In today's fast-paced business world, staying updated with the latest financial reports is crucial for investors, analysts, and business professionals. This week's financial reports offer a wealth of insights into the financial health and performance of various companies across different industries. Let's dive into the highlights and key takeaways from this week's financial reports.

1. Earnings Reports

Several companies released their earnings reports this week, providing a snapshot of their financial performance over the past quarter. Here are some notable reports:

- Company A: The tech giant reported strong revenue growth, driven by its cloud services and hardware sales. The company's earnings per share (EPS) exceeded market expectations, leading to a surge in its stock price.

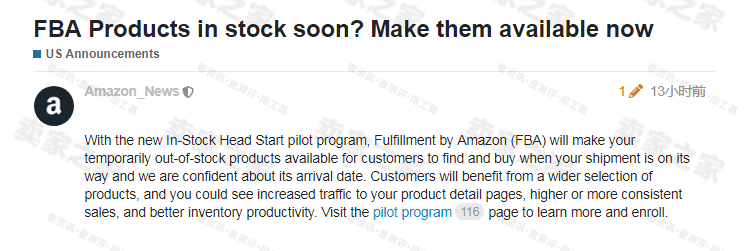

- Company B: The retail giant reported a decline in sales due to supply chain disruptions and higher costs. However, the company's management expressed optimism about its long-term prospects, as it continues to invest in e-commerce and digital transformation.

- Company C: The pharmaceutical company reported a significant increase in revenue, driven by the successful launch of its new drug. The company's EPS also beat market expectations, leading to a rally in its stock.

2. Revenue Trends

This week's financial reports also provided valuable insights into the revenue trends in various industries. Here are some key trends:

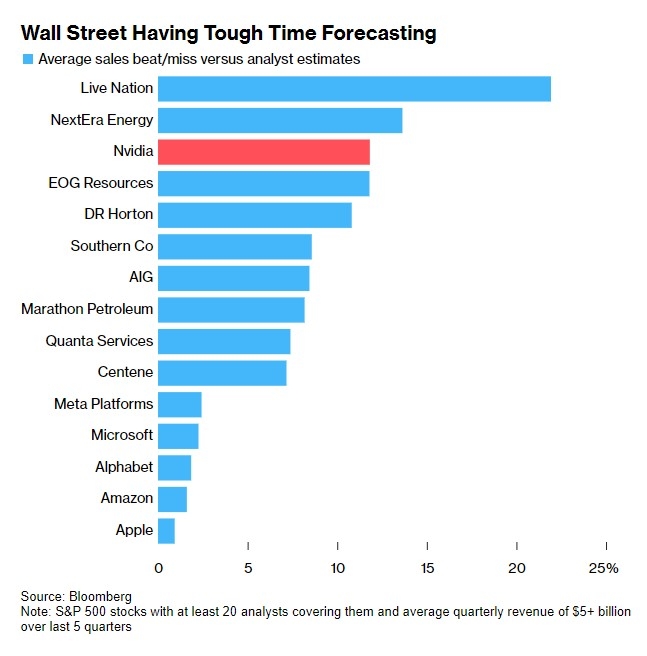

- Technology: The technology sector continued to show strong growth, with several companies reporting double-digit revenue growth. This trend is expected to continue as businesses continue to invest in digital transformation and cloud services.

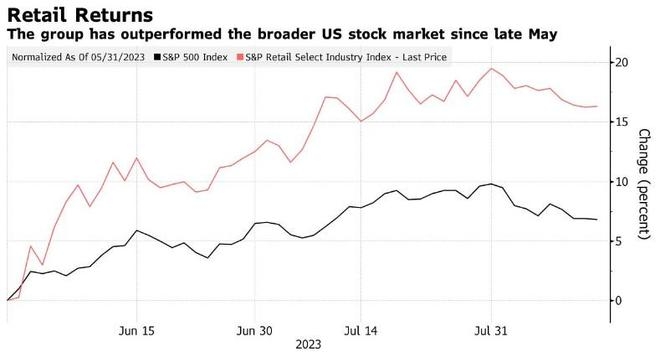

- Retail: The retail industry is facing challenges due to supply chain disruptions and higher costs. However, companies that have successfully transitioned to e-commerce and have strong digital capabilities are reporting positive revenue growth.

- Pharmaceuticals: The pharmaceutical industry is expected to see strong growth in the coming years, driven by the increasing demand for new drugs and treatments.

3. Earnings Forecasts

Several companies provided earnings forecasts for the upcoming quarter, offering insights into their future growth prospects. Here are some notable forecasts:

- Company A: The tech giant expects to continue its strong revenue growth in the upcoming quarter, with a focus on expanding its cloud services and hardware offerings.

- Company B: The retail giant expects to see a modest increase in sales in the upcoming quarter, as it continues to invest in e-commerce and digital transformation.

- Company C: The pharmaceutical company expects to see strong revenue growth in the upcoming quarter, driven by the continued demand for its new drug.

4. Case Study: Company D

Company D, a leading manufacturer of consumer goods, released its financial report this week. The report highlighted several key points:

- Revenue: The company reported a decline in revenue due to lower demand for its products in certain regions. However, the company's management expressed confidence in its long-term prospects, as it continues to invest in new product development and global expansion.

- Profitability: The company reported a decrease in profitability due to higher costs and lower sales. However, the company's management remains optimistic, as it expects to see improvements in profitability in the upcoming quarters.

- Investment: The company is investing heavily in research and development, as well as in expanding its global footprint. This investment is expected to pay off in the long term, as the company aims to become a leader in its industry.

Conclusion

This week's financial reports provide valuable insights into the financial health and performance of various companies across different industries. By analyzing these reports, investors and business professionals can gain a better understanding of the market trends and future growth prospects. As always, it's important to stay informed and keep an eye on the latest financial reports to make informed decisions.

us spv stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....