In the ever-evolving real estate market, investing in home construction stocks has proven to be a profitable venture. One such investment vehicle is the iShares US Home Construction Stock (ITB). This article delves into the details of this stock, highlighting its potential benefits and risks, and why it could be a lucrative addition to your investment portfolio.

Understanding iShares US Home Construction Stock (ITB)

The iShares US Home Construction Stock (ITB) is an exchange-traded fund (ETF) that tracks the performance of companies involved in the residential construction industry. This includes home builders, lumber companies, and suppliers of construction materials. By investing in ITB, you gain exposure to a diverse range of companies that benefit from the growth in the housing market.

Benefits of Investing in ITB

Market Growth: The US housing market has seen significant growth over the past few years, driven by factors such as low interest rates and a growing population. Investing in ITB allows you to capitalize on this upward trend.

Diversification: ITB provides diversification by investing in a variety of companies within the home construction industry. This helps to reduce the risk associated with investing in a single company.

Potential for High Returns: The home construction industry has the potential to generate high returns, especially during periods of economic growth. Investing in ITB allows you to benefit from this potential.

Access to a Professional Fund Manager: ITB is managed by iShares, a well-known and reputable fund management company. This means that your investment is in the hands of professionals who have extensive experience in the market.

Risks of Investing in ITB

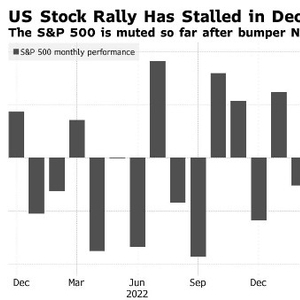

Market Volatility: The stock market is subject to volatility, and ITB is no exception. Investing in ITB means that you may experience fluctuations in your investment value.

Economic Factors: Economic factors such as interest rates, inflation, and unemployment can impact the housing market and, in turn, ITB.

Company-Specific Risks: While ITB provides diversification, it does not eliminate the risk associated with investing in individual companies. Some companies within the ETF may face specific challenges that could affect their performance.

Case Studies

To illustrate the potential benefits of investing in ITB, let's look at a couple of case studies:

PulteGroup (PHM): PulteGroup is one of the largest home builders in the United States. By investing in ITB, you gain exposure to PulteGroup, which has seen significant growth over the past few years.

Lumber Liquidators (LL): Lumber Liquidators is a leading retailer of hardwood flooring and other construction materials. Investing in ITB provides you with exposure to this company, which has seen strong growth in recent years.

Conclusion

In conclusion, the iShares US Home Construction Stock (ITB) is a valuable investment opportunity for those looking to capitalize on the growth of the residential construction industry. While it does come with risks, the potential for high returns and diversification makes it an attractive option for many investors. As always, it's important to conduct thorough research and consider your own investment goals and risk tolerance before making any investment decisions.

us stock market live

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....