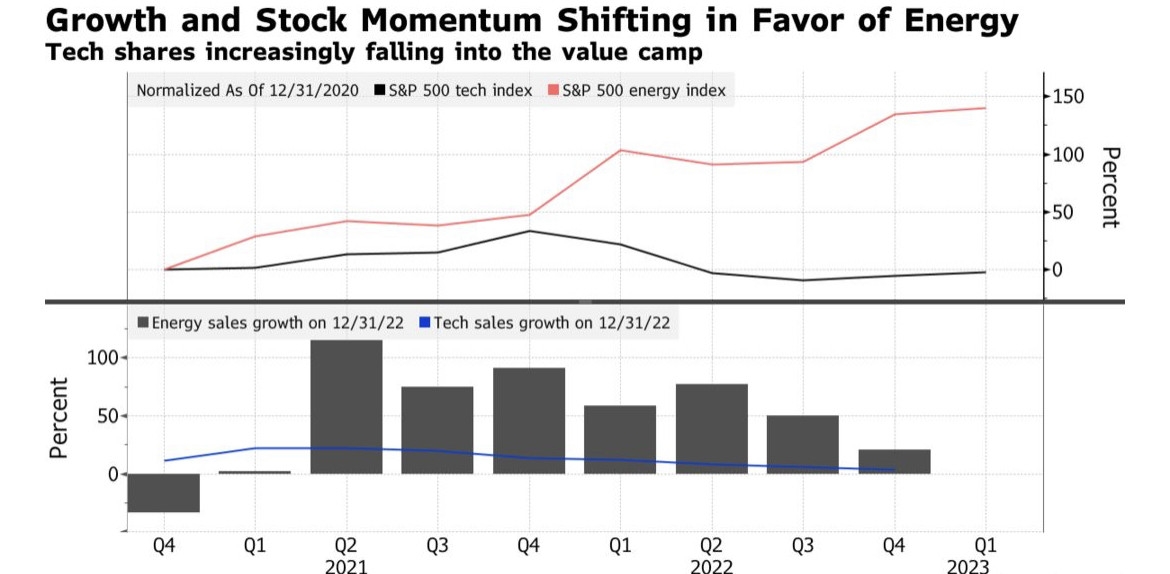

Stock Market Performance: The Dow Jones predicts that the stock market will experience a mixed performance in 2023. While some sectors, such as technology and healthcare, are expected to outperform, others, such as energy and financials, may face headwinds due to regulatory changes and economic uncertainties.

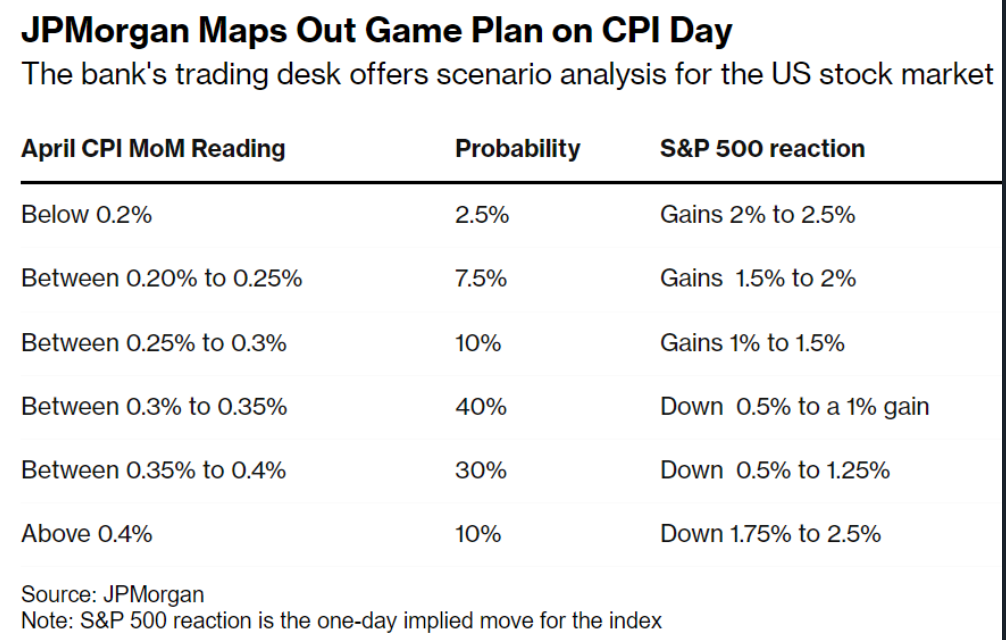

Interest Rates: The Dow Jones predicts that interest rates will remain low in 2023, supporting economic growth and potentially boosting stock market valuations. However, there is a possibility of rate hikes later in the year if inflationary pressures persist.

Cryptocurrency Market: The Dow Jones experts believe that the cryptocurrency market will continue to grow in 2023, driven by increasing institutional interest and technological advancements. However, they also caution investors to be cautious due to the high volatility and regulatory risks associated with this sector.

Case Study: Tech Sector Growth

A recent analysis by Dow Jones highlighted the potential growth in the technology sector. Companies like Apple, Microsoft, and Amazon are expected to benefit from increasing demand for digital services and cloud computing. Dow Jones predicts that these companies will continue to dominate the market and deliver strong financial results in the coming years.

Conclusion

Dow Jones predictions provide valuable insights into the future of financial markets. By understanding these predictions, investors can make informed decisions and stay ahead of market trends. However, it is important to remember that predictions are just that – predictions. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....