In today's fast-paced world, managing finances efficiently is crucial for both individuals and businesses. Finenc, a cutting-edge financial management platform, is making waves by simplifying complex financial processes and empowering users to achieve their financial goals. This article delves into the key features and benefits of Finenc, providing you with valuable insights to take control of your finances.

Understanding Finenc

Finenc is a comprehensive financial management tool designed to cater to the needs of individuals, businesses, and investors. By offering a wide range of features, Finenc helps users make informed financial decisions, optimize their resources, and achieve long-term financial stability.

Key Features of Finenc

Budgeting and Expense Tracking: One of the standout features of Finenc is its robust budgeting and expense tracking system. Users can easily categorize their expenses, set spending limits, and monitor their financial health in real-time.

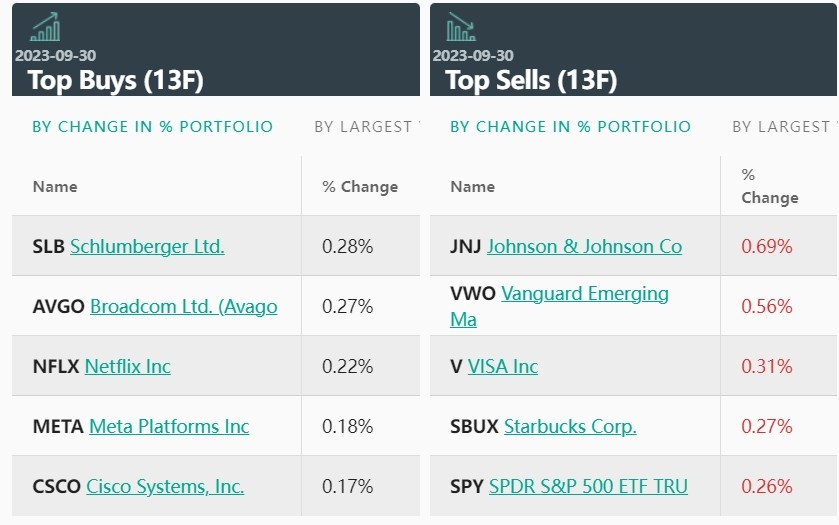

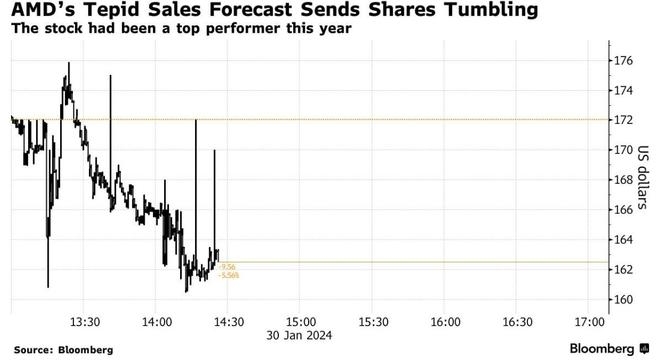

Investment Management: Finenc provides a seamless investment management experience, allowing users to track their investments, analyze performance, and make informed decisions. The platform offers access to a variety of investment options, including stocks, bonds, and mutual funds.

Cash Flow Analysis: By analyzing your cash flow, Finenc helps you identify areas where you can save money and optimize your spending. This feature is particularly beneficial for businesses looking to improve their financial performance.

Debt Management: Finenc's debt management tool helps you create a plan to pay off your debts efficiently. By breaking down your debts into manageable payments, you can reduce your interest rates and pay off your debts faster.

Retirement Planning: With Finenc, you can easily create a retirement plan that aligns with your financial goals. The platform provides personalized advice based on your income, expenses, and investment preferences.

Case Studies

To illustrate the effectiveness of Finenc, let's consider a few case studies:

John, a Freelancer: John struggled to manage his finances as a freelancer. By using Finenc, he was able to track his income and expenses, create a budget, and save money for his future goals. Within a few months, he successfully paid off his credit card debt and increased his savings.

ABC Corp, a Small Business: ABC Corp faced financial challenges due to poor cash flow management. After implementing Finenc, the company was able to optimize its expenses, identify revenue-generating opportunities, and improve its overall financial performance.

Jane, an Investor: Jane wanted to diversify her investment portfolio. Using Finenc, she was able to analyze her investments, identify underperforming assets, and reallocate her investments for better returns.

Conclusion

In conclusion, Finenc is a powerful financial management platform that can help you achieve your financial goals. By offering a wide range of features and personalized advice, Finenc empowers users to take control of their finances and achieve long-term stability. Whether you are an individual, a small business owner, or an investor, Finenc can be a valuable tool in your financial journey.

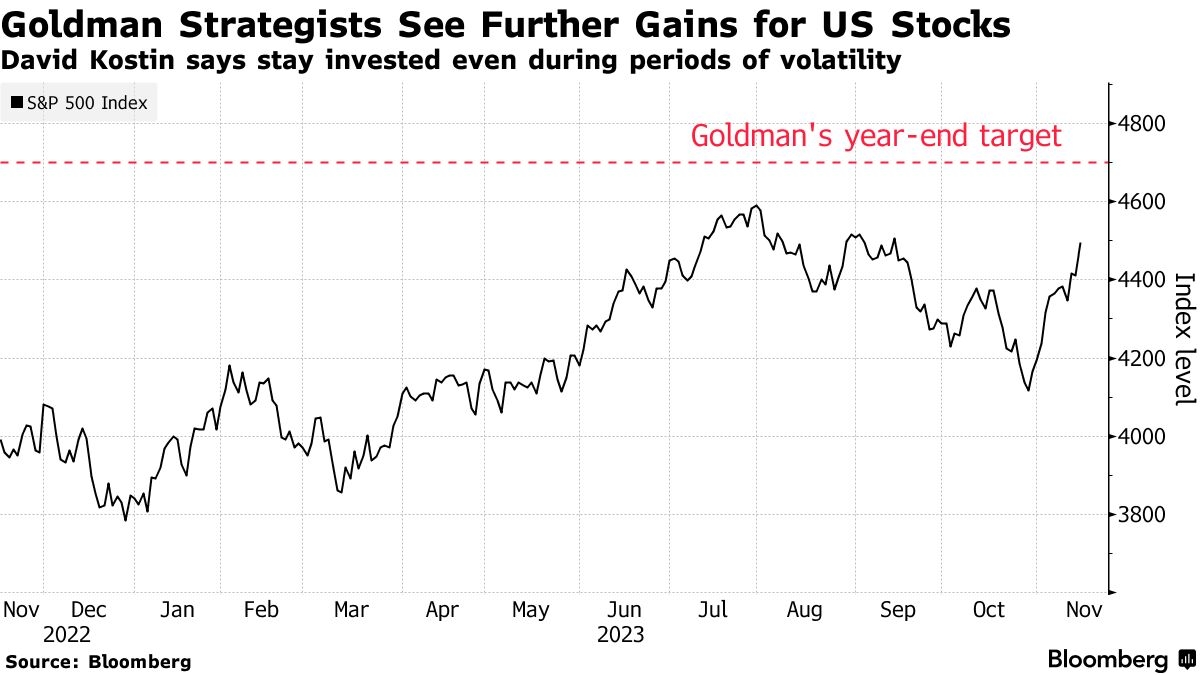

us stock market today live cha

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....

spv stock-Start small, grow steady, and turn your U.S. market dreams into tangible returns today.Democratize your U.S. stock investing journey—no fancy degrees or huge capital required.....