Are you a foreign investor looking to purchase stocks in the US? Understanding the process and regulations is crucial for a successful investment. This guide will provide you with all the necessary information to hold stocks in the US as a foreigner.

Understanding the Basics

1. Stock Exchange Regulations

Foreign investors must comply with the regulations of the stock exchange where they wish to trade. The most popular stock exchanges in the US are the New York Stock Exchange (NYSE) and the NASDAQ. Each exchange has its own set of rules and regulations for foreign investors.

2. Tax Implications

Foreign investors must understand the tax implications of holding stocks in the US. Generally, foreign investors are subject to a 30% withholding tax on dividends paid by US companies. However, certain treaties may reduce or eliminate this tax.

3. Account Requirements

Foreign investors need a brokerage account to buy and sell stocks in the US. Most brokerage firms require foreign investors to provide additional documentation, such as a passport and proof of address.

Opening a Brokerage Account

1. Choosing a Brokerage Firm

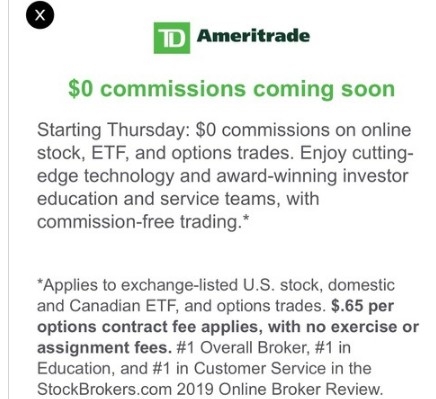

When choosing a brokerage firm, consider factors such as fees, customer service, and the range of investment options. Popular brokerage firms for foreign investors include TD Ameritrade, E*TRADE, and Charles Schwab.

2. Required Documentation

To open a brokerage account, you will need to provide the following documents:

- Passport

- Proof of address (such as a utility bill or bank statement)

- Tax identification number (TIN) or social security number (SSN)

Investing in US Stocks

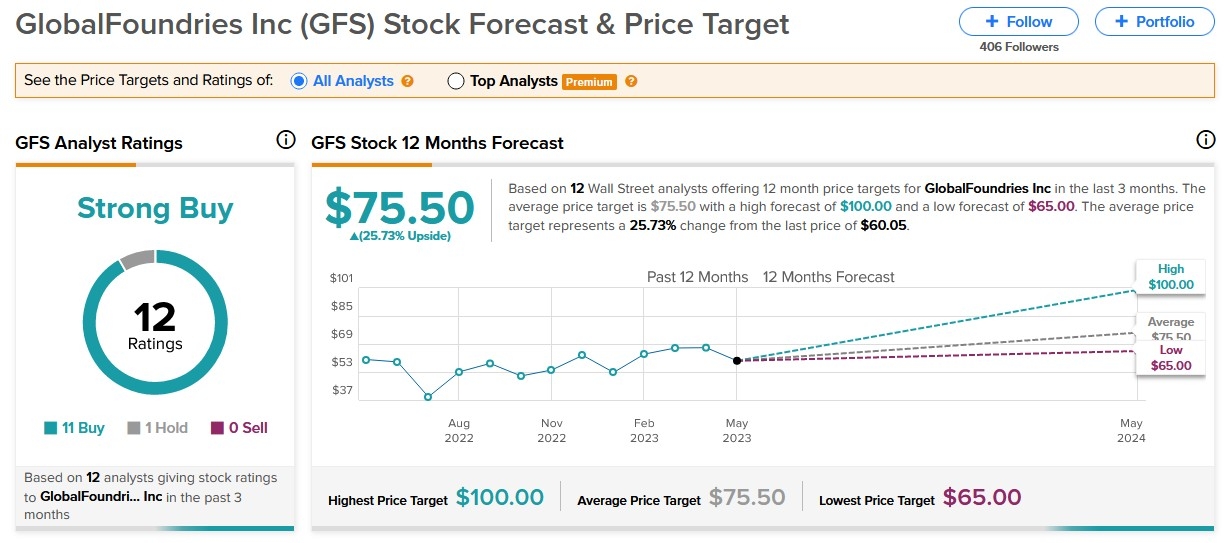

1. Researching Companies

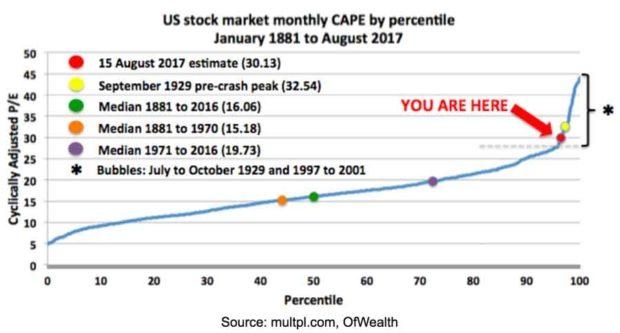

Before investing, it's essential to research the companies you're interested in. Look at their financial statements, earnings reports, and market trends. Websites like Seeking Alpha and Yahoo Finance can provide valuable insights.

2. Diversifying Your Portfolio

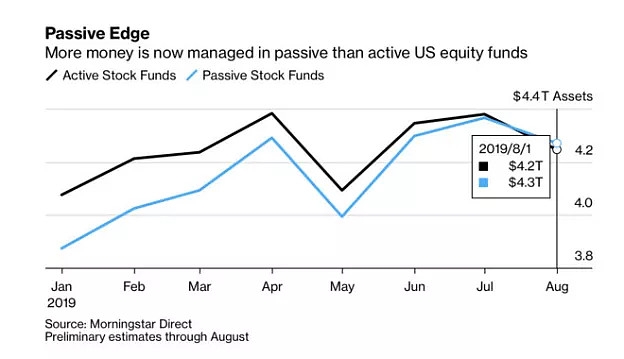

Diversifying your portfolio can help reduce risk. Consider investing in a mix of stocks, bonds, and other assets. Many brokerage firms offer diversified mutual funds and ETFs (exchange-traded funds) for foreign investors.

3. Monitoring Your Investments

Regularly monitor your investments to ensure they align with your investment goals. Use online tools and mobile apps provided by your brokerage firm to stay informed.

Case Study: John's Investment Journey

John, a foreign investor from Germany, decided to invest in US stocks. He opened an account with TD Ameritrade and began researching companies. After careful analysis, he invested in a mix of tech and healthcare stocks. Over time, his investments grew significantly, and he even received dividends.

Conclusion

Holding stocks in the US as a foreigner can be a lucrative investment opportunity. By understanding the regulations, opening a brokerage account, and conducting thorough research, you can make informed investment decisions. Remember to diversify your portfolio and stay informed about market trends.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....