Are you looking to maximize your investment returns? If so, you might want to consider focusing on active stocks. These are shares of companies actively managed by professionals, aiming to outperform the market. This article will delve into what makes active stocks unique, their benefits, and how to identify them.

Understanding Active Stocks

First, let’s clarify what we mean by active stocks. Unlike passive stocks, which are part of a broad market index and typically not actively managed, active stocks are selected and monitored by investment professionals. These professionals use various strategies to identify undervalued or promising companies and adjust their portfolios accordingly.

Benefits of Active Stocks

The primary benefit of investing in active stocks is the potential for higher returns. While it’s true that active stock investing can come with higher fees and risks, the goal is to generate outperformance. Here are some key advantages:

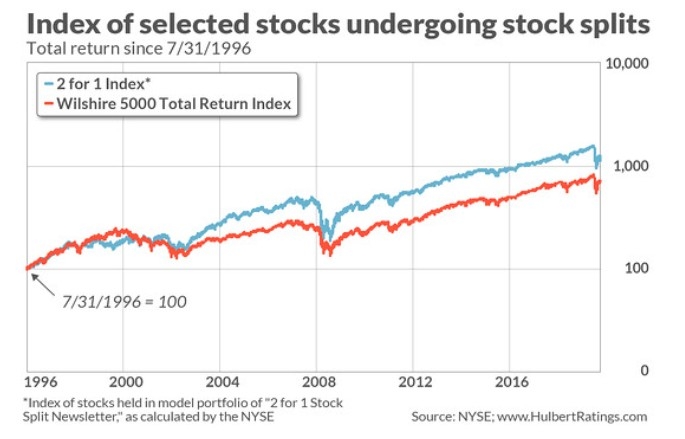

- Outperformance Potential: Active managers often aim to outperform the market by identifying mispriced stocks and taking advantage of market inefficiencies.

- Active Management: Professionals with expertise in analyzing stocks and markets manage active portfolios, potentially leading to better decision-making.

- Diversification: Active managers can tailor portfolios to meet individual investment goals, risk tolerance, and market conditions, offering diversification benefits.

Identifying Active Stocks

So, how do you identify active stocks? Here are some tips:

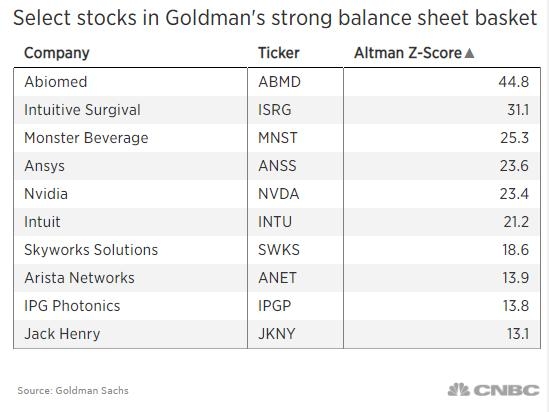

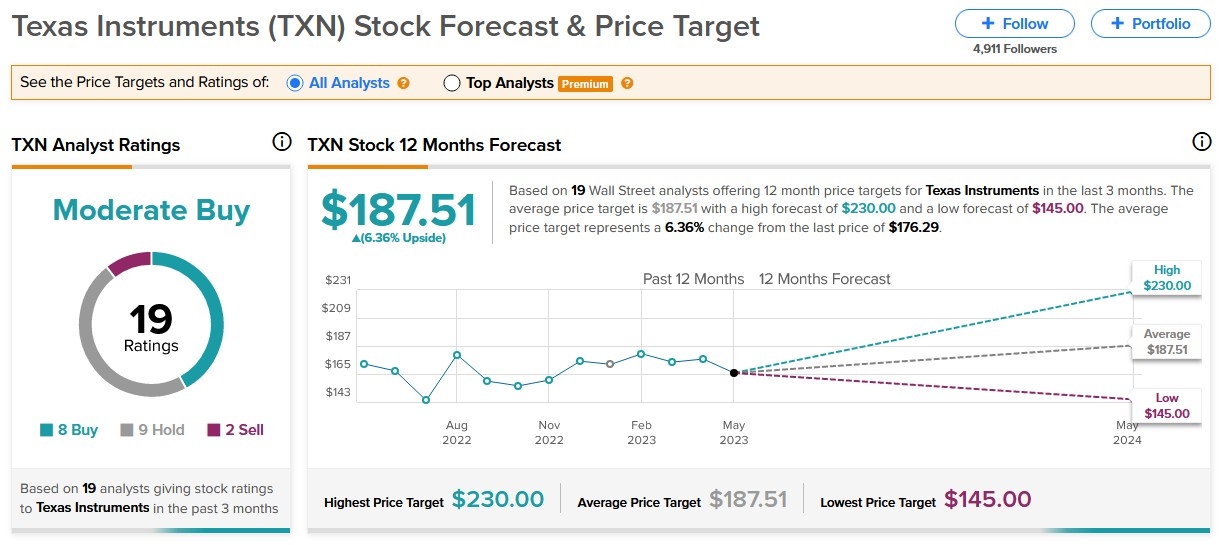

- Research Active Managers: Look for managers with a strong track record of outperforming the market. Pay attention to their investment strategies and the companies they tend to invest in.

- Examine the Portfolio: Review the portfolio of a mutual fund or ETF to see if it consists of actively managed stocks.

- Read the Prospectus: The prospectus of a mutual fund or ETF will provide details on the investment strategies and fees associated with the fund.

Case Studies

To illustrate the potential of active stocks, let’s look at a couple of case studies:

- Fidelity Select Technology Portfolio: This mutual fund invests in companies with high growth potential in the technology sector. Over the past decade, it has outperformed the S&P 500 index.

- BlackRock Global Allocation Fund: This balanced fund invests in a mix of stocks, bonds, and other assets. It has a long history of outperforming the market, with a focus on active management.

Conclusion

Investing in active stocks can be a powerful way to potentially boost your investment returns. By focusing on actively managed portfolios and conducting thorough research, you can identify promising opportunities in the stock market. Remember to stay informed and stay patient, as active stock investing may require a longer-term perspective.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....