In today's rapidly evolving market, green growth brands have emerged as a significant force in the business world. These companies prioritize environmental sustainability and social responsibility, while also generating impressive financial returns. If you're looking to invest in green growth brands, understanding their stock prices is crucial. This article provides a comprehensive guide to analyzing the stock prices of green growth brands, including key factors to consider and potential opportunities.

Understanding Green Growth Brands

First, let's clarify what we mean by "green growth brands." These are companies that focus on sustainable business practices, aiming to minimize their environmental impact while creating economic value. This includes businesses that use renewable energy, produce eco-friendly products, and adopt sustainable supply chain practices. Some popular examples of green growth brands include Tesla, Patagonia, and Whole Foods Market.

Factors Affecting Green Growth Brands Stock Prices

Several factors can influence the stock prices of green growth brands:

- Financial Performance: Like any other company, green growth brands' financial performance plays a critical role in determining their stock prices. Look for companies with strong revenue growth, solid profit margins, and a sustainable business model.

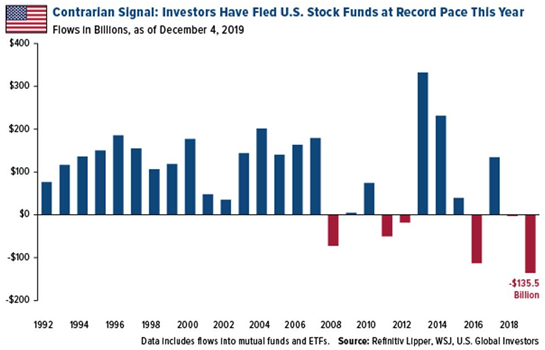

- Market Sentiment: The perception of green growth brands can fluctuate based on market trends and consumer preferences. Positive news, such as successful product launches or sustainability initiatives, can boost stock prices, while negative news, like regulatory challenges or financial setbacks, can lead to declines.

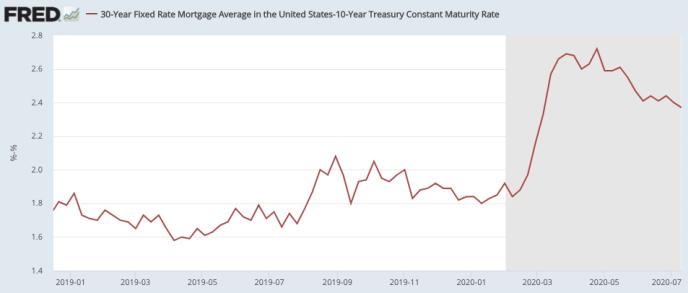

- Economic Factors: The overall economy can impact the stock prices of green growth brands. During periods of economic growth, these companies may benefit from increased consumer spending and investment, while during economic downturns, they may face greater challenges.

- Regulatory Environment: Government policies and regulations regarding environmental sustainability can significantly impact green growth brands. Companies that align with these policies may see their stock prices rise, while those that face regulatory hurdles may see declines.

Analyzing Green Growth Brands Stock Prices

To analyze the stock prices of green growth brands, consider the following steps:

- Research Financial Reports: Review the companies' annual and quarterly financial reports, focusing on key metrics like revenue, profit margins, and return on equity.

- Examine Market Trends: Stay updated on market trends, consumer preferences, and regulatory changes that could impact the green growth brand industry.

- Compare with Peers: Compare the stock prices of green growth brands with their peers to understand how they are performing relative to the industry.

- Use Technical Analysis: Analyze stock price charts and technical indicators to identify potential buying and selling opportunities.

Case Study: Tesla

One of the most prominent green growth brands is Tesla, Inc. (NASDAQ: TSLA). Since its inception, Tesla has experienced significant growth, driven by its electric vehicles and renewable energy products. The company's stock price has surged over the years, reflecting its strong financial performance and market potential. However, it's important to note that Tesla's stock has also experienced volatility, influenced by various factors, including market sentiment and regulatory challenges.

In conclusion, investing in green growth brands offers a unique opportunity to support environmental sustainability while potentially generating attractive financial returns. By understanding the key factors affecting stock prices and conducting thorough research, investors can make informed decisions when considering green growth brands for their investment portfolios.

us flag stock

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....