In the ever-evolving landscape of the US stock market, predicting the future is a task that stirs excitement and trepidation alike. As we gaze toward the horizon of 2025, several key factors are shaping the current outlook. This article delves into the potential trends, opportunities, and challenges that investors should be aware of as they navigate the stock market landscape of the next few years.

Economic Fundamentals and Interest Rates

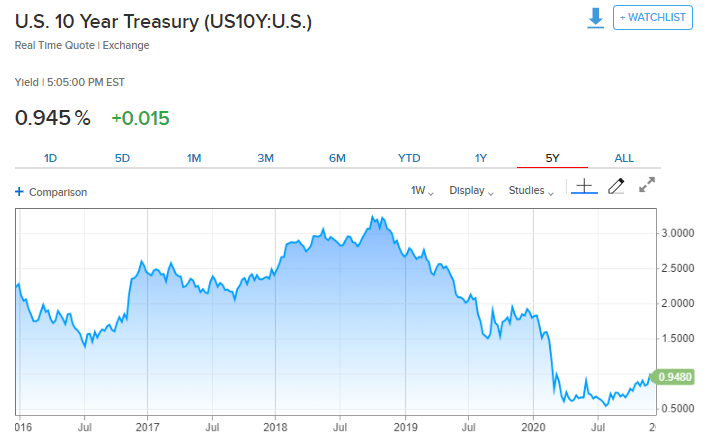

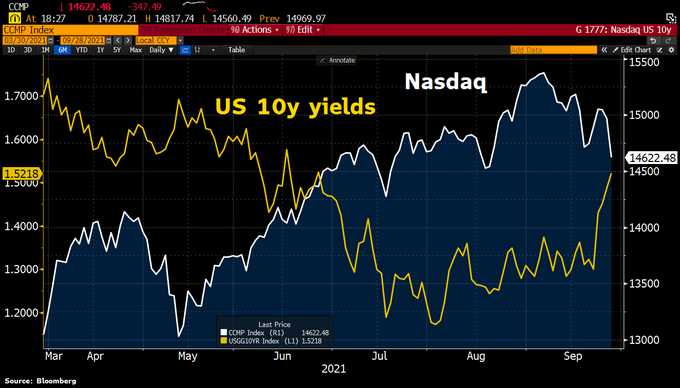

One of the primary drivers of the stock market is the broader economic landscape. Economic fundamentals such as GDP growth, unemployment rates, and inflation are closely watched indicators of market health. In 2025, interest rates are expected to play a significant role. While the Federal Reserve has indicated a gradual approach to rate hikes, unexpected inflationary pressures or economic downturns could alter this trajectory.

Tech Giants and Innovation

The technology sector, often considered a bellwether for the US stock market, has been a dominant force in recent years. Tech giants like Apple, Microsoft, and Amazon have continued to innovate and expand their market presence. Emerging technologies, such as artificial intelligence and 5G, are expected to drive growth in this sector, offering both opportunities and challenges for investors.

Sector Performance

Sector performance is another crucial factor in the stock market outlook for 2025. The performance of key sectors like energy, healthcare, and finance can significantly influence market trends. Energy prices are expected to fluctuate due to geopolitical tensions and global demand. Healthcare companies are facing regulatory challenges and increasing pressure to innovate, while financial institutions are navigating a complex regulatory landscape.

Impact of Global Events

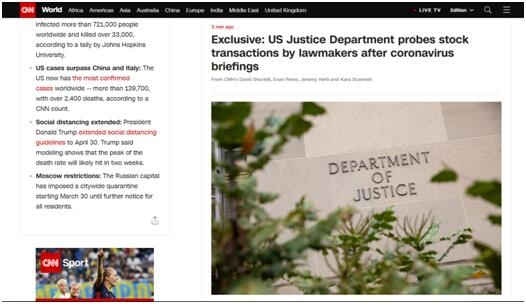

The stock market is highly influenced by global events, such as political instability, trade wars, and pandemics. As the world continues to navigate the challenges posed by the COVID-19 pandemic, geopolitical tensions are also a concern. These factors can have a significant impact on market sentiment and investor behavior.

Emerging Markets and International Exposure

In the years leading up to 2025, investors have been increasingly looking beyond traditional US markets. Emerging markets such as China, India, and Brazil offer potential for growth and diversification. International exposure can be a valuable component of a well-rounded investment strategy, but it also comes with additional risks.

Case Studies: Tesla and Netflix

Two companies that have captured the attention of investors in recent years are Tesla and Netflix. Tesla has been at the forefront of the electric vehicle revolution, and its stock has seen significant volatility. Netflix, on the other hand, has been a leader in the streaming industry, but has faced challenges due to competition and content costs.

In conclusion, the stock market outlook for 2025 is shaped by a complex interplay of economic, technological, and geopolitical factors. As investors prepare for the future, staying informed and diversified will be key to navigating the challenges and opportunities ahead.

new york stock exchange

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....